Financial Engine for Well-being

Now is the time to digitally engage your customers and empower them to improve their financial well-being, providing them with superior banking experience.

The Financial Engine for Well-being (FEW) enables banks and financial institutions (FIs) to help customers based on financial empathy. It is a hyper-personalized and self-assisted platform for financial curation that enhances financial awareness with actionable recommendations. This platform:

- Helps retail customers in improving their financial status.

- Assists MSME customers with growing their business through financial support.

- Enables sustainable banking that contributes to social responsibility, essentially the S of ESG.

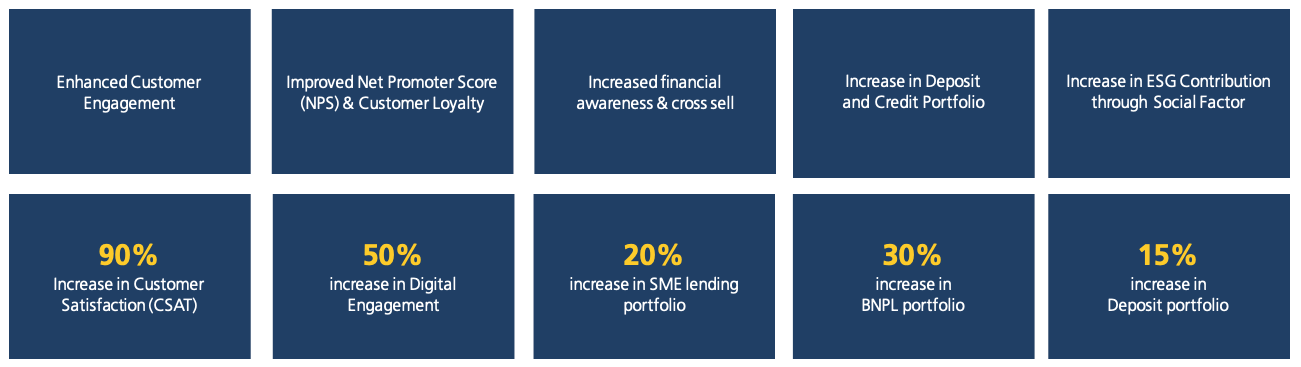

FEW embraces FINANCIAL EMPATHY as a unique differentiator, engaging retail and MSME customers with a social cause of financial well-being. It contributes to the betterment of society; a true driver of change that improves ESG score and performance.

It drives long-term customer satisfaction and loyalty and enhances revenue growth by offering personalized products such as sustainability-linked loans, BNPL (Buy Now Pay Later), overdraft, multi-currency Forex card, and global wallets to suit the exact needs of retail and MSME customers.

FEW acts as a catalyst for MSMEs’ financial stability, recommending the right SME lending product that supports the growth of small and medium-sized businesses.

- Engages retail and MSME customers digitally with personalized communication.

- Provides omnichannel experiences with increased financial awareness.

- Establishes a higher degree of trust and satisfaction.

- Delivers personalized recommendations based on need, behavior, and preferences.

- Navigates customers to their Next Best Action by optimizing their financial wellbeing.

- Converts customer touchpoints into context-driven and meaningful experiences.

Reach us

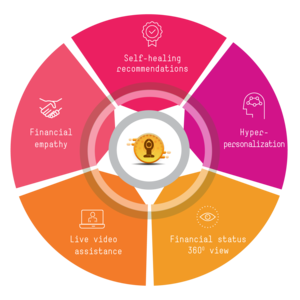

Five pillars of the FEW

FEW is a highly portable, scalable, reliable, and flexible solution.

API-based integration makes it extremely easy to plug-in to your existing digital banking ecosystem.

It adheres to geo-compliance that includes data security, privacy, and encryption.

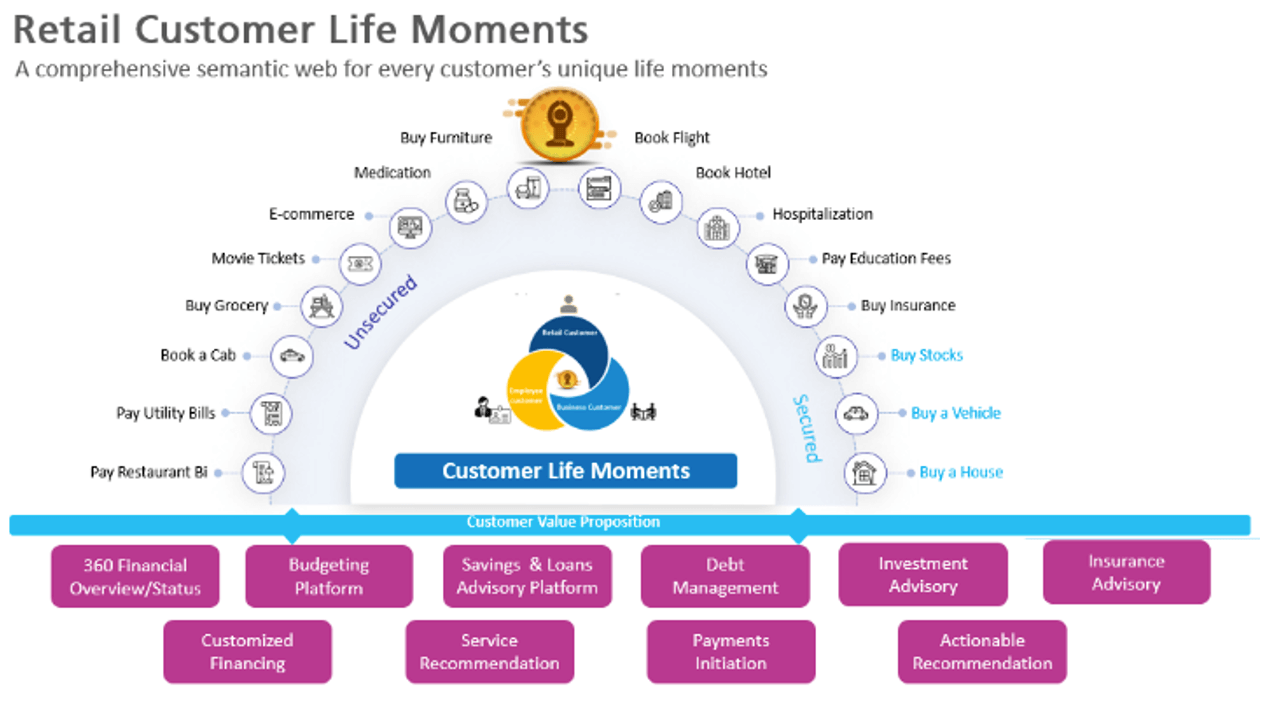

For a business or retail customer, a clear comparison with their peer group helps understand the financial status. FEW provides past trends and a forecast of account balance, savings, and expenditure patterns to help customers realize their own financial pattern. It highlights the areas that need immediate attention, especially with upcoming liabilities and credit. The solution recommends personalized products and services, with the next best action. It also provides an opportunity to take immediate action to correct customers’ financial behavior, and helps them overcome stress.

Beyond retail banking, FEW considers customer life moments by keeping an eye on their expenditure and savings habits, loans necessity, investment eagerness, and insurance history. It helps create a 360-degree overview to provide insights about customers’ financial well-being and provides guidance on reducing liabilities, with options to avail cheap loans, investments for future, life insurance etc.

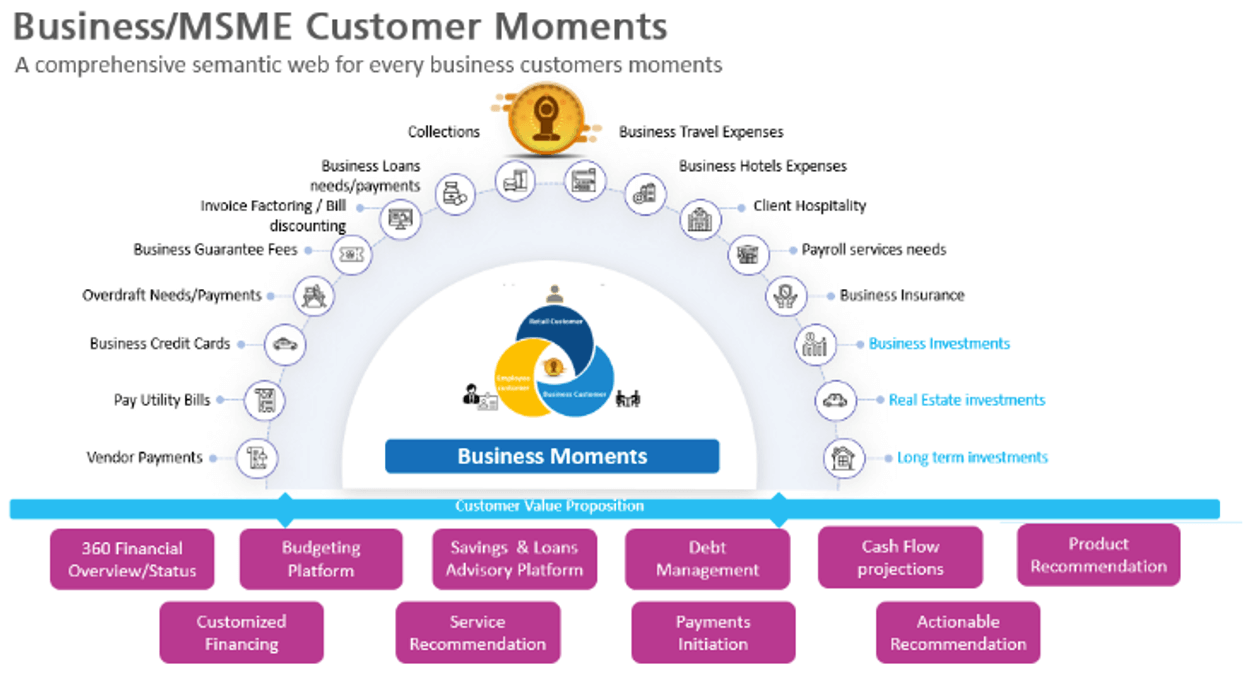

The solution also addresses the business/MSME segment by providing a holistic view of the cash flow and finances. It forecasts cash flows, recommends better working capital finance options and cheaper business credit cards, and suggests collateral-free credit and green loans etc.

Business insights and contextualized product recommendations are key when MSME customers seek financial advice.

FEW helps customers in improving their cash flows, increasing deposits securely, reducing debts, improving financial status and assisting them with growing their business with key differentiators such as self-healing recommendations, hyper-personalization, ensuring a 360-degree view of the financial status, and live video assistance. It helps banks monetize data and increase the valuation.

LTIMindtree’s FEW solution embraces financial empathy as a unique differentiator and taps customers’ sentiments, which is pivotal. It helps in customer engagement – enabling banks and FIs to cross-sell new products and services, and generate new revenue streams.

Videos

Whitepaper

Brochure