Robotic Process Automation

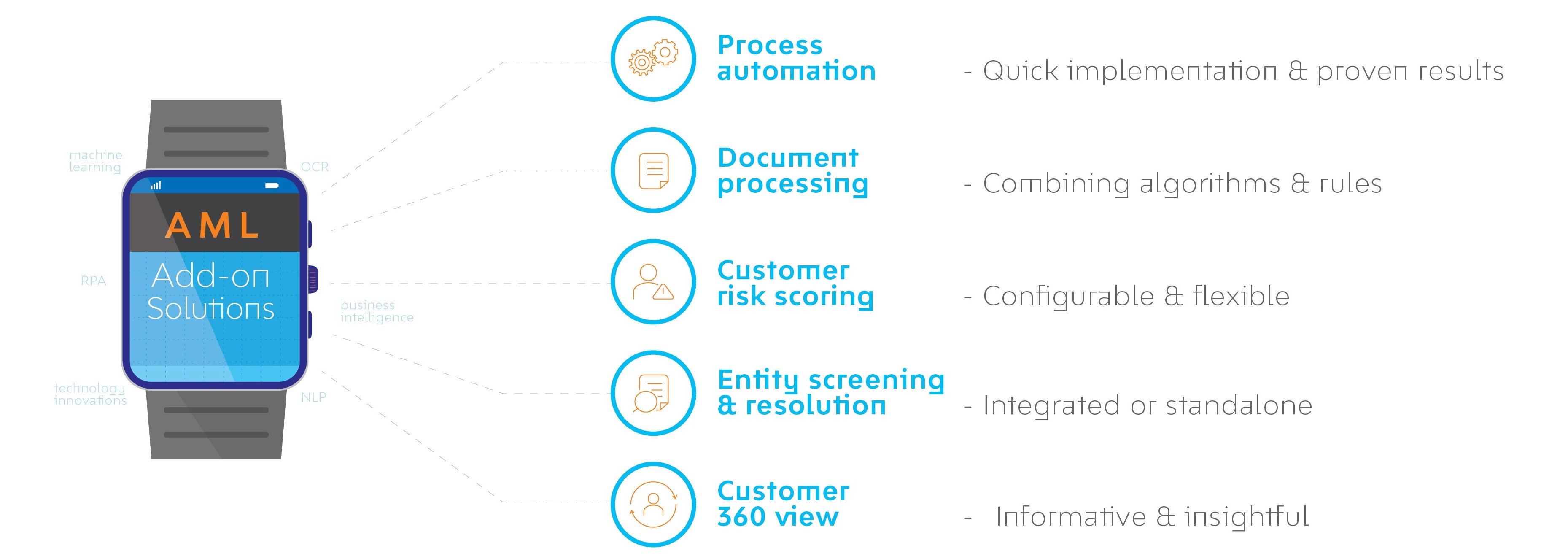

AML Add-on Solutions

In recent years, Anti-Money Laundering (AML) Compliance has been one of the key focus areas in the Banking industry, and the cost of AML compliance is expected to increase at an accelerated pace, due to the growing complexities & challenges involved in anti-money laundering program, solution and operation. Having spent the past decade helping its global clients implement and enhance AML solutions, LTIMindtree has addressed many infrastructure, scalability, availability, stability, performance, efficiency and functional problems faced by clients. Naturally, the company has thus garnered a wealth of expertise in this area, which can benefit the Banking industry in general.

LTIMindtree’s AML Suite is a set of add-on solutions & tools, built on top of the proprietary Mosaic Framework, which has been developed using the latest technology innovations, including Big Data, Business/Robotics Process Automation, Machine Learning, Natural Language Processing (NLP) and more. It offers scalability and flexibility, and can be implemented to augment the capability of clients’ existing AML solutions.

Reach us