Real-Time Monitoring

Global financial crime is a multi-trillion-dollar problem threatening the financial ecosystem’s security and integrity. According to the FTC, US consumers lost $10 billion to fraud in 2023, which is expected to reach $23 billion by 2030. The increased sophistication of financial crimes and rising regulatory challenges are pushing financial institutions to secure transactions using the latest technologies. In fact, fraud protection is critical to ensuring payment system integrity, optimizing customer experience, and protecting the reputation of financial institutions.

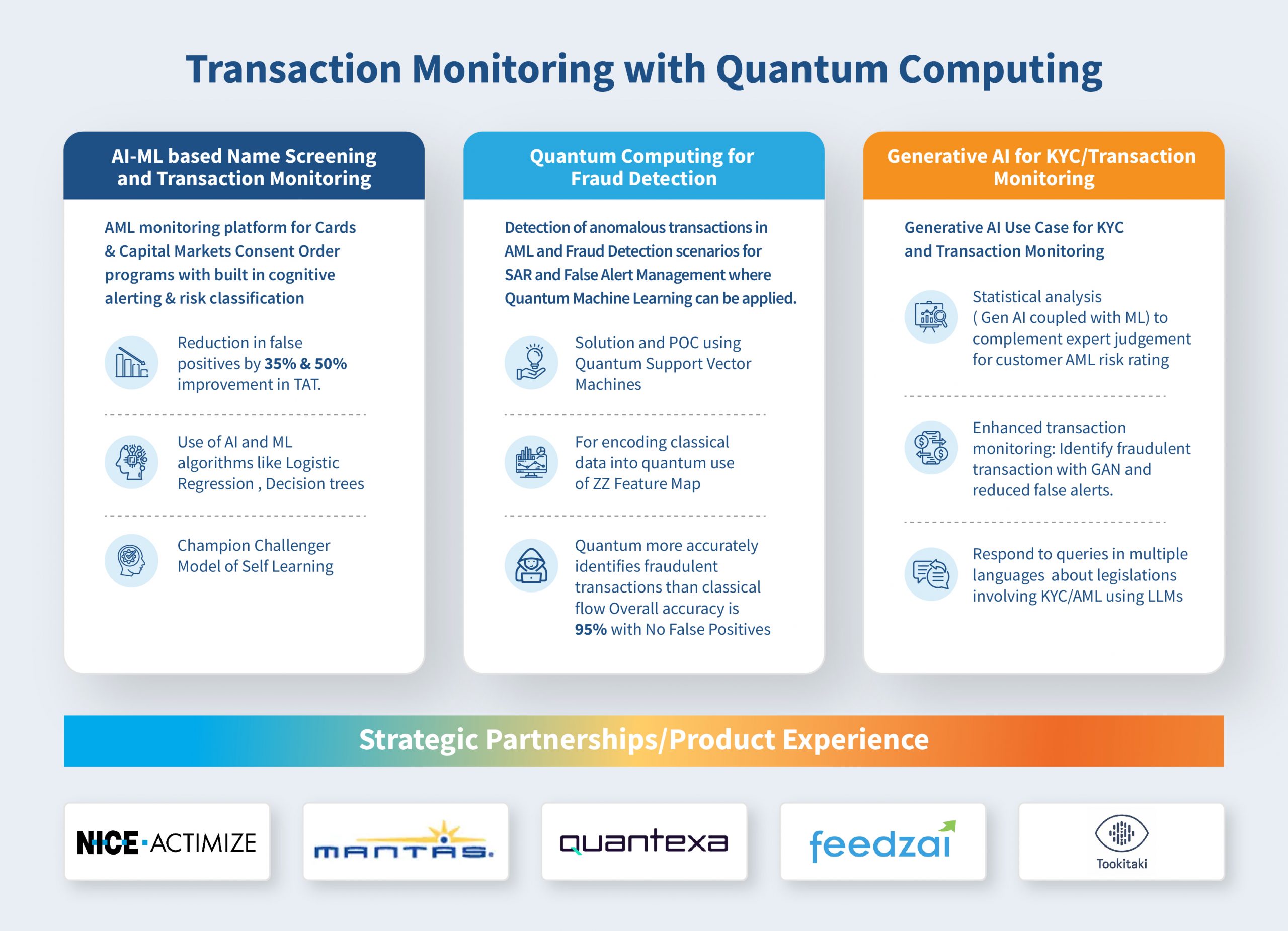

LTIMindtree’s suite of quantum computing-driven real-time monitoring solutions is engineered to detect fraudulent activities and financial crimes at unprecedented levels. It adopts a contextual monitoring framework that leverages both internal and external data sources to implement an Anti-Money Laundering (AML) strategy. The quantum computing solution further uses entity resolution and network ties to generate meaningful and actionable alerts.

We frequently collaborate with academia and IT industry leaders, such as IBM, to drive innovations that can tackle financial crimes and AML. Our quantum computing solution uniquely combines classical AI with quantum methods through a Quantum Support Vector Machine algorithm, adeptly predicting fraudulent transactions even in highly imbalanced datasets.