ILF Event Highlights

Setting the tone for the event

Anil Vazirani, EVP and Chief Business Officer (Insurance and Healthcare) at LTI welcomed attendees and kicked off the event. He articulated the opportunities that Artificial Intelligence presents in the areas of Customer Engagement, Claims handling and Risk prediction. He provided examples of how Insurance companies are already leveraging AI to gain competitive differentiation and operational efficiencies.

Industry Point of View by Analyst – AI Opportunities and Adoption Issues

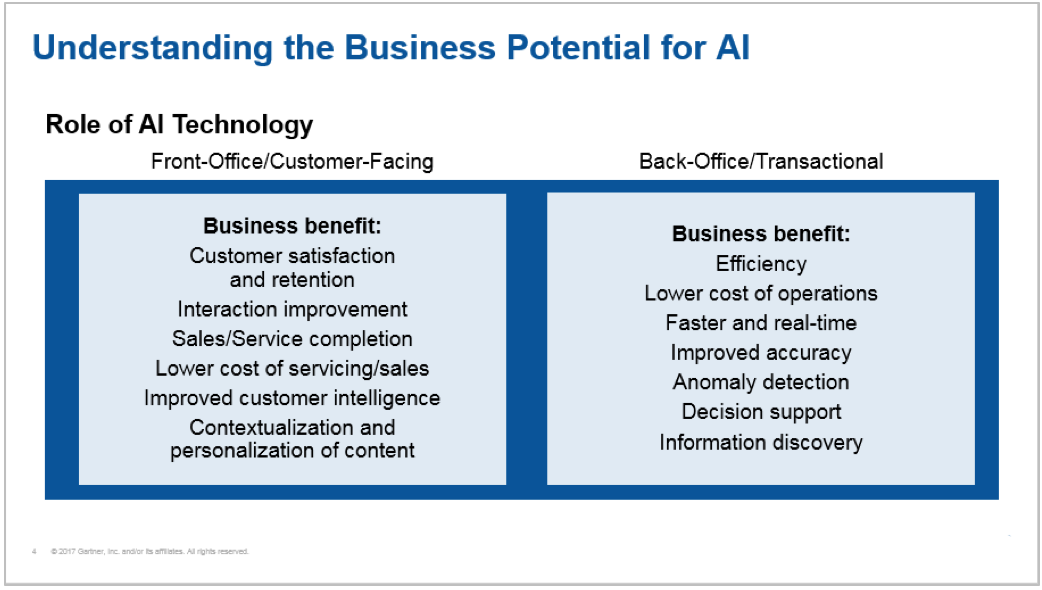

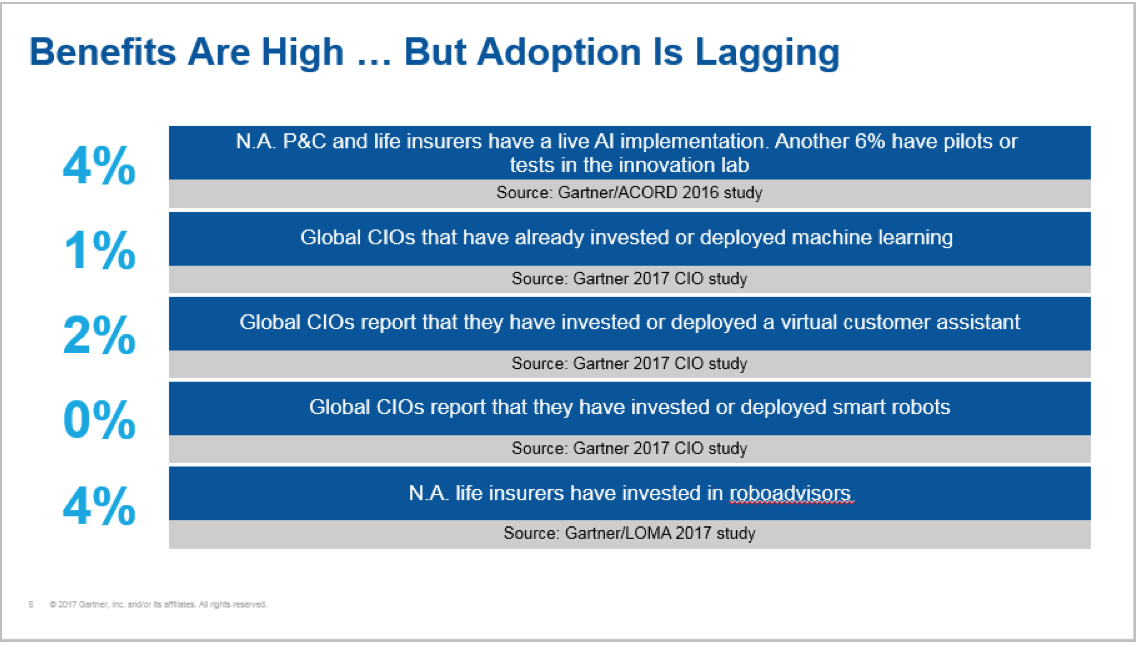

The Guest Speaker from Gartner provided a compelling keynote presentation on Artificial Intelligence opportunities and issues in adoption. She highlighted the role of AI technology across front office and back office areas, but also pointed out how adoption is lagging across the industry.

Her presentation emphasized that the current adoption of AI is limited to basic information delivery and not transactional, terming it as ‘non-advanced’. She drew analogy with how banks are transforming customer engagement through Robo-advisors. She highlighted immense opportunities of cognitive computing for risk scoring in underwriting of complex products, automating claims adjustment and driving proactive customer engagement through behaviour analysis. She presented interesting use cases such as advanced machine learning for fraud detection using structured and unstructured data analysis, or real time analysis of images and videos delivered by drones. She also pointed out the transformation opportunity by complementing Robotic process automation with Artificial Intelligence, paving way for Smart process automation.

Source : Gartner, “Digital Insurance: Innovation Through Analytics and Artificial Intelligence ” 28 Sep 2017

A lively panel discussion becomes the high point of the event

The Analyst moderated a high octane discussion between panelists – Scott Snowiss (CIO, Global Health delivery at Mercer), Jim Kane (SVP, USI Insurance Services) and Bob Pick (SVP & CIO, Tokio Marine North America). The panel, representing completely diverse market segments, gave their perspectives of opportunities and issues pertaining to Artificial Intelligence in Insurance. Their practical insights and direction, with a pinch of humour, enthralled the audience. The discussion started with each panelist presenting their state of transformation journey related to AI. When asked about staffing-related challenges, they highlighted the critical role of partner vendors in identifying, experimenting and implementing AI projects in a risk sharing model. The panel also emphasized on the importance of changes needed in the workplace as organizations implement new technologies. The panel recognized challenges such as reliability of data, domain expertise, clear alignment of funding to business justifications and finding the right partners who have the right experience. Despite these challenges, the optimism, excitement and commitment towards continuing their transformation journey was evident from the discussion.

Positioning LTI’s Mosaic platform

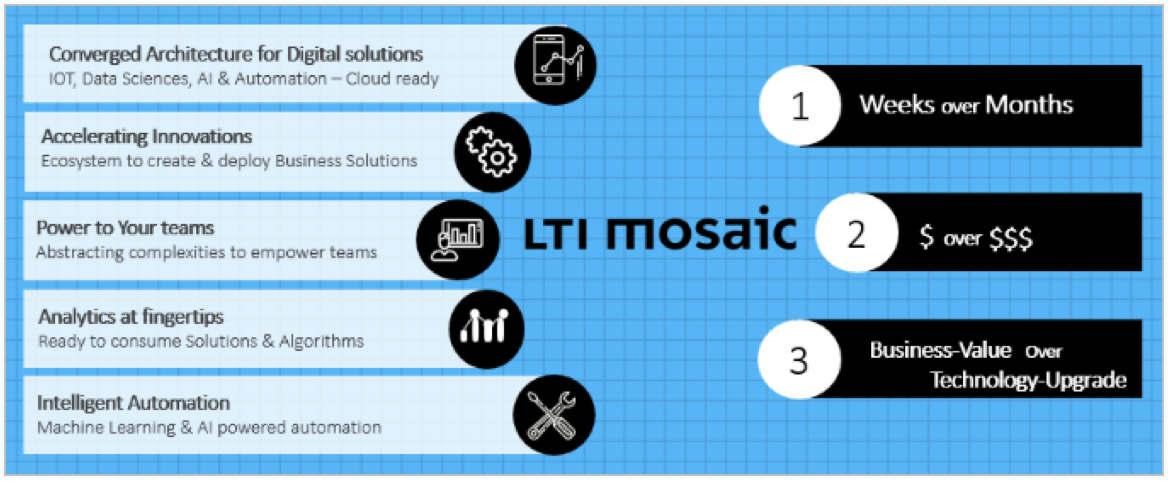

Amit Unde (CTO, Insurance and Healthcare at LTI), Sachin Vyas (Head, LTI Mosaic Platform) and Viswanathan N (Head, A.I and Cognitive) jointly introduced LTI’s Mosaic platform capabilities.

Amit started off providing an overview of LTI’s Insurance solutions, which were demonstrated later at the solution exhibition booths. Sachin gave his perspective on how Operational technologies and Information technologies are merging to create new possibilities, and how LTI has positioned Mosaic to deliver them. Viswanathan emphasized the importance of focus on business outcome while leveraging AI. He also gave a brief demonstration of LTI’s Cognitive Claims solution, and how Mosaic AI platform can be leveraged for easy & fast realization of Insurance use cases.

Solution Exhibits

LTI then opened the floor for networking over wine and cheese, as well as Solution exhibition booths. LTI demonstrated its range of insurance solutions that leveraged digital technologies such as Artificial Intelligence. This included: Smart Underwriting, Cognitive Data Intake, Cognitive Claims, Connected Insurance, Salesforce, Customer Experience (DICE), Test lifecycle automation (PLATO) and partner solution from IBM. The solutions were well received by the audience and the forward looking capabilities presented by these solutions were appreciated.