What the EU Corporate Sustainability Reporting Directive (CSRD) Means for Your Organization

This blog is co-authored by Levent Ergin, Global Chief ESG Sustainability Strategist & Global Head of ESG Strategic Alliance Partnerships at Informatica.

| In the first of our two-part blog series, we explore the European Union’s (EU) newly mandated Corporate Sustainability Reporting Directive (CSRD) and highlight the significance of the underlying data elements for securing high-quality reporting. In our forthcoming blog, we aim to provide a more in-depth exploration of the architecture required for the capture, transformation, curation, and publication of these critical data elements (CDEs) as they relate to the CSRD. |

What is EU CSRD?

One of the primary objectives of the Corporate Sustainability Reporting Directive (CSRD) is to ensure that companies provide reliable and comparable sustainability information. This crucial data enables investors to direct their investments toward more sustainable industries and technologies, thus promoting a greener economy. Likewise, the CSRD assists civil society organizations, consumers, and other stakeholders in evaluating companies’ sustainability performance, aligning with the goals of the European Green Deal.

As part of its Sustainable Finance Package,[1] the European Commission proposes that large companies and non-EU subsidiaries regularly publish reports on the social and environmental risks they face, and the impact of their activities on people and the environment. This package was adopted on April 21, 2021, and aims to boost the flow of financial resources toward sustainable initiatives across the EU.

The CSRD is an extension of the Non-Financial Reporting Directive (NFRD), [2] which was introduced in 2018. The NFRD mandated sizeable public interest entities to report their sustainability performance. With the introduction of CSRD, the scope of reporting requirements has significantly expanded.

Who will CSRD affect?

The CSRD extends its reach to several categories of EU as well as listed companies, including:

- All large EU companies with a workforce of 250 employees or more, holds total assets worth €25 million or more, and has a turnover of €50 million or more.

- Non-EU subsidiaries

Any non-EU subsidiary with a net turnover of €150 million within the EU must comply with the CSRD.

- All listed companies

All companies listed on the stock exchange, including small and medium enterprises (SMEs), must adhere to the CSRD. However, micro-businesses are exempt from these CSRD reporting requirements.

In conclusion, the CSRD represents a significant step forward in the EU’s efforts to promote sustainability and combat climate change. Mandating comprehensive sustainability reporting aims to encourage responsible corporate behavior and drive investment towards sustainable industries.

Disclosures under CSRD

CSRD goes beyond the disclosures mandated by the NFRD, which include a company’s efforts in:

- Environmental matters

- Social matters and treatment of employees

- Respect for human rights

- Anti-corruption and bribery

- Diversity on company boards (in terms of age, gender, educational and professional background)

The CSRD requires businesses to report how sustainability risks could impact their performance. Unlike the NFRD, which provides voluntary reporting guidelines, CSRD reports must adhere to the European Financial Reporting Advisory Group. The CSRD reporting aligns with the existing Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy.

Who defines the reporting standards for CSRD?

The European Sustainability Reporting Standards (ESRS) define the rules of the CSRD. They set the structure and disclosure requirements that companies, banks, and insurance companies in scope need to report on.

The ESRS report should have a specific format with four sections: general information, environmental information, social information, and governance information—also referred to as the ESG standard. [3]

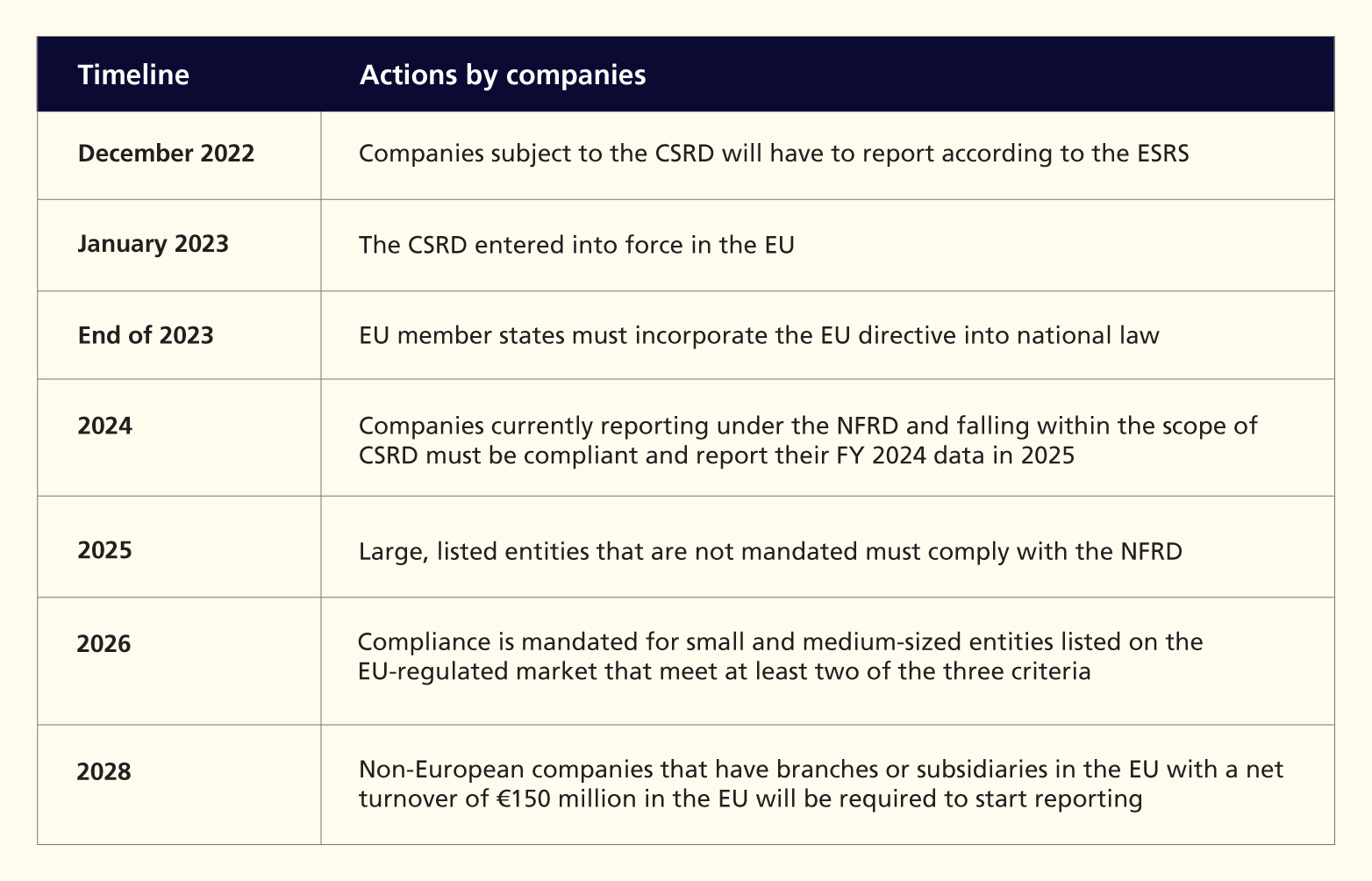

Timeline for CSRD compliance

Following the final approval in November 2022 and coming into force in January 2023, the CSRD mandates that companies be aware of the following key dates:

Implications for businesses

Besides EU companies, over 50,000 businesses operating in Europe are expected to report in accordance with ESRS.

Since reporting standards are obligatory, establishing an organizational structure comprising people, processes, and technology to support the CSRD reporting becomes crucial.

By 2030, almost all companies will need to disclose their non-financial results. The capacity of businesses to harness these indicators will significantly impact their success in funding, recruitment, and client loyalty.

Audit-ready data related to Environmental, Social, and Governance (ESG) factors is crucial for reporting purposes and carbon emissions calculations. The success lies in accurately gathering ESG data and applying appropriate business rules within the sector.

How do we get ready for the next wave of CSRD reporting?

At the intersection of the CSRD reporting and data, regulators will expect companies to have the same level of control as they do on financial reporting for CSRD reporting. This means that companies need to ensure that they have audit-ready ESG data.

When we look at the CDEs that appear in the CSRD/ESRS, we find that there are over 1400 elements to consider. Companies that must comply with the CSRD requirements need to undertake a Double Materiality Assessment (DMA) to identify two key areas:

- Single Materiality: The impact of ESG factors on the company, which includes conducting an assessment of financial risks and

- Double Materiality: The impact of the company’s operations on society and the environment.

The outcome of the materiality assessments will determine which of the 1400 CDEs apply to a company.

Companies need to be able to provide evidence, backed by data, of the process they followed to conduct a materiality assessment. It can be argued that, moving forward, the intersection of the CSRD and data becomes more pronounced, as companies are required to gather the necessary data for ESG disclosures.

Preparing for the next wave of reporting

| If you are keen to delve deeper into this topic, we have co-written another blog alongside Levent from Informatica. In that blog, we explore the data management capabilities that auditors and regulators anticipate, ensuring your organization processes the accurate data it requires. |

[1] https://finance.ec.europa.eu/publications/sustainable-finance-package_en

[2] https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

[3] https://www.climatepartner.com/en/knowledge/glossary/environmental-social-governance-esg

More from Tom Christensen

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

It pays to be data driven. Research conducted by Forrester1 reveals that companies advanced…

Welcome to our discussion on responsible AI —a transformative subject that is reshaping technology’s…

At our recent roundtable event in Copenhagen, we hosted engaging discussions on accelerating…

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…