Using Machine Learning to reduce False Positive in Anti-Money Laundering (AML)

This article provides some thoughts on how machine learning can help in reducing the false positive alerts thereby helping FIs improve their operational efficiencies.

To identify, prevent and report any suspicious activity, Financial Institutions (FIs) spend tremendous amount of time and resources to review the alerts generated by the Transaction Monitoring (TM) software. Monitoring and reporting of suspicious transaction is a mandatory regulatory requirement. This also helps FIs to manage their risk.

For large and mid-size FIs, the volume of alerts can reach more than millions. To review and dispose each alert is a paramount task, and hence, many FIs have implemented risk-based monitoring, thereby reducing number of alerts generated by the TM software. False positives alerts can be reduced by taking following approach:

1) Customer risk profile / segmentation (high, medium and low risk customers)

2) Alert risk scoring

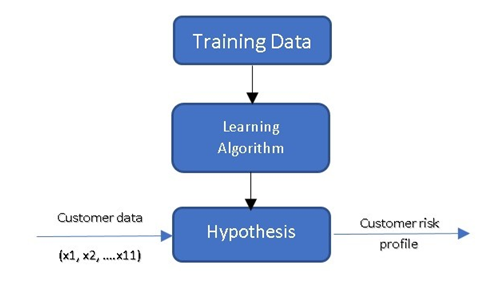

Customer Risk prediction model implementation using machine learning

Step: 1

Identify features for defining the customer risk profile:

Some of the features that can be considered are listed below. Please also note that if more number of features are added, the model will predict with greater accuracy.

x1 = Customer Age (Years)

x2 = Customer Risk (1-10)

x3 = Domicile Country Risk (1-10)

x4 = Individual (0) vs Corporation (1)

x5 = Avg Customer Balance (1-10)(1-100, 2-1000, 3-10000, etc.)

x6 = On the Screening List (0-NO, 1-Yes)

x7 = Negative News (0-No, 1-Yes)

x8 = High Risk Industry Income Src (0-No,1-Yes)

x9 = # of Accounts

x10 = # Escalated Cases (1year)

x11 = # of SARs

Prediction:

y = predict customer risk profile (low=1, medium=2, high=3)

Step: 2

Designing the Customer Risk Profile model:

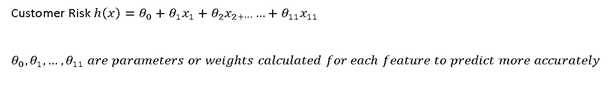

Hypothesis (Prediction)

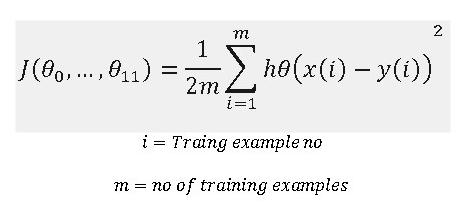

Cost function

Cost function calculates the value of each feature, goal is to minimize the cost.

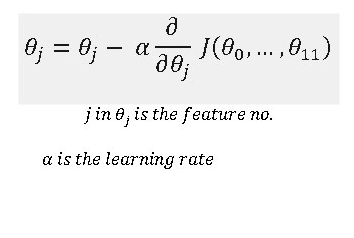

Gradient Descent

To calculate the value of theta for the hypothesis function h(x) use gradient descent algorithm as follows:

Step: 3

Training Data collection:

To train the model, collect data of customers and their risk profile covering details of each customer as required in Step: 1.

More the training data more accurate the model will be.

Step: 4

Test / Validation Data collection:

Test data will help to validate / test the trained model for accuracy of prediction. The test data can be subset of training data covering all the types of customers.

Step: 5

Run the model to predict the Customer risk.

Alert risk prediction model implementation using machine learning.

- Define the features for alert (just like how it is done for Customer Risk model)

- Use the gradient descent to find the values of features using training and validate it using test data

- Run the model for alert risk scoring

Predicting false positive

- Extract the customer information from the alert generated by the Transaction Monitoring system. Find out the Customer risk weight-age from the customer risk data

- Auto Close the alert if the customer risk and alert risk is low

To make the model more accurate, review the prediction with actuals and tune the hyper parameters (like learning rate).

More from Parvez Shaikh

The AML transaction monitoring is based, among other criteria, on customer segments. These…

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…