Using Gen AI for Containing Operational Risk Emanating from Procedural Lapses

Introduction

Operational risk is inherently complex, making it challenging to monitor, regulate, and manage. When an operational risk event occurs, it can have profound, long-lasting spillover effects. Recent years have seen numerous instances where operational risks have spiraled out of control. Traders have placed large, unapproved bets; salespeople have opened accounts without clients’ permission; managers have manipulated market benchmarks; and internal systems have malfunctioned, leading to breaches and compromises of customer data.

These operational errors can have catastrophic consequences, costing banks millions or even billions of dollars in revenue losses, fines, and other penalties from the government. They can result in losing customers, upending management, infuriating shareholders, and causing significant, if not irreparable, damage to a bank’s brand and reputation.

According to a BCG report, from 2011 to 2016, major banks suffered nearly $210 billion in losses from operational risk. Most of these losses stemmed from preventable mistakes made when employees and systems interacted with clients, flaws in transaction processing, or outright fraud.

In this blog, we will explore the causes and impact of operational risk due to procedural lapses and how it can be mitigated by using Gen AI for risk management. But first, let’s take a step back and discuss:

Instances of Audit Lapses Due to Standard Operating Procedures (SoP) Violations:

- French Investment Bank Fraud (2008): In January 2008, a French investment bank discovered that one of its traders had created fictitious trades to conceal a transaction. This was detected by the bank’s control systems, leading to an internal investigation.

- The London Whale Incident: A trader, nicknamed the London Whale, accumulated outsized credit default swap (CDS) positions. The American investment bank initially reported a $2 billion trading loss, but the total loss exceeded $6 billion.

- American Bank Fake Accounts Scandal (2016): In 2016, an American Bank fake accounts scandal shook the banking industry to its core. However, the discovery that the bank had been creating fake accounts in the names of its customers without their knowledge or consent was a major blow to its reputation and financial stability.

Banks’ Audit Function Unable to Trace Procedural Lapses

Despite digitalization, problems persist due to a combination of factors: intentional violations of policies, sloppy execution, lack of knowledge, and inadequate training. Banks’ audit functions struggle to trace procedural lapses in real-time, given the high volume of transactions, multiple systems involved in single transactions, and limited time for auditors. Employees with malicious intent can collude, making it even more challenging.

Figure-1: Audit challenges.

As highlighted in Figure 1, banks’ audit departments cannot monitor and scrutinize the vast amount of data generated, often resulting in reactive, short-term measures for operational risk management rather than a proactive, integrated approach.

Impact of Reactive, Short-Term Measures for Managing Operational Risk

- Reputation Loss: Banks may suffer severe reputational damage

- Ineffective Frameworks: Companies react from one crisis to the next, failing to create robust frameworks

- Regulatory Penalties: Banks face fines and other penalties

- Loss of Customer Confidence: This results in missed business opportunities

- Financial Impact: There are significant impacts on the top and bottom lines

Way Forward

A Gen AI-based risk management solution can help contain operational risk emanating from procedural lapses by identifying violations in SoPs. The solution can:

- Continuously and automatically screen vast amounts of data on the bank’s operations

- Scrutinize transactions across platforms

- Flag procedural lapses in run-time

- Perform audits at a granular level, enhancing the productivity of the audit team

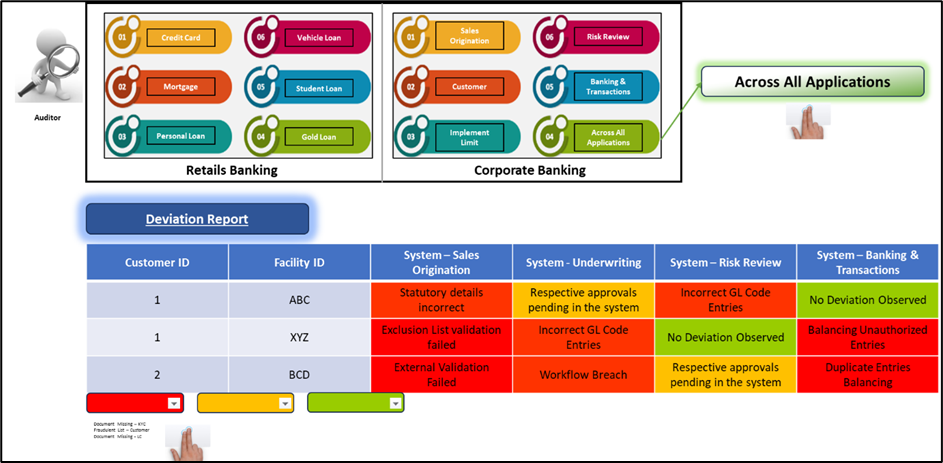

Figure 2: Deviation report from a Gen AI based Risk Management solution.

In Figure 2, The SoP screen displays detailed deviation and violation reports, enabling the audit team to examine infractions from a system-wide perspective.

Conclusion

Operational risks from procedural lapses can have disastrous outcomes for financial institutions. These lapses can cost them millions or even billions of dollars, exposing them to fines, driving away clients, upsetting management, and enraging shareholders. These lapses significantly impact the institution’s reputation.

Gen AI-based risk management solutions can augment these strategies by integrating data engineering, machine learning, and language models to assimilate data from different sources, validate against SoPs, and flag deviations. Banks’ audit functions can use insights from such solutions for ongoing surveillance, quickly developing and adapting key risk indicators (KRIs) that serve as early warning signs of potential problems. This leads to comprehensive risk management using AI.

LTIMindtree, a pioneer in Gen AI-related innovations, has established its presence in the risk management segment by continually creating audit and compliance solutions that ‘ensure a strong bottom line for banks and maintain brand reputation.’

For more information, please reach out to: solutions.EAIAdvisory@ltimindtree.com

Reference

- How banks can manage operational risk, Jan Frederic and Daniel Funaro, Bain, July 10, 2018: https://www.bain.com/insights/how-banks-can-manage-operational-risk/

More from Prashant Raizada

Introduction The financial industry drives the global economy, but its exposure to risks has…

In today's fast-paced business environment, financial institutions operate under intense regulatory…

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…