Transforming Regulatory Compliance: Can Generative AI Empower Financial Institutions to Manage Summons

In today’s fast-paced business environment, financial institutions operate under intense regulatory scrutiny. Central banks, income tax authorities, and customers issue summons and notices requiring timely and accurate responses. Managing these communications is a resource-intensive process, often burdened by stringent deadlines and high stakes.

Enter generative AI—a transformative technology that empowers financial institutions to respond to these challenges with speed, precision, and efficiency. By leveraging AI-driven solutions, financial institutions can automate the drafting of responses, ensure compliance with complex regulatory frameworks, and reduce operational bottlenecks. Traditionally, this process is labor-intensive and time-consuming. It involves complex documentation, stringent regulatory compliance, and the handling of sensitive data. In this blog, we’ll explore how generative AI holds the key to optimizing the summons response process for financial institutions. By embracing Gen AI, these institutions can not only enhance their operational efficiency but also tackle compliance challenges with greater speed and accuracy.

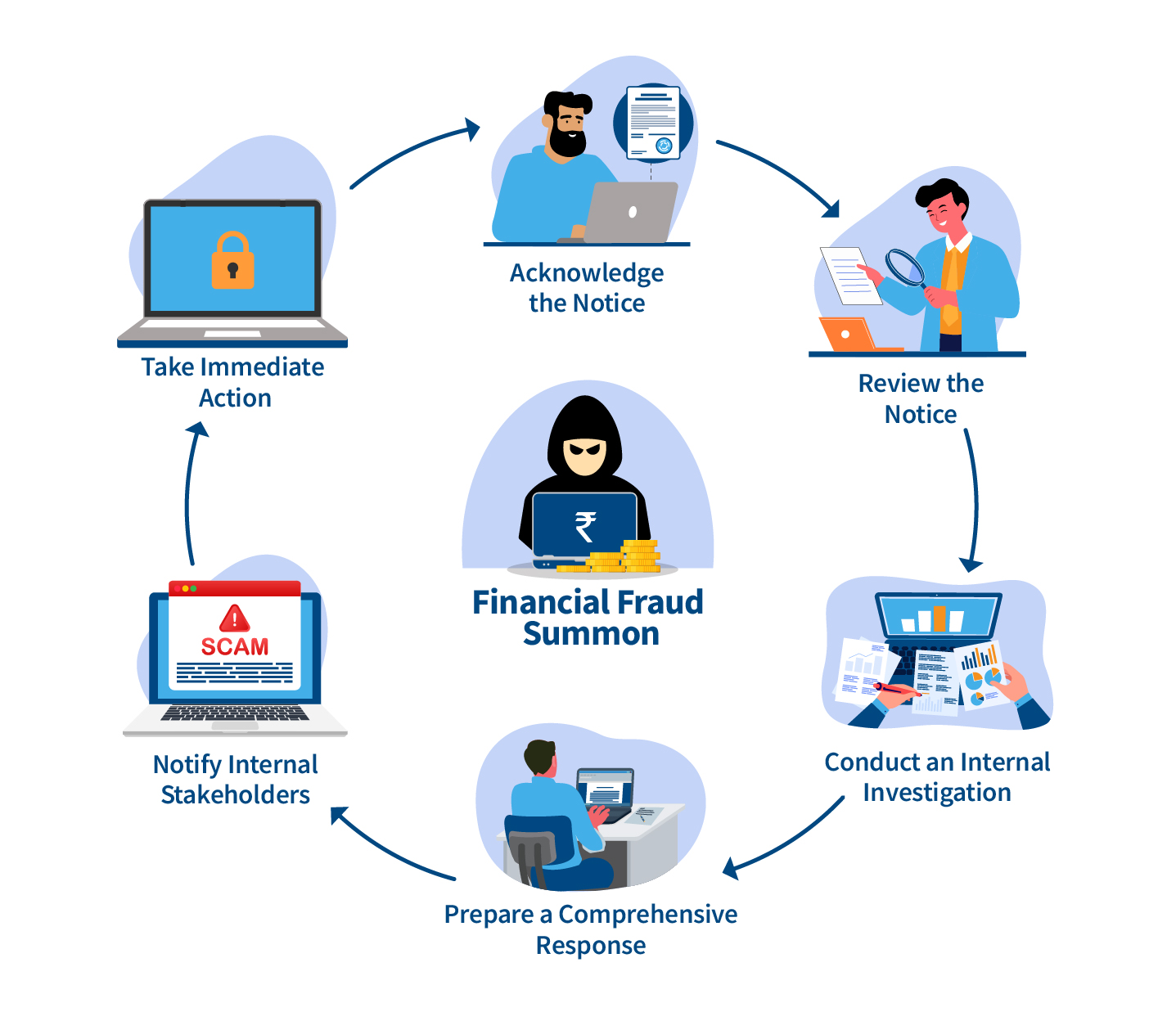

There can be multiple scenarios where financial institutions must respond to the summons/notices. Some of these include:

Key challenges financial institutions face in summons/notice response

Before we learn how generative AI can enhance summons response management, it’s important to understand the challenges that financial institutions are currently facing. When financial institutions receive summons from regulators like central banks and tax authorities, they encounter a range of significant challenges in responding promptly and accurately. Here are some key hurdles they face:

- Data volume and complexity: Picture a massive library filled with countless books, each representing vast amounts of transaction records and customer details. Now imagine needing to find a single chapter amidst that chaos! Similarly, financial institutions must sift through extensive transaction records and customer information, often stored in various systems and formats, to find the relevant details needed for the summons.

- Accuracy and completeness: A rushed response can lead to errors, which might result in repercussions or tarnished reputations. Ensuring accuracy and thoroughness becomes not just important but essential.

- Strict deadlines: Summons often have a deadline that feels more like a sprint than a marathon. Financial institutions must rally their resources fast, balancing the urgent need to respond with their everyday operations.

- Coordination across departments: Effective responses often require collaboration among legal, compliance, IT, and operations teams. Coordinating these efforts can be time-consuming and hindered by communication barriers, making timely responses more difficult.

- Regulatory compliance: Think of it as walking a tightrope: institutions must ensure they’re complying with privacy laws while also delivering what’s needed. For global players, this challenge intensifies as they juggle different regulations from various countries, making compliance a complex puzzle.

Navigating these challenges isn’t just about following the rules; it’s about turning a stressful situation into a well-oiled response machine.

What does the future hold for generative AI and summons response management?

If you haven’t yet embraced this technology in summon response management, here are some compelling reasons to consider its adoption:

- Automating the drafting of summons

One of the key areas where Gen AI is making a significant impact is in the automation of drafting summon responses. Traditional drafting methods, which involve human oversight at every stage, have always been prone to delays and errors. Gen AI can now automate the process of generating regulatory-compliant summons with the following benefits:- Faster turnaround times by leveraging AI-driven document generation tools.

- Error reduction: AI systems are trained on regulatory databases and ensure that documents adhere to the precise language required for banks.

- Customizable templates: Templates are tailored to specific legal cases or jurisdictions, allowing for rapid adjustments based on case complexity.

By automating document generation, banks can respond more swiftly to summons, ensuring compliance with court-mandated timelines and minimizing risks associated with delays.

- Enhancing accuracy in complex legal language

Financial institutions often receive highly detailed and complex summons that require precision in both language and content. Through advanced natural language processing (NLP) capabilities and computer vision, Gen AI is equipped to:- Interpret legal jargon accurately, ensuring that the responses are clear, unambiguous, and error-free.

- Adapt to regulatory changes in real-time, ensuring that the responses remain compliant with evolving financial laws and regulations.

- Align with jurisdiction-specific requirements, offering tailored document generation that accounts for local, national, or international banking regulations.

This level of precision reduces the chances of misinterpretation or non-compliance, which is critical for financial institutions dealing with multiple jurisdictions.

- Improving regulatory compliance and risk management

Compliance with financial regulations is one of the most crucial responsibilities for financial institutions, especially when faced with a summons that may involve complex regulatory issues. Gen AI’s integration into the process of handling summons offers numerous benefits in this area:- Real-time compliance checks: Gen AI can analyze summons content to ensure they align with the financial institution’s regulatory obligations. It flags any potential risks or discrepancies before they escalate into larger issues.

- Cross-referencing financial laws: Gen AI can cross-reference summons with a financial institution’s internal policies and current regulations, ensuring that all documentation meets compliance standards.

- Automated reporting: Gen AI tools can generate detailed compliance reports, highlighting potential risks for the financial institution and recommending appropriate responses.

With AI-driven compliance solutions, financial institutions can reduce their exposure to regulatory penalties and ensure they meet their obligations in a timely and accurate manner.

- Handling large volumes of summons

Large financial institutions often deal with multiple summons simultaneously, particularly when involved in class-action lawsuits, regulatory investigations, or complex financial disputes. Gen AI excels in managing these large volumes by:- Batch processing of summons allows for multiple documents to be created, tracked, and processed at once.

- Efficient categorization and prioritization of summons based on urgency, complexity, and financial impact.

- AI-driven document management systems that ensure all summons are securely stored, indexed, and easily retrievable for future reference.

This high-level document management ensures that banks can handle vast numbers of summons without being overwhelmed by administrative burdens, allowing them to focus on higher-value tasks.

- Data-driven insights

Another powerful feature of Gen AI is its ability to analyze vast amounts of data from previous cases and summons to provide strategic insights. This can prove invaluable in responding effectively to summons. Key benefits include: Predictive analytics: Gen AI can analyze historical data to predict outcomes of similar summons, helping Financial Institutions anticipate regulatory challenges and plan accordingly. Case-specific recommendations: AI can recommend strategies based on patterns in previous cases, helping teams within Financial Institutions make informed decisions about handling summons. Data-driven insights: Banks can leverage AI to understand trends in the types of summons/notices they receive, enabling them to identify and mitigate recurring risks. These insights enable banks to adopt proactive strategies, reducing the likelihood of unfavorable outcomes and minimizing financial exposure.

Way forward

Enabling the Decision maker in responding to summons/notices

To effectively manage the challenges of responding to summons, financial institutions can leverage generative AI (Gen AI) to streamline their processes and maintain compliance. A comprehensive Gen AI solution should:

- Simplify the summon response process: Create a more efficient workflow for handling legal documents.

- Implement a streamlined summons management system: Reduce human error and enhance compliance tracking.

- Utilize advanced data management: Facilitate easy retrieval and analysis of relevant information.

- Incorporate scheduler functionality: Automate key tasks, including:

- Summon extraction

- Summon classification

- Data extraction

- Transaction scrutiny

- Workflow approvals

- Automate document drafting and review: Increase accuracy and efficiency in responses.

- Continuously monitor compliance: Adapt proactively to regulatory changes.

Responding to summons/notices poses significant challenges for financial institutions, requiring a balance of efficiency, accuracy, and compliance under tight deadlines. By adopting the “Summon Response Enabler,” a Gen AI-based compliance solution, financial institutions can enhance proactive compliance programs, optimize resource management, and improve coordination.

This approach not only helps avoid repercussions but also underscores the institution’s commitment to regulatory compliance and operational excellence. LTIMindtree, a leader in Gen AI innovations, is dedicated to developing audit and compliance solutions that strengthen the bottom line and uphold the brand reputation. For more information, write to us at EAIBusiness.Advisory@LTIMindtree.com.

You can also gain insights on Using Gen AI for Containing Operational Risk Emanating from Procedural Lapses here.

More from Prashant Raizada

Introduction The financial industry drives the global economy, but its exposure to risks has…

Introduction Operational risk is inherently complex, making it challenging to monitor, regulate,…

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…