Three Ways How Computer Vision Can Revolutionize Insurance

Computer vision as in interdisciplinary field that involves recognizing visual patterns. We use computer vision to focus the camera on our cell phones or apply fun filters to the images. Deep learning-enabled computer vision can identify faces in images and in live video. Some medical industry applications can detect cancerous tissues by analyzing lots of images and learning patterns that detect cancerous from healthy tissues.

Self-driving cars use cameras and sensors to see the world around them. The images from the camera are analyzed in real-time to detect objects such as other cars, and pedestrians. The images are also analyzed to assess where the car is on the road and in the world based on the car’s surroundings. Thus, computer vision not only helps identify objects, but also builds a physical model of the world around it. According to Tractia, computer vision will be USD 26B+ industry by 2025.

- Top applications from an insurance industry perspective include:

- Vehicle, object detection and collision avoidance

- Auto damage detection

- Medical image analysis

- Face recognition and analysis

- Converting paperwork to digital data

- Visual search

- Computer vision can offer unparalleled personalization to the user of the application, thus providing dramatically improved customer experience.

- Traditionally, the insurance industry has not been known to provide the best user experience.

- However, providing a better customer experience is now a key focus area for the new ‘digital insurer’.

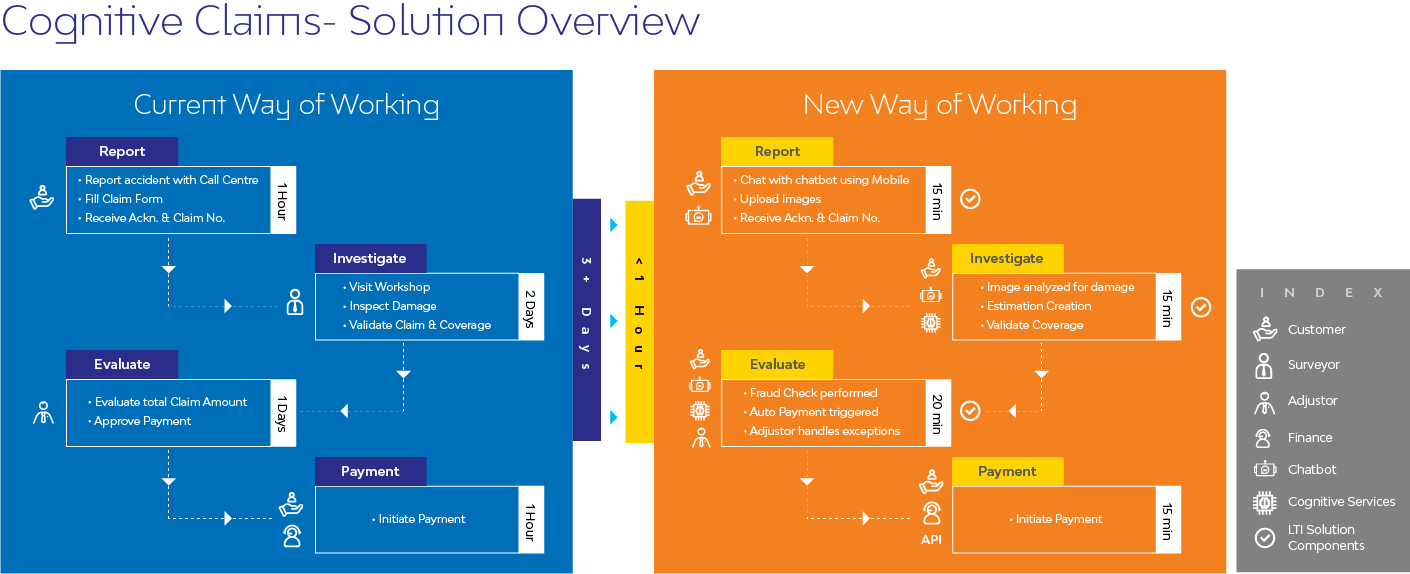

Auto insurance is one such area where computer vision will have a profound impact. While self- driving cars may still be few years away from going mundane, computer vision can provide superior customer experience to the user, today! Take the case of computer vision-enabled auto damage detection for a typical fender bender, here is how it works:

- AI-enabled virtual adjuster on user’s mobile app can detect and analyze auto damage, validate coverage, check for fraud, offer claims estimate and even trigger payments in a matter of minutes, right from the scene of the accident.

- Contrast this with the current situation where the user calls the call center, files a claim. This is followed by a human adjuster who visits the workshop to inspect the damage, validate claim and coverage, evaluate the claim amount and approve payment followed by the finance department initiating payment. The latter scenario plays out over a number of days.

The machine brings down claim settlement from days to minutes and wins hands down. No more wait time, no to being put the call on an endless hold, no more following up to check the claim status. All that you need is available instantly on your cell phone and at your fingertips.

This is first part of the three- part blog series on how computer vision is revolutionizing Insurance. In the next two blogs, I will take a deep dive in computer vision-enabled Face recognition and analysis and Medical image analysis.

More from Amit Chopra

Homes are getting smarter and insurers want to ride this wave of enchantment!The smart…

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…