The Insurance Challenge: Managing Product Complexity

Rationalization and standardization of products has always been a key business concern. It has been a constant challenge to accommodate customer demands and stay competitive, while maintaining a consolidated suite of offerings. For the Insurance industry, this challenge becomes even more significant because of the very dynamic nature of the industry and its marketplace. Besides, for the Insurance industry especially a complex product portfolio does not necessarily drive additional business value.

The culprit: complexity

Each Insurance carrier today is dealing with plenty…and not necessarily in a good way. Over the decades, Insurance firms have become increasingly complex as a result of acquisitions and product proliferation. There are various versions of the same product, thanks to legacy, mergers & acquisitions, the multitude of application platforms in use, or the sheer market demand for custom products based on geography, agency profile or niche creation.

Obviously, Insurance carriers need to do the math for maintaining and supporting so many variants of their products, or risk confusing their distribution channels and even customers. Low volume products cost more to maintain than the revenue they bring in, and a large product portfolio means as many regulations to manoeuvre, and distribution channels to build. Moreover, underwriters also get bogged down by the sheer number of rules, forms, rating algorithms, workflows etc.

Other key business drivers for Insurance carriers to make their product portfolio simplified, leaner and agile include improved speed to market, more efficient operations and sales processes, and reduced costs of marketing and product design.

The complication: wrong approach

The most obvious solution has been to adopt appropriate design concepts for products and workflows from industrial production and apply them to Insurance. As a result, products are now treated like configurations, much like factory made products. Carriers look at how Insurance products can be assembled from components using the principle of managing multi-variant product configurations from industrial manufacturing. So where are they going wrong?

Insurance products are intangible. The most common mistake that carriers commit is combining the consolidation and rationalization exercise as part of the Insurance Product Administration System implementation viz. an IT project. While this seems like a logical step, it fails to evaluate insurance products in the light of business value they generate.

The solution: product simplification and alignment

What they really need is a common product model identified and vetted by the core business team, and not something designed by the IT team. That’s because product simplification/ consolidation seeks to optimize the product offering as per market needs, and to maintain consistency in the way products are sold across entities and different channels.

Insurance firms that manage product complexity will have a strategic advantage, as they can focus on growth areas, build sustainable market positions, and improve customer experience. Here’s how they can build transparent products and be in tune with marketplace developments:

Product Simplification:

- Consolidate the numbers of products in-force

- Simple core structures with variations based on brand / channel

Product Alignment:

- Flexible product structure using inheritance model

- High level of adaptation and integration for rating

- Eliminate high maintenance – low-profit contributors

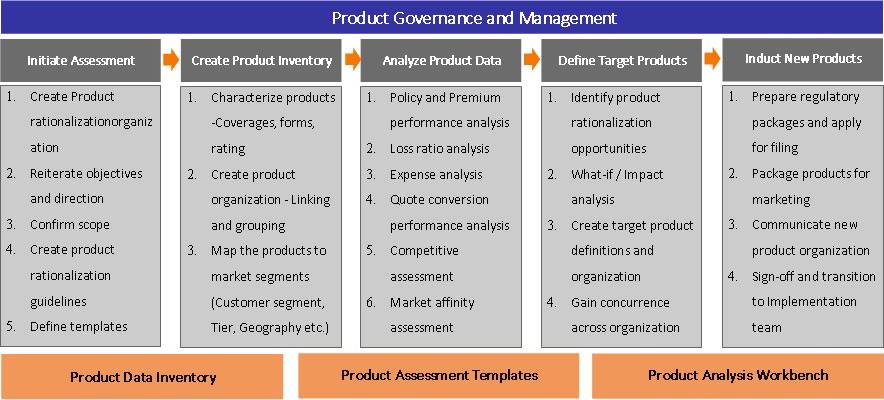

The chart below is a suggested roadmap for Insurance firms to build a more streamlined portfolio, for Insurance firms:

The end Game: success factors

While having the right team to build the product portfolio is a key aspect, having a roadmap for the future insurance products is equally important. Rationalization and simplification of forms can improve operational efficiency, increases reusability of remaining forms, and provides intangible benefits. They need to streamline business areas that generate profitable growth and abandon products that neither offer sufficient value to customers nor add to profits. The critical success factors for an effective Product Consolidation and Rationalization project would be:

- Get a buy-in from channel partners and customers and avoid channel conflict

- Give an omni-channel experience to each set of end-users

- Differentiated product strategy – right analytics to truly understand profitability

- Cost of migration

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…