Smooth Financial Close in JD Edwards ERP: Fact or Fiction

Introduction

CxOs world over are chasing business goals all the time. One of the important goals of a CFO, is to report company financials accurately and quickly, without any non-compliance to statutory regulations. As it appears, this task is easier said than done, primarily due to complexity of business with financial accounting being done for multiple countries, businesses, divisions, entities, etc. It is not uncommon to see large numbers of companies defined in a typical ERP system with associated Business units, Branch Plant, etc. forming a complex organizational hierarchy and structure. It is also important to ensure that the period close activity is performed quickly without any possibility of transactions carried out in the system for previous period, as it may give erroneous reporting.

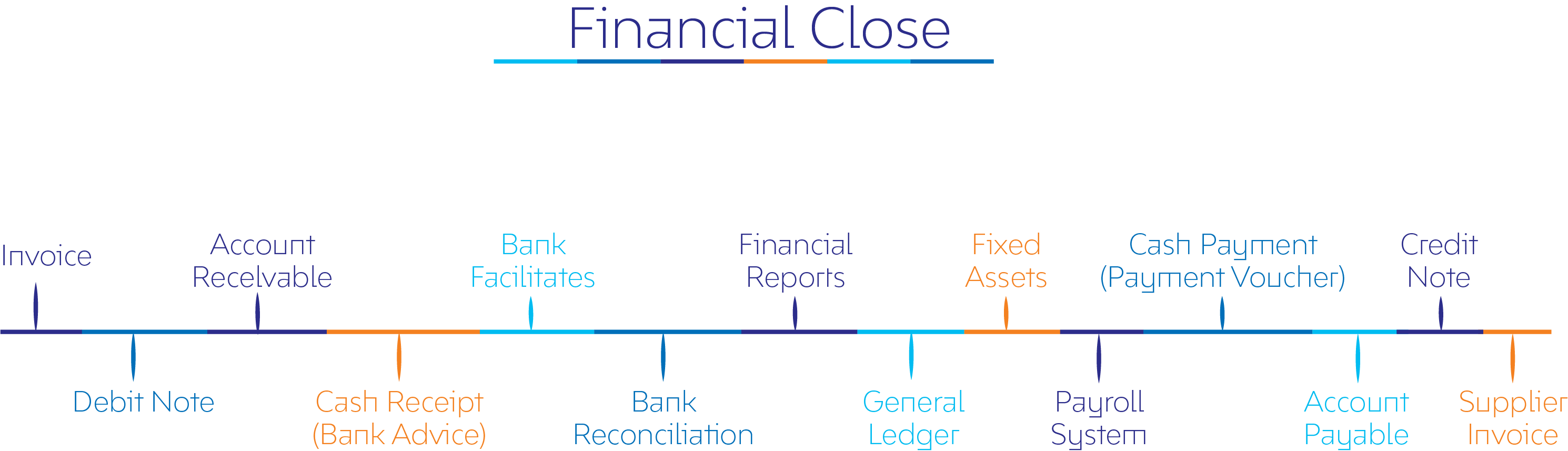

Financial close itself is a complex process as it is. The process in itself involves series of steps such as closing period, bank account and cash reconciliation, reconciling inventory, closing job costing transactions, AP/AR close through reconciliation, and finally General Ledger (GL) close, which will give the desired outcome that can then be used for the reporting purposes.

The whole Financial close cycle and associated modules are as shown in Figure below:

Large companies having multi-country, multi-divisional set ups, have to go through complex set of activities and steps, and missing any one of them can result in to erroneous reporting or needs tedious task of checking and reconciling thousands of transactions, to ensure accurate reporting. Financial period close is carried out monthly, so the finance folks and CFO typically goes through such cycles at least 12 times in a financial year.

What are the typical challenges of Financial Close process?

As described above, there are challenges encountered during financial close as below:

- Highly Manual & Labor-intensive Process

- Absence of system-based control points

- Dependence of Non-system-based communication of completion of tasks

- A large number of highly dependent and sequential tasks are to be carried out by different stakeholders within a short period of time

Apart from the above, there are many other possibilities that need to be closely verified, such as:

- Your financial processes do not run, and you have no inkling about it

- If your financial integrities are not verified and confirmed.

- Tasks are not executed on time, and in a way required to meet reporting deadlines

- You are not sure if, conformance to the audit standard and processes are not adhered to

- In your multi-site environment you do not know the status of each site/country

- Gaps in communication leads to delay

Any tool or a system that can simply this complex process and give a transparent view of the status of Close process, can be a boon to the Finance community and the Financial Controllers.

LTI-built Financial Close Cockpit

In order to address this issue and make the Close process robust and reliable, we developed a Financial Close cockpit built in JDE environment, with a single screen interface that enables easier navigation and improves usability. The cockpit itself has following features:

- Graphical presentation layer giving clear indication of the status

- Provision of specific process updates

- Facility to synchronize data across countries within an Instance

The cockpit itself has multiple other features such as:

- Reusability across releases

- No additional licenses or software for Reporting needed

- Enables Audit trail

- Leverages JDE user roles and security

- Ease of configuring the Country\Company\Module\Process

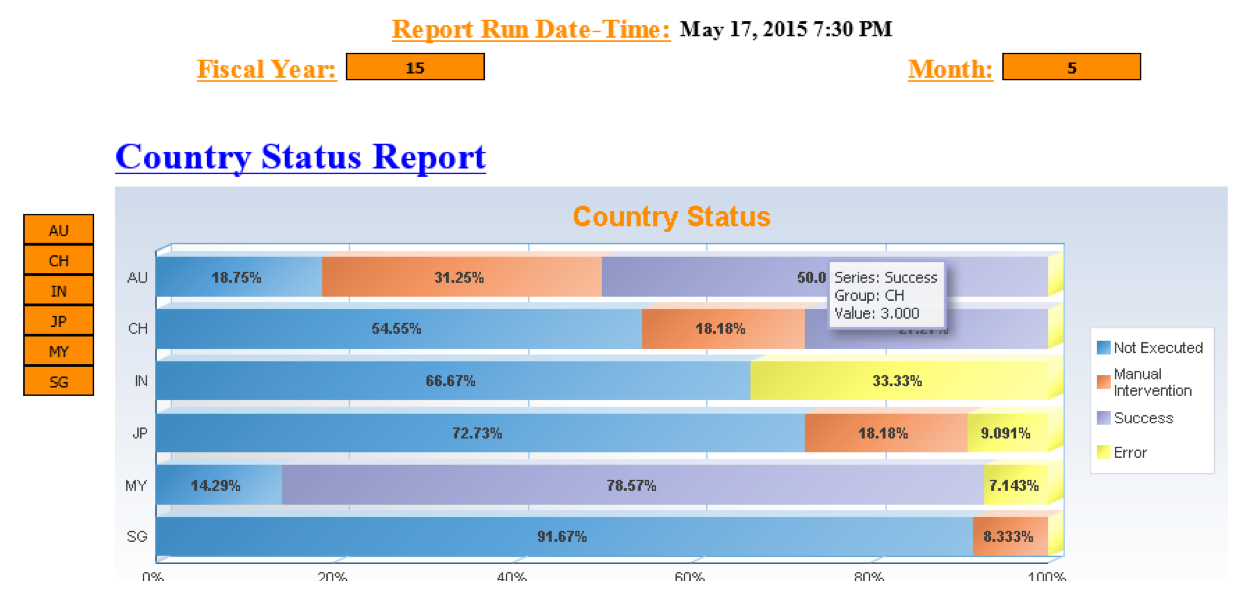

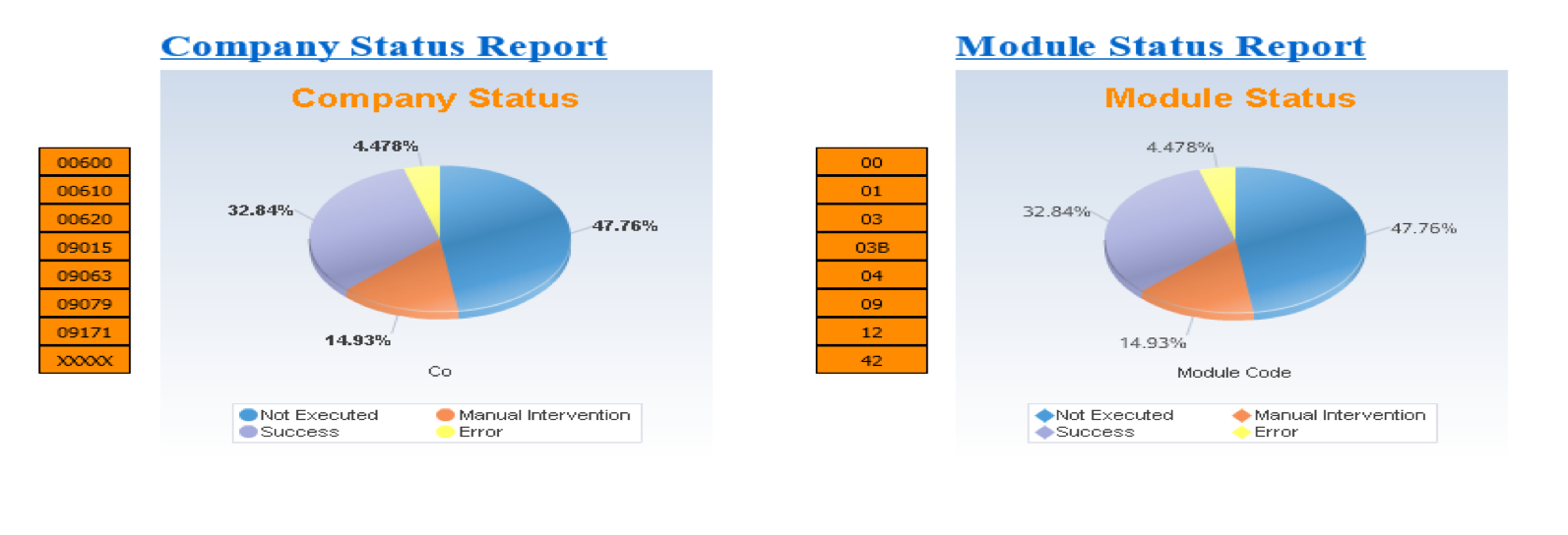

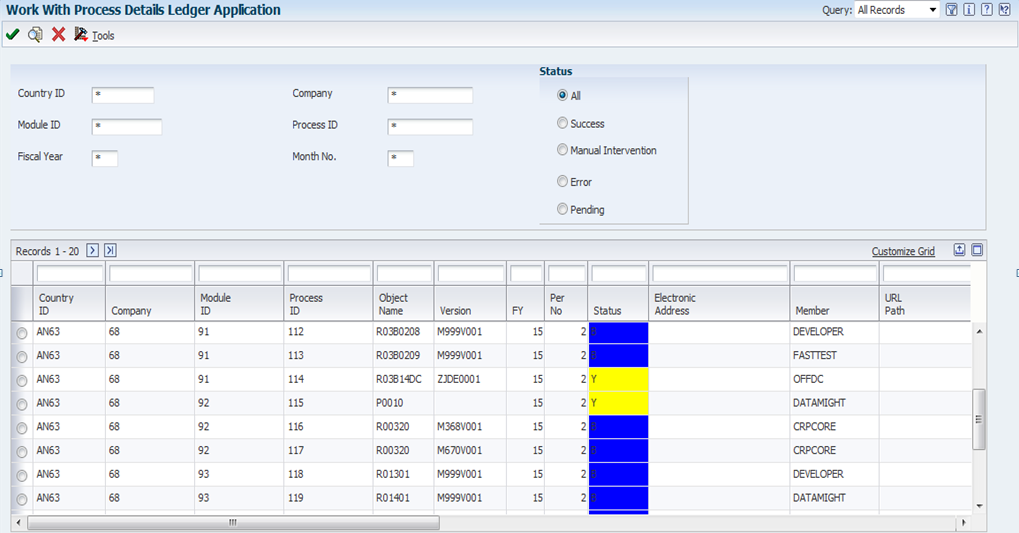

Some of the screens are as shown in Figure below:

The whole access and process triggers are built in JDE environment and screens design are carried out based on same standards as any other JDE screen, as can be seen in Figure below:

Conclusion

Many customers are already deriving significant benefits by using the system. The benefits can be summarized as below:

- JDE-based Tool , no license cost involved

- Reduced manual efforts to monitor Financial Close Processes

- Single-screen display of financial close across countries in an instance

- Stores Outputs of the successfully completed UBEs for Audit purpose

- Conforms and confirms the processes compliance by respective stakeholders

- Assists all – CEOs, CFOs, Company Heads, Process Owners, etc.

- Completely Configurable

- Collation of data using minimum resources

More from Dr. Arvind Ankalikar

Latest Blogs

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…

Introduction In the upstream oil and gas industry, drilling each well is a high-cost, high-risk…