Reimagining Insurance Claims With Agentic Ai: A New Era Of Accuracy, Speed, And Trust

Introduction

Have you ever wondered how the insurance industry can radically improve claims settlement—cutting costs, boosting accuracy, and restoring customer trust? The answer lies in the adoption of agentic AI, a transformative leap beyond traditional and generative AI. Unlike reactive systems, agentic AI perceives its environment, interprets context, and acts independently to achieve outcomes. It doesn’t just respond—it reasons, decides, and executes.

In 2025, insurers face mounting pressure: rising operational costs, complex compliance demands, and customer expectations for faster, fairer resolutions. According to the latest NAIC report, over 25% of premiums are consumed by operating expenses, with claims processing as a major contributor. Delays between First Notice of Loss (FNOL) and settlement inflate loss-adjustment costs and erode customer confidence. As a result, 88% of auto and 70% of home insurers are turning to AI i—but not just any AI.

Agentic AI is the next wave in digital transformation. These autonomous agents can manage entire claims workflows—from fraud detection and document verification to settlement recommendations—without human intervention. They adapt, learn, and collaborate across systems, making them ideal for handling emotionally charged, high-stakes claims.

This blog explores the benefits of agentic AI in insurance, including reduced manual errors, faster settlements, and empathetic customer engagement.

From first notice to final settlement: The anatomy of a claim

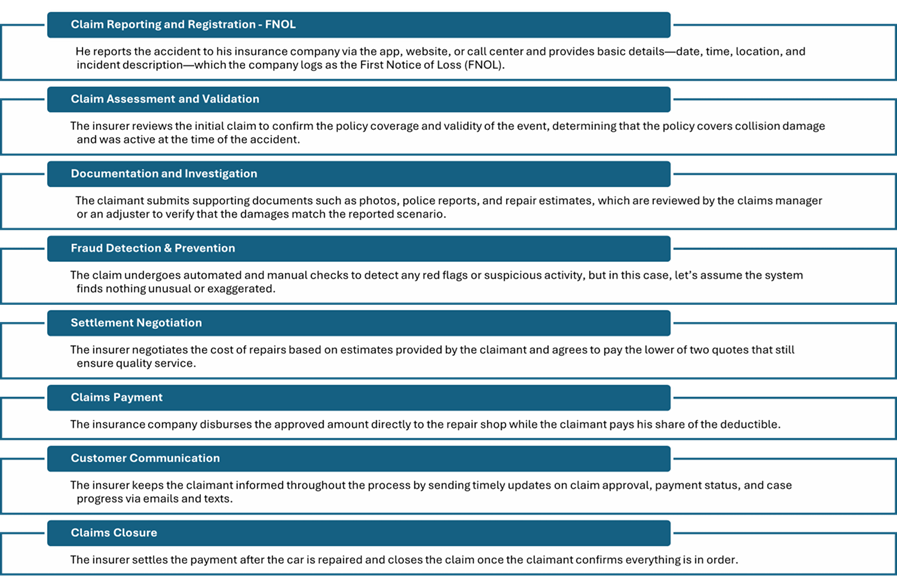

Let’s examine the typical claims management process. Imagine a policyholder who has just been in a car accident; here’s how the standard insurance claims journey unfolds, step-by-step.

Figure 1: Claims management process flow

Top 5 challenges in traditional insurance claims processing

Despite digital advancements, many insurers still rely on manual claims workflows that are costly, slow, and error-prone. Here are five key challenges impacting both insurers and policyholders:

High administrative costs: Manual data entry, paper handling, and rework significantly inflate loss-adjustment expenses (LAE), consuming up to 25–30% of earned premiums in some P&C lines. According to NAIC’s 2024 year-end snapshot, the U.S. property-and-casualty industry runs an expense ratio of 25.2% ii, largely driven by underwriting and claims administration.

Slow cycle times: Claims often stretch from days to weeks due to manual hand-offs, document chasing, and fragmented communication. These delays increase rental car and litigation costs, erode customer trust, and raise the risk of churn. PropertyCasualty360 estimates that poor claims experiences could put up to USD 170 billion in premiums at risk over the next five years.iii

Error-prone processes and rework: Human errors—such as mistyped data or misplaced documents—lead to compliance breaches, supplemental payments, and duplicated effort. A recent case in India saw an insurer fined ₹90,000 for wrongful denial, highlighting the reputational risks of manual claims handling. iv

Fraud vulnerability: Without real-time analytics, insurers struggle to detect suspicious patterns early. This exposes them to inflated or staged losses and costly post-payment recoveries. The FBI estimates that insurance fraud costs U.S. families USD 400 to USD 700 annually due to higher premiums. v

Poor customer experience: Complex digital interfaces and slow responses deter claims filing. A surveyvi found that 22% of consumers avoided filing claims due to frustrating digital experiences. J.D. Power reports that 38% of customers fall into the lowest satisfaction tier, making them more likely to switch providers.vii

Reimagine claims management with agentic AI

Agentic AI—autonomous, goal-driven systems capable of perceiving, reasoning, and acting – offers transformative potential in insurance claims management. By automating and optimizing various stages of the claims process, agentic AI can enhance efficiency, accuracy, and customer satisfaction. Here’s a step-by-step approach to incorporating agentic AI into the insurance claims management process.

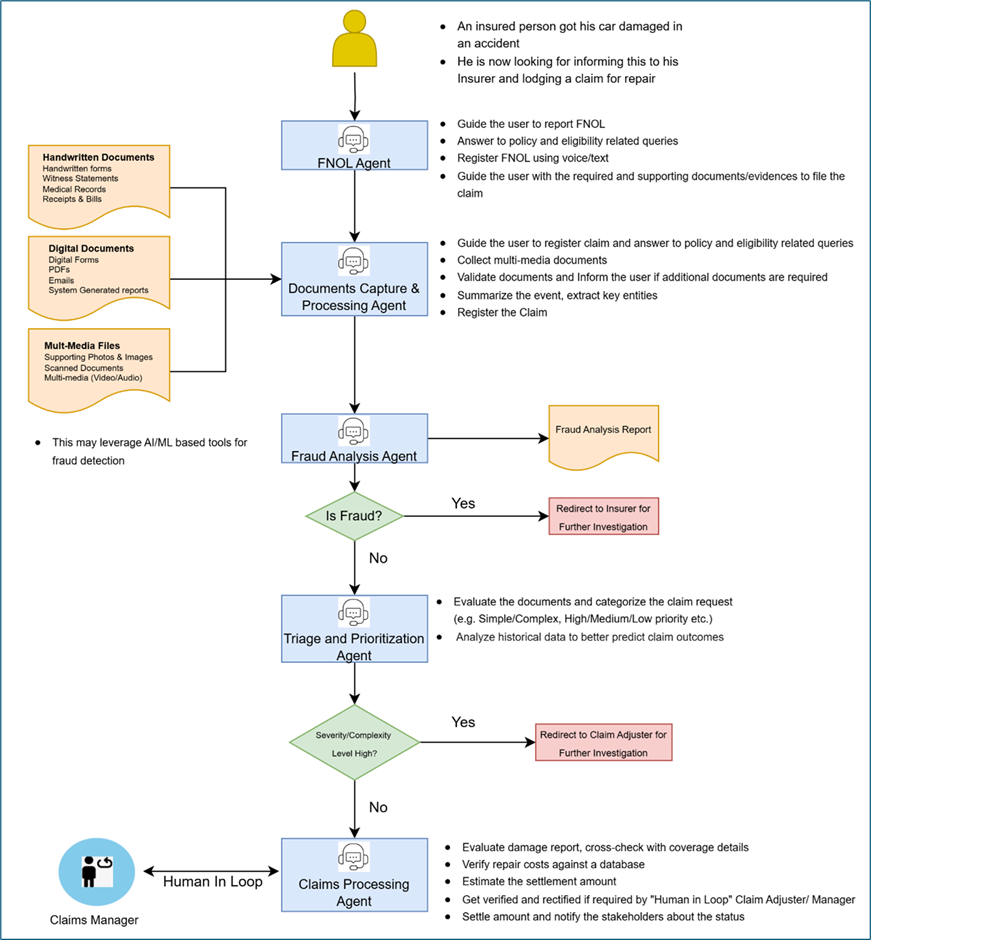

Figure 2: Claims management process Flow with agentic AI

As seen in the above diagram, the FNOL agent collects incident details and initiates digital claims, validating input automatically. The document capture and processing agent captures, extracts, validates, and stores data from various formats, learns document types, and flags missing items. The fraud analysis agent applies rule-based and ML models to detect anomalies, updating logic continuously and routing claims accordingly. The triage agent assesses complexity and urgency, adjusts criteria based on trends, and escalates high-impact cases. The claims processing agent confirms coverage, calculates settlements, prepares offers, and optimizes decisions for fairness and speed, validating with adjusters before notifying stakeholders. Each agent exhibits autonomous, adaptive behaviour throughout the process.

To embark on this journey of building an agentic AI solution for claims processing, Insurers need to begin with pilot use cases, define agent roles (e.g., FNOL, fraud detection), and scale iteratively with a focus on transparency, adaptability, and customer-centric outcomes. Platforms are also available that can help Insurers jumpstart by leveraging purpose-built agents and custom-built platforms.

LTIMindtree’s BlueVerse is one such platform that converts enterprise AI strategies into measurable outcomes. It replaces fragmented initiatives with a unified, scalable system that integrates intelligent automation and domain expertise. It is powered by the industrial-grade BlueVerse Foundry and a marketplace of 300+ reusable agents. Some examples of pre-built agents which can be useful in building an insurance claims management agentic solution are FNOL agents, and insurance claim document validation agents, coverage verification agents, claims status trackers, and insurance process digital acceleration.

Benefits of agentic AI in insurance claim processing

Here is a list of benefits that agentic AI-enabled claim processing offers:

Figure 3: Benefits of agentic AI-enabled insurance claim processing

Pitfalls – and how to navigate them

- Data bias and fairness: Models trained on historical claims can perpetuate geographic, socioeconomic, or demographic skew, leading to disproportionate denials or lower pay-outs—and lawsuits.

Mitigation: Synthetic data augmentation and fairness metrics in model cards are a way to overcome this. - Explainability: Regulators increasingly demand “reason codes.” Opaque LLM output exposes carriers to fines and remediation orders.

Mitigation: Coupling LLMs with symbolic rules or causal graphs can generate human-readable rationales. - Workforce impact: 58 % of frontline adjusters say they receive little or no training on new AI tools, stalling ROI and fueling skepticism.vii

Mitigation: Launch role-based up-skilling, embed AI champions in claims teams, and use co-pilot UIs that surface intermediate reasoning instead of “black-box” scores. - Cyber and model security: Adversarial prompts or poisoned images can skew results. Also, vast PII/PHI flows into LLM prompts; prompt injection or model inversion could leak sensitive data.

Mitigation: Mask PII before inference; apply zero-trust, prompt-sandboxing, and red-team testing. Adopt gated endpoints, retrieval-augmented generation (RAG) with policy constraints, and regular red-team testing.

Future trends of agentic AI in insurance

Integration with Internet of Things (IoT)

IoT devices like connected cars and smart home systems enable real-time incident detection and automated claims reporting, improving speed and accuracy. For example, a connected car can transmit crash data instantly, while smart home sensors alert insurers to issues like leaks or fires.ix Leveraging the power of IoT in Insurance is the way forward.

Blockchain and AI collaboration

Blockchain and AI together streamline P&C claims—blockchain ensures tamper-proof records and automatic payouts, while AI speeds up validation and fraud detection. For instance, “parametric insurance” pilots in Kenya—run by Lemonade Foundation – use blockchain-oracles for rainfall data and smart contracts to trigger automatic payments, eliminating manual claims steps, reducing cycle times, and cutting fraud.x

Conclusion

Agentic AI represents not only a technological innovation but also a paradigm shift in how insurance providers interact with their customers and manage their operations. Its ability to accelerate claim settlements, prevent fraud, and optimize workflows makes it an indispensable tool for insurers aiming to stay competitive in a rapidly evolving market. As this technology continues to advance, its potential to create a more efficient, fair, and customer-centric insurance industry is boundless.

References

i – AI in the Insurance Industry: Balancing Innovation and Governance in 2025, Fenwick, February 13, 2025: https://www.fenwick.com/insights/publications/ai-in-the-insurance-industry-balancing-innovation-and-governance-in-2025

ii – NAIC’s 2024 year-end snapshot, NAIC, December 31, 2024: https://content.naic.org/sites/default/files/2024-year-end-snapshot.pdf

iii – P&C insurance claims processing: Overcoming challenges through tech, propertycasualty360, March 06, 2024: https://www.propertycasualty360.com/2024/03/06/pc-insurance-claims-processing-overcoming-challenges-through-tech/

iv – Insurance company fined Rs 90k for denying eye treatment claim, Jun 03, 2025: http://timesofindia.indiatimes.com/articleshow/121603174.cms?utm_source=chatgpt.com&utm_source=contentofinterest&utm_medium=text&utm_campaign=cppsthttps://timesofindia.indiatimes.com/city/hubballi/insurance-company-fined-rs-90k-for-denying-eye-treatment-claim/articleshow/121603174.cms

v – NICB and Agero join forces to combat insurance fraud, National Insurance Crime Bureau (NICB), June 12, 2024: https://www.nicb.org/news/news-releases/nicb-and-agero-join-forces-combat-insurance-fraud

vi – 1 in 5 Consumers Avoid Filing Claims Due to Frustrating Digital Processes, According to Insurity’s Latest Survey, Insurity, May 27, 2025: https://insurity.com/press-release/1-5-consumers-avoid-filing-claims-due-frustrating-digital-processes-according

vii – It’s Now a Buyer’s Market for Auto Insurance, J.D. Power Finds, J. D. Power, June 10, 2025: https://www.jdpower.com/business/press-releases/2025-us-auto-insurance-study

viii – From Investment to Implementation: Addressing AI Adoption Challenges in Claims Management, The Gradient AI, March 25: https://www.gradientai.com/from-investment-to-implementation-addressing-ai-adoption-challenges-claims-management-blog

ix – IoT in Insurance: Improving Claims Accuracy and Speed Through Connected Devices, HashStudios, December 26, 2024: https://www.hashstudioz.com/blog/iot-in-insurance-improving-claims-accuracy-and-speed-through-connected-devices/

x – Is blockchain the next big thing for insurance companies?, Reuters, October 9, 2024: https://www.reuters.com/legal/legalindustry/is-blockchain-next-big-thing-insurance-companies-2024-10-09/

Latest Blogs

A closer look at Kimi K2 Thinking, an open agentic model that pushes autonomy, security, and…

We live in an era where data drives every strategic shift, fuels every decision, and informs…

The Evolution of Third-Party Risk: When Trust Meets Technology Not long ago, third-party risk…

Today, media and entertainment are changing quickly. The combination of artificial intelligence,…