Managing General Agents: Future Readiness

Over the last decade, Managing General Agents (MGA) have enjoyed a much higher growth rate than the overall commercial property and casualty market in the insurance ecosystem. The MGA market exceeded USD 70 Bn in premiums in 2021. This trend doesn’t seem to stop anytime soon and shall continue over the next few years. This blog does a critical and constructive analysis following the 5W1H principle of questioning the existing situation to identify the trends in the MGA market and describe the context precisely, followed by the hypothesis suggesting how MGAs could prepare and be ready for the future from a technology standpoint.

Key indicators of the growing MGA market –

- Continued growth in the program sector, outperforming the wider commercial insurance market

- Surging E&S market, triggering significant demand for solutions to address risks such as cybercrime, climate change, pandemics, etc.

- Continued wave of insurtechs that view the sector as a preferred avenue to provide speed to market for their innovative products and access to capacity

- Increased new entrants in the hybrid fronting carrier space to provide a conduit between reinsurance capital and MGAs

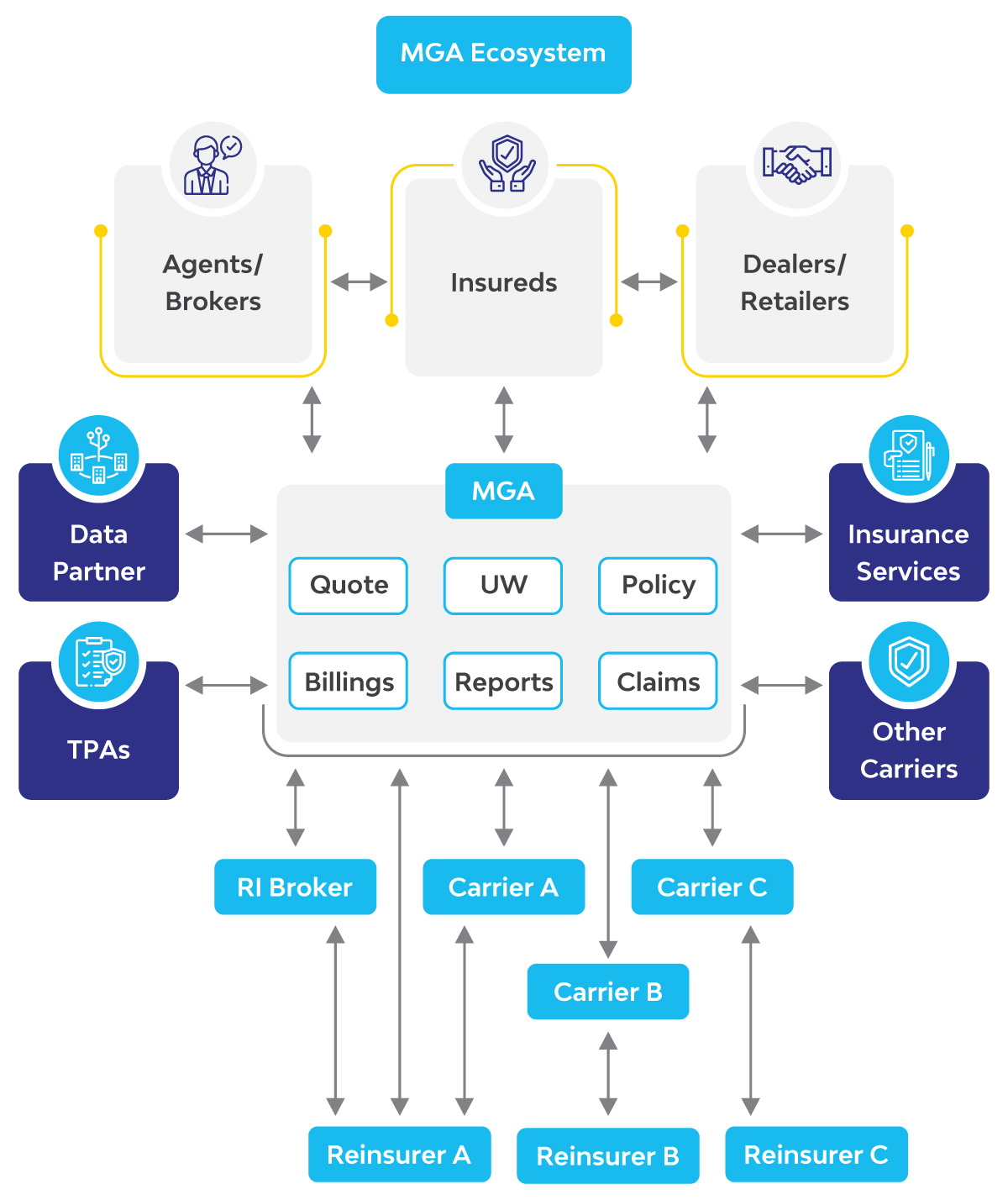

The attractiveness of the MGA model is that it allows upstarts to build products and underwrite policies without needing a balance sheet to hold the risk. They offload the risk to primary carriers or work directly with reinsurers. They also act as the servicing hub for rating, underwriting, policy issuance, and premium billing, partnering with third-party administrators (TPA) to handle claims. Essentially the entire insurance value chain is handled by the MGAs, including the front-end delivery. The figure below depicts the MGA ecosystem.

The current MGA market is highly competitive and active since:

- Brokers are leveraging the MGA model to expand their business

- Primary carriers are acquiring high-performing MGAs

- Reinsurers and private-equity investors turning towards MGAs for new revenue channels

Traditionally MGAs have dominated the specialty coverage markets and program business; their expertise in specific segments, strong distribution network, access to affinity groups, and lean operations has always been a compelling proposition.

But now they’re being seen in a new light, creating new possibilities and product innovation. Some startups are using the MGA model as a step toward becoming a carrier and bringing new parametric, embedded product offerings catering to dramatically changing market needs like connected cars, smart homes, connected health, industrial IoT, smart construction, smart real estate – offices, commercial shops, smart cargo, etc. Large carriers and brokers are also trying to take advantage of this opportunity as some carriers are delegating underwriting authority to MGAs, some are establishing their own or acquiring MGAs, and others are using the model to augment capacity and increase speed to market.

To thrive in the competitive environment and become a preferred partner of choice within the insurance ecosystem, MGAs need to enhance their value proposition and maintain their advantages of cost, speed, and profitability. While doing so, they need to be very sensitive towards customer experience, product innovation, and partner ecosystems.

Customer Experience

Global digitalization and pandemics have resulted in massive changes in customer behavior, impacting the insurance industry. In the MGA world, the story is no different but is more complex as MGAs not only serve the insured via direct-to-consumer channels but also through independent agents and dealers or retailers. In fact, the latter is the more dominant distribution channel.

Direct to consumer – The industry is undergoing a customer experience overhaul focused on loyalty and retention—and the stakes have never been higher, so raising the bar in service and keeping policyholders happy is no longer a nice to have but a need to have. If the expectations are not met, the consumers will quickly move on.

In today’s MGA ecosystem, the preference is clearly for digital experience over traditional models. A modern-day consumer usually heads to online portals. The availability of digital comparison tools nowadays has enabled consumers to make comparisons and evaluate insurance offerings based on price, coverage, and features and get the best deal and service experience.

It is crucial for insurance consumers to get more value for the money they pay. Thus, it automatically becomes imperative for insurance providers to provide not only digital channels but also a personalized experience. Technologies like bots, big data, analytics, etc., can personalize consumer interactions, creating rich profiles using large volumes of actionable data. It provides a closer look into demographics and accordingly formulates engagement strategies that help drive seamless digital experience.

Independent agents and dealers: Predominantly, they work with MGAs to get –

- Access to a wider variety of markets and carriers

- Expertise in niche markets

- Better rates and commissions

- Credibility

- Customer services and administration support

- Products and compliance training

In the current market, apart from the mentioned criteria, one of the major reasons for them to stay loyal to their respective MGAs is the digital experience they are enabled with to service their consumers and their own portfolio enrichment, including digital products and service offerings.

MGAs interested in growing their market share with new and existing distribution partners must understand that agents’ technological needs are changing, and they expect advanced digital capabilities to be the benchmark for doing business. A consolidated online portal supporting all the business functions required by agents and dealers, leveraging the latest technology trends that sync with the new technology skills of millennials, is the way forward.

Product Innovation

The market needs and expectations are dramatically changing. Some of the Insurtech MGAs are fueling the competition by creating products including – usage-based, embedded insurance, shared economy, self-driving cars, IoT, social and big data, machine learning and predictive analytics, and peer-to-peer insurance. Coupled with the technology they bring in is delivering – a much more efficient, intuitive, and effective consumer journey and deliver a much better digital experience.

The focus is rapidly shifting towards modernizing products and services in alignment with emerging risks, providing differentiated products tailored for specific programs/segments, and dynamic coverages.

It is imperative for the MGAs to equip their agents and brokers with multiple differentiated product options coupled with speed to market. This will only ensure that they are able to service their consumers with appropriate competitive coverage options.

Leveraging the partner ecosystem

Availability of advanced digital technologies, proliferation of data, and surge in the Insurtech vendors are triggering a tectonic shift in the way insurance business is conducted. The focus is on eliminating or minimizing friction throughout the insurance value chain. Essentially, redefining the traditional ways of doing business, including submission intake, rate-quote, underwriting, inspections, and policy and claims administration.

The pandemic has accelerated insurance ecosystem evolution. We’ve seen that during the pandemic, retail and commercial consumers have rapidly learned to engage remotely, and they now expect 24/7 service and easy interactions in everything they do. Most of the providers were able to deliver the services as they had partnered with service providers and participated in the interconnected supply and demand service model. Example – property inspection – pulling Property and hazard data from one vendor and getting the satellite or drone images of the property from another to deliver the underwriting decision. Similarly, taking data feed from IoT devices and using it for usage-based pricing, prevention, and predictions.

The ecosystems’ appeal is surely undeniable. It offers a chance to reach beyond conventional business models and products and helps strengthen consumer relationships.

Hypothesis

MGAs can deliver true value by adopting the role of “Insurance Ecosystem Orchestrator” and bringing in all the services as a one-stop shop model. Many MGAs have started restructuring and reimagining their business models, developing or adopting modular platforms that allow for flexibility through micro-services or application programming interface (API), coupling with front end and back end, and internal and external systems.

To bring forth the key differentiation and stay competitive, MGAs should focus on five key areas from a technology standpoint:

- Innovative front-end technologies that bring real differentiation and customer-centric culture, delivering value to consumers and solving their real problems

- Flexible core platform that can exchange data with agency management, underwriting, rating, policy writing, and CRM solutions that can generate significant savings and operational excellence

- Technology that integrates with carrier systems and vice versa

- Leverage data to redefine excellence in product innovation, customer acquisition, underwriting and pricing

- Adoption of AI and automation technologies ensuring fast, reliable, and seamless processing of repetitive and operational tasks to stay profitable and competent

Technology and the market are constantly evolving, so MGAs must be vigilant in their efforts to keep pace with the changes. In our industry, a company needs to evaluate its systems constantly. While the future is hard to predict, the market has its own relentless logic, which is easy to see. The companies that survive will be those that can adapt to changes in their surrounding environment and respond to emerging opportunities. Those not flexible enough to do this will fall by the wayside. MGAs hold a prime position in the market today. By carefully nurturing key business models that deliver unique value and the intelligent application of technology, they will continue to thrive in the Darwinian economy. The bottom line is that MGAs must be more agile and more adaptive to changes in the market.

More from Uday Kumbhare

Imagine a time in the future…say sometime in 2020s. Our car insurance renewal process could…

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…