The Juggling Act of Commercial Lines Underwriting

It’s no secret that the role of Underwriters in the Commercial Lines Insurance industry is changing dramatically. They are obviously expected to exponentially improve their risk assessment capabilities and achieve pricing precision. But beyond that, underwriters are increasingly looked upon as the most strategic lever for an insurance company to achieve its revenue and profitability goals.

Fundamentally, Underwriting is all about balancing between the four key capabilities that define an insurance company’s standing in the market. These capabilities – Competitive Pricing, Quality of Business, Market Responsiveness and Customer Lifetime Value – are what will differentiate enterprises as market leaders or laggards. Forward-looking insurers are combining the five pillars of the Underwriting process – Strategy, Skill, Process, Data and Technology – to help their Underwriters juggle these capabilities and create a winning formula, which will empower them to attain the market-leading position. I call this, ‘Smart Underwriting’.

But, the growing complexity of business environment, emergence of new risks, evolving distribution channels and increasing adoption of connected insurance products, present significant roadblocks toward meeting these changing expectations. The need of the hour is to explore beyond the core policy system replacement & leverage advancements in technology, and use it as a backbone for Underwriting Transformation.

Smart Underwriting – Looking beyond Core Policy System Replacement

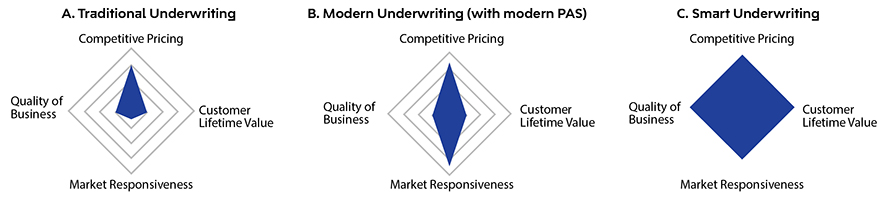

An Underwriter’s ability to juggle between the following three parameters is directly proportional to the extent of digitization that the insurer has managed to achieve in its core policy processes.

Traditional insurers, who still live in the ‘legacy’ world, will continue to struggle to remain competitive, or may even become irrelevant. They largely rely on pricing to sell their products, with little consideration for profitability and long-term view of customer value.

Fortunately, most of the insurance companies have moved to the first stage of digitization. Modern insurers, who have implemented modern policy administration systems, have developed a great ‘Speed-to-Market’ capability. Their business fulfilment capability has improved dramatically, by bringing in automation in areas such as Submission, Rating, Issuance & Policy Maintenance. However, the core capability of ‘risk analysis’ is largely ignored.

Digital insurers build on top of their modern core systems, and leverage advanced technologies such as Predictive Analytics, Artificial Intelligence, Process Automation and Internet of Things for Underwriting transformation. They realize the value of ‘data assets’ – internal & external – and use them to derive greater insights, enabling accurate underwriting decision-making. Many new sources of data have emerged in the last few years, which can enable carriers to detect blind risk spots, mitigate loss and enrich customer experience.

To summarize, Commercial Lines Underwriting is a function that is growing in complexity. Underwriters will be required to manage this complexity, while also stepping up to meet its evolving expectations from them. Insurers will need to look beyond their modern core systems, and undertake digital initiatives, which will help them compete effectively in the market. The transition to ‘Smart Underwriting’ needs a careful shift in the Underwriting Strategy, Skill, Process, Data and Technology. Insurers need to examine their business strategy and prepare for this transition. The sooner, the better.

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…