How Insurers Are Transforming Product Development – 2

Business Drivers to Transform Product Development

Evolving customer behavior and demographics: With the emerging millennial generation, insurers are witnessing a shift in customer behavior from purchasing to servicing insurance products. The new generation of customers is driven by innovation, social networking, risk-taking, focus on agility, and cost savings. They are looking for an experience with less to no-human intervention coupled with the ability to self-manage i.e., online availability and end-to-end transactions (quote to issue) in minutes, complete self-servicing capabilities, ability to get specific (non-generic) coverages (based on usage, risk, etc.), simplified yet comprehensive literature and terminology, hassle-free addition, or deletion of coverages, etc. This in turn has transformed the product development process of insurers to churn out simpler, diverse, and innovative products in very short release durations.

Next-gen technologies: with the emergence of big data and next-generation technologies such as AI, Machine Learning, RPA/IPA, IoT and Sensors, AI, analytics, etc., there is a benefit for both the insurers and the customers. Insurers now can focus on error reduction, data-based risk assessment, and pricing, minimizing risk exposure, claims reduction, and lowering the cost of operations. Customers, on the other hand, can expect insurers to translate these benefits into better product pricing, availability of a wider range of products (based on usage, specific risk, and analytics), and lowering premiums.

Market penetration: customers are slowly shifting from the more traditional insurance products to those that are more personalized. If not, customers are willing to switch to insurers who can meet these specific needs. With the advent of insurance aggregators, existing as well as potential customers can perform their research, comparisons, benefit analysis, etc. before deciding on an insurer. Insurers are, therefore, ensuring that they have a base barebone product with the ability to be personalized as per the customer’s needs. Insurers are competing to get a bigger share of the pie, by coming out with products that can give them the first mover or market disruptor advantage and separate them from the herd.

What Insurers are Doing to Transform Product Development

Collaborative teamwork and governance: it is necessary to create a collaborative cross-functional team from the various units such as Marketing, Actuarial, Finance, Underwriting, etc., and have a defined governance structure with responsibility and accountability for each team. Insurers are also creating dedicated product development teams from each business unit with the sole intention and responsibility of improving the speed to market and frequently churning out innovative and competitive products.

Focus on customer centricity: Millennials are looking for insurance products that are simpler, cheaper, and more effective. With the advent of digital next-gen technologies, customers are shopping for products that are more usage-based and address their specific type of risk. Insurers are diversifying their offerings by introducing products specific to wider class codes, usage, customer behavior (tracked by telematics, wearables devices, IoT devices), etc. Hence, insurers are adapting to a simplified modular product development approach of creating a base or shell product, which can be at any time be modified or personalized based on LOB, coverage conditions, and pricing to churn out different products without going through the complete product development process.

Technology enablers: insurers are investing in technology enablers that would enable them to quickly update their applications to support new and enhanced products. Insurers are going for core system transformations such as PAS enhancement/replacements, cloud migration, middleware enhancements, etc. to modernize their technology infrastructure. Many insurers are investing in integrated development and testing environments specific to product development.

Knowledge and data management: insurers are investing in centralization and standardization of data (data on products, plans, coverages, rates, rules, forms, etc.) to ensure reusability, consistency, and traceability for developing new products within a shortened timeline (i.e., significantly improving time to market).

Reducing IT dependency: with technology transformations, many shelf products for the policy admin system, billing, claims, doc management, etc. provide options to configure changes rather than changing or updating the code. These configurations can easily be carried out without any IT involvement. Therefore, any product development effort can gain significant time to market, by easy configuration of newer features, rules, rates, forms, etc. across multiple impacted platforms without much dependency on IT.

Standardized base product architecture approach: many insurers are defining a base product architecture that provides the blueprint for any product development initiative. The architecture provides a hierarchical structure of the product development elements such as product, plan, sub-products, coverages, features, attributes, etc. This architecture can then be leveraged to conceptualize and design new products around it. Also, insurers are investing in a product development workbench that provides a streamlined workflow-driven approach from inception to the deployment of the product.

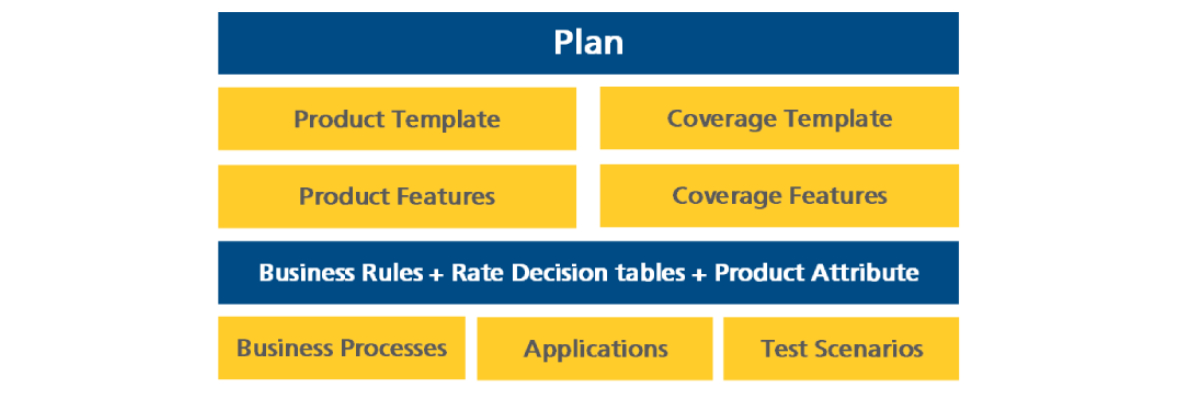

LTIMindtree’s offering on accelerating product releases to the market, MindPronto, brings differentiation in product ideation, design, configuration, and testing process using a ‘Lego’-like building block approach. The solution works on the principle of decomposing products, coverages/benefits into features. These features bring life through business rules associated with them. These features are rolled into a templatized definition of products and coverages, called templates within the tool. These templates are utilized to instantiate the product (plans) and coverages that are sold into the market.

The tool enables a collaborative engagement model amongst business and IT users, reducing the dependency on IT for product development, thus achieving faster time-to-market. MindPronto has an extended mapper tool that enables users to define the mapping between itself and target systems. This will automate the configuration of the plan in the target systems and reduce the development time. The prominent features of the tool include standardization, reusability, integrated data management, centralized repository of product definitions at an enterprise level, and ease of configuration.

More from Prakaash Kumaar Subramaniam

The evolution of next-generation technologies and innovations, and their consumption pattern…

Today’s customer expectations drive insurers to introduce innovations in product development…

Latest Blogs

A closer look at Kimi K2 Thinking, an open agentic model that pushes autonomy, security, and…

We live in an era where data drives every strategic shift, fuels every decision, and informs…

The Evolution of Third-Party Risk: When Trust Meets Technology Not long ago, third-party risk…

Today, media and entertainment are changing quickly. The combination of artificial intelligence,…