How Insurers Are Transforming Product Development – 1

The evolution of next-generation technologies and innovations, and their consumption pattern among the current generation, has witnessed a major shift in the handling of insurance needs. Customers are not only seeking simpler and more effective products, but also expecting an end-to-end digital experience from product purchase to administration. Post-COVID-19, as the world starts recovering from economic stagnation, customers are more focused on getting the bang for their buck. Introducing insurance products for concepts such as ride-sharing, pay as you use (usage-based), pay as you drive (telematics) and pay as you manage risk (IoT, wearables, etc.) are keeping insurers on their toes.

Therefore, launching frequent and diversified products is now considered table stakes to ensure speed to market. However, has the product development process in the insurance industry evolved to meet this evolving need? The long-standing and acceptable timespan of about 12-18 months for new plan/product development, agnostic of the line of business, is constantly being challenged. The rollout in the P&C world is expected every 3-6 months and for life/annuities, it is expected every 3 months. Besides, enhancements to existing products take an average of 3 – 6 months across lines of business.

Pain Points in Traditional Product Development:

Legacy infrastructure and system – Integrating new and innovative products with aged legacy policy administration systems and other ancillary support applications is a major challenge. Many of these applications run on obsolete technologies with hard-coded business and system rules. Any minor change or introduction of new product elements would need a change to the base code. In addition, resources with the knowledge to support such archaic systems are in scarcity as technology keeps advancing.

Team working in silos (Marketing, Actuarial, Finance, Underwriting, etc.): the unified vision and governance to bring together different departments and work toward a product are lacking in most insurers. Every team drives towards their priorities or agenda for the product, which may be conflicting with other teams. Every team works in a decentralized manner and there is no accountability and responsibility at a holistic level. Many a time, product development is considered a lower-priority activity compared to other initiatives being run by the insurer.

No streamlined process: for many insurers, there is no defined or streamlined process of product development. There is no proper workflow management. There is no singular product workbench to support the product development process. Most of the communications, plans, analysis, modeling, etc. happen manually, and involve multiple iterations and handoffs between departments.

Limited knowledge and data management: many insurers don’t have a robust process of documenting and maintaining the information/data used or knowledge gained from prior product developments. There is no consolidated data dictionary around products to enable reusability and reduce duplicity or redundancy.

Product-driven rather than customer-driven: insurers have been developing complex products encompassing multiple class codes, types of coverages, forms, etc., which are not appealing to the millennial demographics anymore. Complex product development directly translates to more time and effort from all stakeholders including regulatory bodies and other external stakeholders. Customers are looking for simple yet effective products that are more usage-based and specific to their classification or risk.

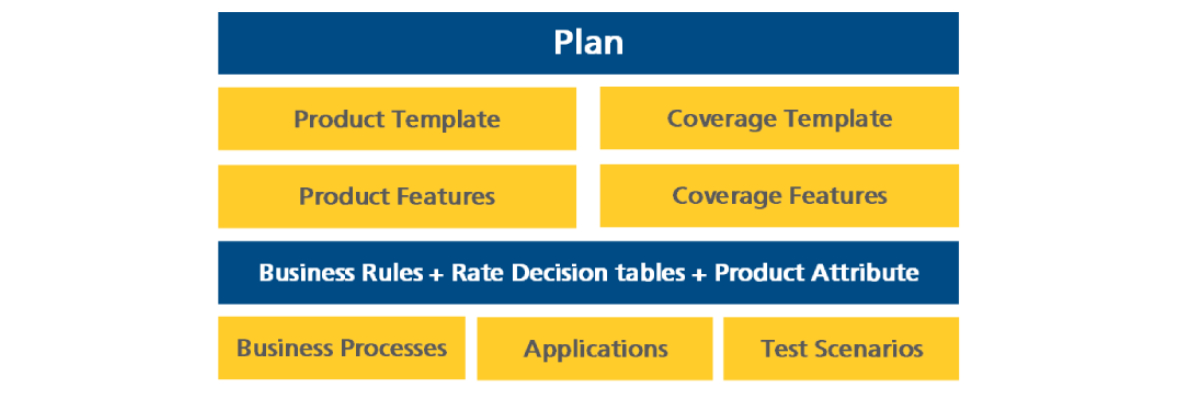

LTIMindtree’s offering on accelerating product releases to market, MindPronto, brings differentiation in product ideation, design, configuration and the testing process using a ‘Lego’-like building block approach. The solution works on the principle of decomposing products, coverages/benefits into features, which in turn bring life through business rules associated with them. These features are rolled into templatized definitions of products and coverages, called templates within the tool. These templates are utilized to instantiate the product (plans) and coverages that are sold into the market.

The prominent features of the tool include standardization, reusability, integrated data management, a centralized repository of product definitions at an enterprise level, and ease of configuration.

More from Prakaash Kumaar Subramaniam

Business Drivers to Transform Product Development Evolving customer behavior and demographics:…

Today’s customer expectations drive insurers to introduce innovations in product development…

Latest Blogs

A closer look at Kimi K2 Thinking, an open agentic model that pushes autonomy, security, and…

We live in an era where data drives every strategic shift, fuels every decision, and informs…

The Evolution of Third-Party Risk: When Trust Meets Technology Not long ago, third-party risk…

Today, media and entertainment are changing quickly. The combination of artificial intelligence,…