How APIs Enable Insurers To Maneuver Digital Transformation

The insurance ecosystem demands that insurers interact with a lot of external systems and applications for various regulatory needs and business growth, to offer a seamless customer journey. This interaction with applications was initially made possible through web services. Web services refers to a group of open-source protocols and standards that are used to exchange data between applications or systems. They can be implemented in various ways, but the most widely used are SOAP and RESTful web services. Although web services enabled the integration between systems or applications, the limitations of supporting only HTTP protocols and the absence of lightweight architecture ensured that organizations moved forward with Application Programming Interface (API).

API is a set of defined rules that facilitates the interaction between two or more applications. Its underlying technology enables applications to communicate and exchange data in real time. API offers secured communication channels, the ability to support all communication protocols and architectural designs, and offers a high level of interoperability. These inherent features make organizations adapt API in their technology ecosystem. To name a few, consumer-centric apps like Uber, Lyft, and Airbnb use Google Maps API. Tech giants like Facebook and Yahoo have exposed their APIs to other firms for user sign-in and sign-up. Regulatory bodies and central agencies leverage API for the exchange and validation of customer data (e.g., SSN – validation of customer details, Medical Information Bureau (MIB) – exchange of customer health history for risk assessment).

The digitization lightening has struck the insurance industry and COVID-19 has forced insurers to stay on top of the digital trends. Tech-savvy millennials and the evolving Gen Z prefer digital interactions and demand omnichannel experiences. To stay relevant and offer a personalized experience with increased customer experience, insurers are embracing technologies like APIs that facilitate digital transformation. Many leading insurers around the globe have started to embrace APIs and other growing digital technologies like cloud, robotic process automation (RPA), etc.

APIs aiding digital transformation in insurance:

In today’s digital world, insurance companies can no longer be laggards in adapting to new technologies. Insurers need to be more agile and ubiquitous to offer a seamless experience to customers, and APIs are one of the key drivers in unlocking these capabilities.

APIs ensure smooth interaction between the insurance ecosystem applications and offer seamless connectivity with legacy applications as well as any cloud-hosted app or device. They enable insurers to build a resilient application platform for customers, agents, and brokers, which allows the former to improve efficiency, streamline, and automate processes, thus paving the way to improve the customer experience.

API use cases in the insurance ecosystem

Increased partner ecosystems and platforms

APIs have enabled and encouraged insurers to venture into new partnerships and have set the foundation for robust lead generation and alternate revenue streams. For instance, home insurers can partner with real estate agencies to cross-sell home insurance from their site and create a repository of mobile/web apps by leveraging API. APIs have enabled insurers to create a new channel of revenue stream by facilitating aggregators to sell insurance products, which has in turn increased partner engagement.

Simplifying the policy buying experience

The advent of Open APIs has enabled life insurers to issue a policy in an accelerated way. The advancement of AI-enabled underwriting and integrations of API to third-party databases such as the Medical Information Bureau and Social Security Administration has made the life insurance buying process hassle-free and seamless. APIs have eased the buying process for customers across insurance industries. Auto insurers integrate with transport authorities to fetch vehicle-related details.

Efficient risk evaluation

Insurance is a data-driven business and with the advancement of technologies, insurers harness enormous data through the help of APIs. This massive data helps insurers perform informed and intelligent risk analysis and evaluation and ensures AI-assisted underwriting. APIs pave the way to gather more data from connected devices such as Smart Wearables, IoT devices, etc. For instance, – Home insurers integrate with third-party providers to fetch the Total Replacement Cost, Public Protection Classification Value, etc. for risk assessment and rating processes. This data helps the insurer evaluate risk tolerance and create more personalized offerings to customers.

Digital customer engagement and journey

The augmentation of digital devices amongst millennials and Gen Z demands more digital touchpoints and fewer physical interactions. An open API will enable insurers, agents, and brokers to create a touchless digital customer experience. Insurance is a document-intensive world involving elaborate paperwork, policy schedules, claim documents, etc., making it a cumbersome journey for customers and other stakeholders. An integrated API with insurer systems allows insurers to send policy schedules, receive digital signatures, and claim related documents in a faster and user-friendly manner and facilitates a digital customer journey.

Faster and enhanced claims processing

Through APIs, insurers can offer their customers a faster and more efficient claim process. API facilitates real-time integration with the insurer systems and other third-party databases, which paves the way for seamless claim intimation (FNOL) by enabling customers to upload pictures of the damages without waiting for the surveyor, or the claims processing documents.

Hassle-free billing and payment experience

A secured and encrypted payment can be made easier through APIs. Customers demand multiple payment options, such as credit/debit cards, ACH (Automated Clearing House), or even through a third-party platform like PayPal, etc. APIs in the billing and Payment landscape have enabled insurers to offer seamless experiences to customers such as real-time access to policy accounts, billing schedules, and self-service channels such as mobile, and web browsers. APIs facilitate secured and smooth interactions with third-party vendors by managing billing and payment-related services.

How can LTIMindtree help insurers?

Demanding customer expectations due to technology advancements have ensured that insurers rethink their strategies. Insurers are eager to get into a partnership with leading InsurTechs to overcome legacy challenges and offer a supreme digital experience to customers. The penetration of digital devices and the internet to remote parts of the world has emphasized the need for automation, and digital transformation is one of the key priorities for insurers moving forward.

LTIMindtree’s API-led solutions have helped leading global insurers drive their digital transformation journeys. We have aided insurers in creating an Open API ecosystem and enabled them to venture into new business models, partner with vendors at ease, transform digital transformation, enhance risk evaluation, and offer a supreme customer experience.

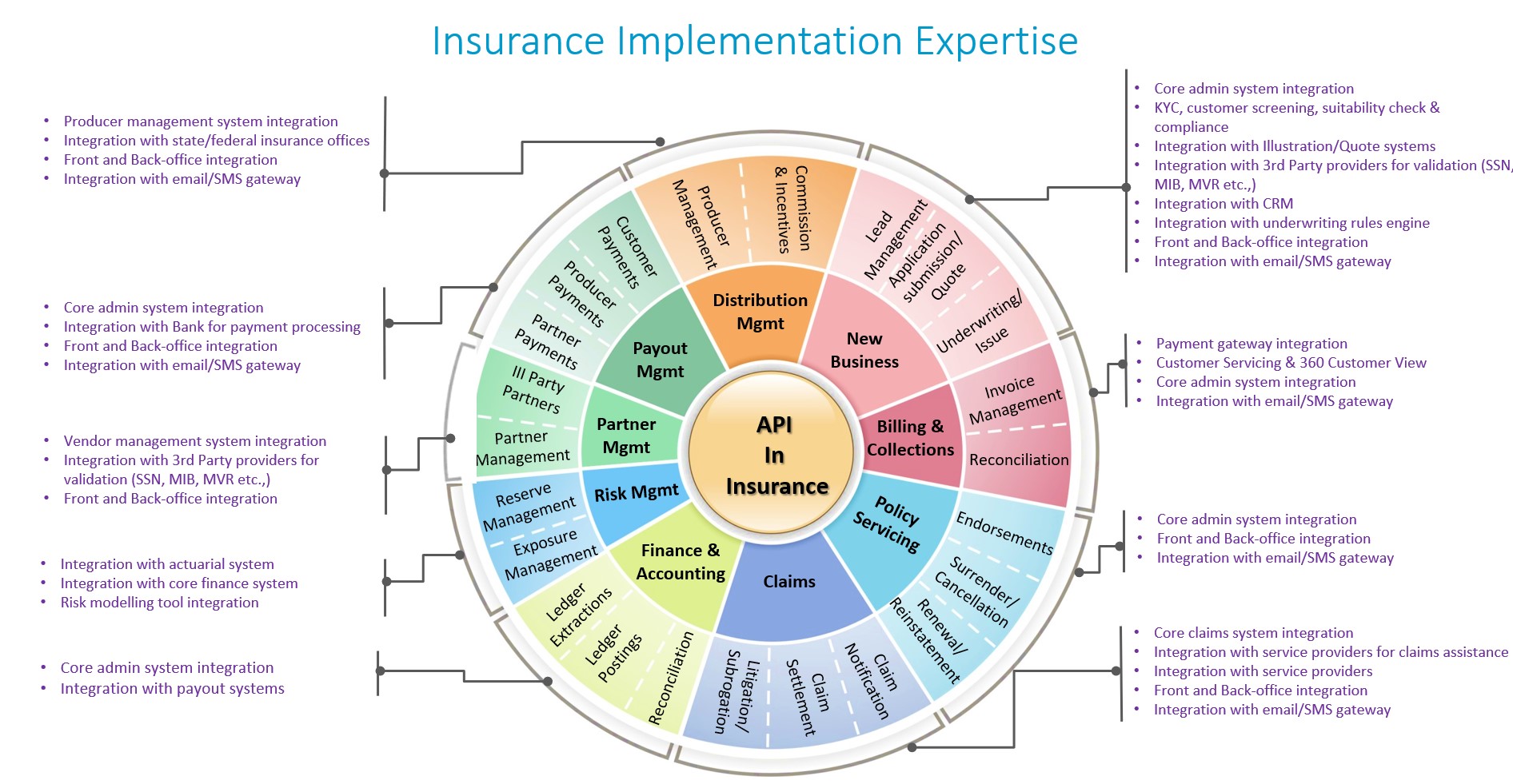

The below infographic represents LTIMindtree’s wide array of API implementation expertise across the insurance value chain and business functions.

LTIMindtree’s partnership with leading insurance technology platforms, coupled with vast experience across the insurance value chain with customized paramount API-led offerings, enables insurers to effectively drive their digital transformation strategies.

References

More from Ashwin Devendran

Time-to-market (TTM) is one of the critical business KPIs for any organization, regardless…

Latest Blogs

The energy and anticipation were evident even before entering the arena, and attendees had…

A tectonic shift in wealth is underway, and agility is the key factor that will distinguish…

Educational institutions are at a crossroads where their future hinges on a single question:…

In times of market unpredictability, alternative investments offer a valuable advantage by…