Generative AI in Cards and Payments: Ensuring Security and Streamlining Transactions

Since the pandemic, the global volume of digital payment transactions has been rising rapidly. The digital payment transaction volume is expected to reach USD 36.75 trillion by 2029, growing at a CAGR of 15.71% from 2024[i].

However, while digital payments have become simpler for users, the complexity keeps increasing for banks and financial service providers. Financial institutions must proactively detect and manage cyber security threats, operational risks, and regulatory compliance while reducing operational costs to enhance customer experience and improve market share. However, even a single error in the payment system can be costly and lead to financial losses and significant fines.

This is where generative AI’s (Gen AI’s) ability to analyze complex data sets in real-time can help the payments domain. In this article, we will explore the effectiveness and capabilities of generative AI in the payments domain.

Challenges faced by the payments industry

While digital payments offer immense convenience, they are not without significant vulnerabilities. The industry faces frequent incidents of fraud, data breaches, and inefficient transaction processes that impact both consumers and financial institutions. For instance, recent data breaches at major financial services firms exposed millions of customer records, highlighting the urgent need for more robust security measures. Additionally, outdated systems that cannot handle the increasing transaction volume contribute to operational inefficiencies, resulting in slower processing times and customer dissatisfaction. Global losses from payment card fraud are projected to reach USD 400 billion over the next ten years, with authorized push payment fraud alone expected to grow at 11 percent CAGR from 2023 to 2027[ii].

Given the rising volume and complexity of digital transactions, financial institutions must adopt enhanced security and streamlined workflows to protect customers and reduce operational costs.

Using generative AI for fraud detection in banking

Fraud detection has traditionally relied on rule-based systems that struggle to keep up with evolving threats. Generative AI, however, introduces a dynamic, data-driven approach to fraud prevention by analyzing vast amounts of transaction data in real time. Through pattern recognition, Gen AI can detect unusual behaviors and anomalies that might indicate fraudulent activity. Here are a few ways in which Gen AI can help the industry minimize fraud:

- Pattern recognition: Understand customer behavior by analyzing the nuanced cues exhibited by customers during their interactions with digital platforms.

- Real-time scoring and alerts: Identify and mitigate fraudulent actions before they can inflict financial damage or data breaches.

- Corrective action: Reduce false positives by refining data, leveraging advanced algorithms, and integrating feedback loops to enhance accuracy in fraud and compliance detection.

- Continuous learning: Gen AI-based Large Language Models (LLMs) can continuously learn and improve to become self-sufficient in handling frauds and anomalies.

- Behavioral biometrics: Predict lie detection and identify possible distress during voice authentication to avoid authentication fraud.

- Contextual authentication: Analyze user behavior, device details, and transaction patterns to dynamically assess risk and seamlessly adapt to real-time context while reducing friction for legitimate users.

- Continual authentication: Track login attempts, analyze patterns like timing and typing speed to flag anomalies, and adjust thresholds based on real-time context.

- Multi-Factor Authentication (MFA): Simulate risk and compliance frameworks to create dynamic, scenario-based, real-time verification layers, adapting authentication processes to strengthen security while ensuring regulatory alignment.

Enhancing transaction security

Security remains a non-negotiable in the world of digital payments, with institutions constantly seeking advanced methods to protect transaction data. Here are a few ways in which security can be enhanced by generative AI in payments:

- Encryption: GenAI-driven encryption algorithms continuously evolve to counteract new cyber threats, making it difficult for unauthorized users to access sensitive payment data. Many regulations, such as the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS), already mandate encryption as a critical component of data protection strategies, helping organizations avoid legal repercussions.

- Tokenization: Replacing sensitive information with unique tokens during transactions minimizes the exposure of customer data. Visa[iii], for instance, reported a 60% reduction in fraud through tokenized transactions, which prevented unauthorized use of card information and saved USD 650 million in fraudulent activities.

- Biometric Authentication: AI-based biometric systems that use fingerprints, facial recognition, and voice verification add an additional layer of protection. These methods are harder to bypass, securing sensitive financial information and ensuring that only authorized users access accounts.

Streamlining transaction processes

In addition to security, generative AI significantly improves transaction efficiency by streamlining workflows and reducing manual intervention. Here’s how:

- Predictive Analytics: Generative AI analyzes historical data to predict peak transaction times, optimize resource allocation, and determine efficient transaction routes, reducing bottlenecks, latency, and operational costs.

- Fraud Detection and Prevention: It continuously learns transaction patterns, simulates fraud scenarios, and generates synthetic datasets to enhance real-time fraud prevention, improve adaptability to evolving threats, and bolster proactive defenses.

- Automation: GenAI automates repetitive tasks like data entry and reconciliation, reducing errors, processing times, and disputes while enhancing operational efficiency and customer satisfaction.

- Intelligent Insights: GenAI provides real-time anomaly detection, actionable insights for discrepancy resolution, tailored reporting, and proactive risk management, streamlining operations and supporting strategic decision-making.

Ensuring compliance and regulatory requirements

Here’s how institutions can leverage Generative AI in the payments industry to enhance compliance efforts:

- Data privacy and protection compliance: Automate data privacy measures, ensuring personal data is handled in compliance with laws like GDPR and Consumer Credit Protection Act (CCPA). Gen AI can be trained to encrypt sensitive customer data and monitor its storage, ensuring proper protection.

- Risk assessment: Simulate various fraud scenarios using synthetic data to test and refine risk frameworks. By simulating real-world scenarios, institutions can better understand regulatory requirements and quickly adapt to new regulations, reducing the chances of compliance deviations.

- Real-time monitoring: Continuously monitor transactions for suspicious activity or non-compliance. Flag potentially fraudulent transactions and ensure compliance with regulations like Second Payment Services Directive (PSD2), Anti-Money Laundering (AML), and Strong Customer Authentication (SCA), providing real-time safeguards.

- Compliance with cross-border payment rules: For institutions operating internationally, Gen AI can automatically adjust payment processes to meet various regional regulations. This ensures compliance with different laws governing payments in each country, reducing the complexity of managing cross-border transactions.

- Regulatory reporting: Automate report generation, such as AML and Know Your Customer (KYC) reports. Gen AI can automatically create and file Suspicious Activity Reports (SARs) with authorities like the Financial Action Task Force (FATF) or the Financial Conduct Authority (FCA).

- Audit trails: Create transparent logs detailing compliance decisions, transaction data, and actions taken, ensuring the availability of complete audit trails during regulatory reviews.

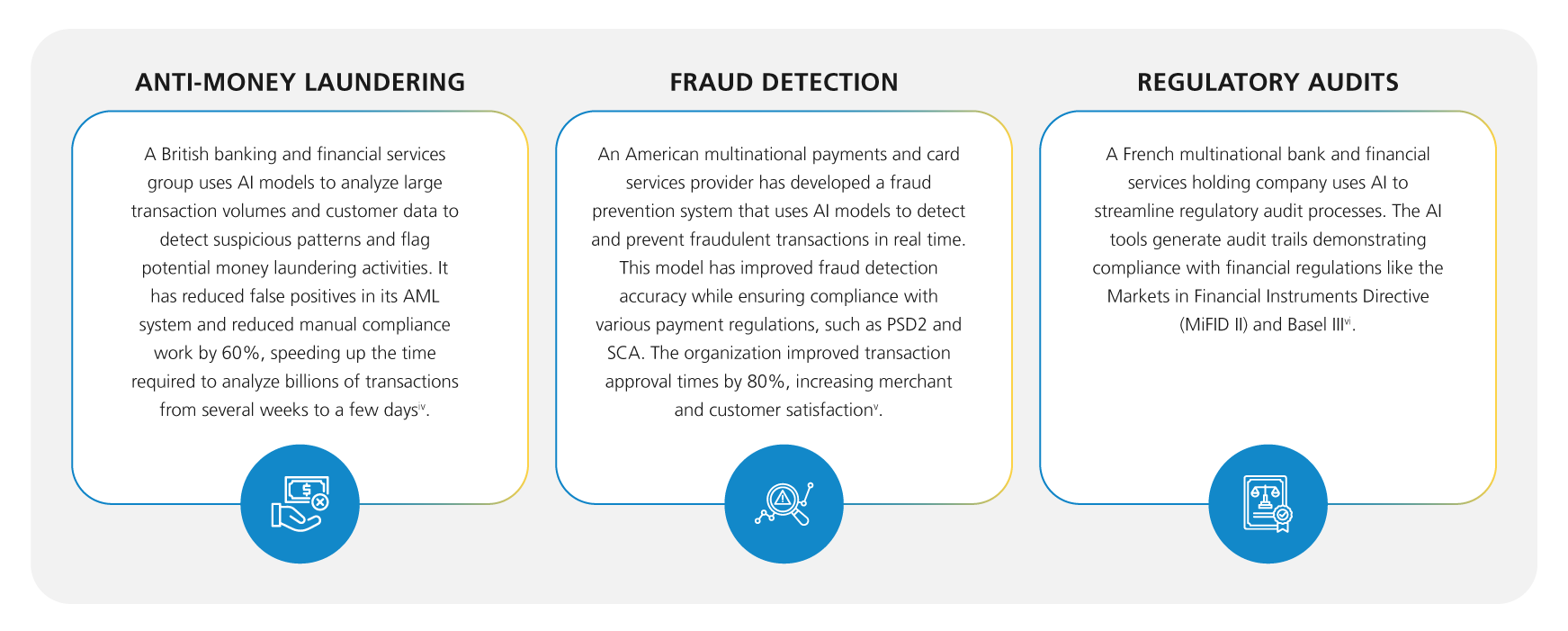

Generative AI in action

Conclusion

Generative AI is revolutionizing cards and payments by enhancing security, efficiency, and compliance. Its ability to analyze vast data sets in real time, detect fraud, adapt to new threats, and automate manual processes makes it indispensable for financial institutions. With rising fraud risks and record-high AML fines that exceeded USD 6 billion in 2023[vii], adopting AI-driven solutions is no longer optional but essential. Generative AI helps financial organizations to fortify transaction security, streamline operations, and deliver seamless customer experiences. By leveraging this technology, institutions can meet growing demands for secure, efficient payments while building trust and staying competitive in an evolving financial landscape.

Click here to learn more about our payment solutions.

[i] Digital Payments – Worldwide, Statista, https://www.statista.com/outlook/fmo/digital-payments/worldwide

[ii] Global payments in 2024: Simpler interfaces, complex reality, McKinsey, https://www.mckinsey.com/industries/financial-services/our-insights/global-payments-in-2024-simpler-interfaces-complex-reality#/

[iii] Visa Issues 10 Billionth Token, Generating $40 Billion in Incremental E-commerce Globally, Visa, Visa Issues 10 Billionth Token | Incremental E-commerce Globally | Visa

[iv] HSBC reduced its fraud alerts by 60% using Google’s new AI tool for anti-money laundering, Insights Distilled, https://insightsdistilled.com/editions/june-27/hsbc-google-aml-ai-tool-reducing-fraud-alerts-compliance/

[v] How AI is making payments safer and simpler — and what’s next, Mastercard, https://www.mastercard.com/news/perspectives/2023/how-ai-is-making-payments-safer-and-simpler-and-what-s-next/

[vi] Risk Control of Artificial Intelligence Systems, LIVRE BLANC, www.hub-franceia.fr/wp-content/uploads/2022/10/22_10_19_Controle-des-risques-des-systemes-IA_PDF.pdf

[vii] Global payments in 2024: Simpler interfaces, complex reality, McKinsey, https://www.mckinsey.com/industries/financial-services/our-insights/global-payments-in-2024-simpler-interfaces-complex-reality#/

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…