Business Innovation Centers: Emerging Paradigm in the Fintech Age

Smarter and Quicker approach to continuous innovation in Financial Services

What does it take to deliver true innovation in Banking and Financial Services?

The fundamentals of banking and financial services have hardly changed over time, right from the industry’s very beginning–when merchants financed farmers–to today’s age of crowd-funding and robo-advisory. However, several elements of the industry have transformed significantly, including the parties involved, the products offered, and the sheer velocity, variety and volume of business transactions. While technology breakthroughs have served as enablers for these changes, innovative business models based on emerging technologies are the primary drivers of growth in the banking and financial services industry today.

What are the key focus areas for innovation?

CXO round tables and industry conversations often revolve around ‘hot’ topics such as banks versus fintech startups, human versus automated advisory, branch versus opti-channel investor solutions, blockchain versus regular exchanges, and so on. However, we can gain deeper insights into banking innovation if we simply analyze the industry, right from the time of the Great Depression in 1929, to the 2008 subprime crisis, and the more recent EU sovereign debt crisis. Retail and Investment banks, which survived and excelled over the years, including during turbulent times, are the ones that drove business innovation by addressing the four key objectives:

- Generating new business models that increase market share

- Achieving operational efficiencies that deliver radical cost savings

- Transforming the overall customer experience

- Launching new products and services dynamically & successfully

What are the hurdles to innovation?

Innovation, however, is easier said than done in the banking and financial services domain. Multiple factors impede the creation of breakthrough models and efficient processes. Consider the following challenges in recent times:

- Multiple mergers and acquisitions that have led to complex organization structures and IT landscapes

- Stringent and dynamic regulatory norms including Basel III, CCAR, AML, AIFMD, Dodd-Frank, FATCA, etc., have not only added to compliance costs, but also fostered an aversion to innovation in some companies

- Broadened product offerings have led to banks and investment firms losing out on a unified view of their customers

- Technology is rapidly evolving, making it difficult to plan the next ‘leap’

- Policies such as PSD2 and technologies such as Open API, blockchain are bringing banks, intermediaries & fintechs on a level playing field

What is the secret to successful innovation?

Most large banks are addressing these challenges through ‘centers of excellence’ or ‘digital innovation labs’. But what makes some of these dedicated setups more successful as against others that are often treated as cost centers by their management?

Team composition is definitely an important factor, but the approach taken to drive innovation is often the leading contributor to success. While many units depend on the individual genius within their CIO organizations, the successful ones rely on an approach of collective creativity. This is where the concept of a Business Innovation Center (BIC) comes into play.

Business Innovation Center (BIC) – A Recipe for Disruptive Innovation

BIC is an idea-led innovation approach from LTI, built upon the principles of collective creativity, design thinking, agile development and fail-fast methodology. BIC teams typically comprise innovation sponsors, business stakeholders, techno-functional experts, and full stack developers. BIC is executed in a 3D mode – DISCOVER-DREAM-DESIGN, over a typical period of 3 days – 3 weeks – 3 months.

- DISCOVER: The BIC team works with business stakeholders to define the primary objectives for innovation ideation. In scenarios where innovation objectives are undefined, the team adopts a design thinking approach, involving certified Design Thinkers, specializing in human-centric problem-solving.

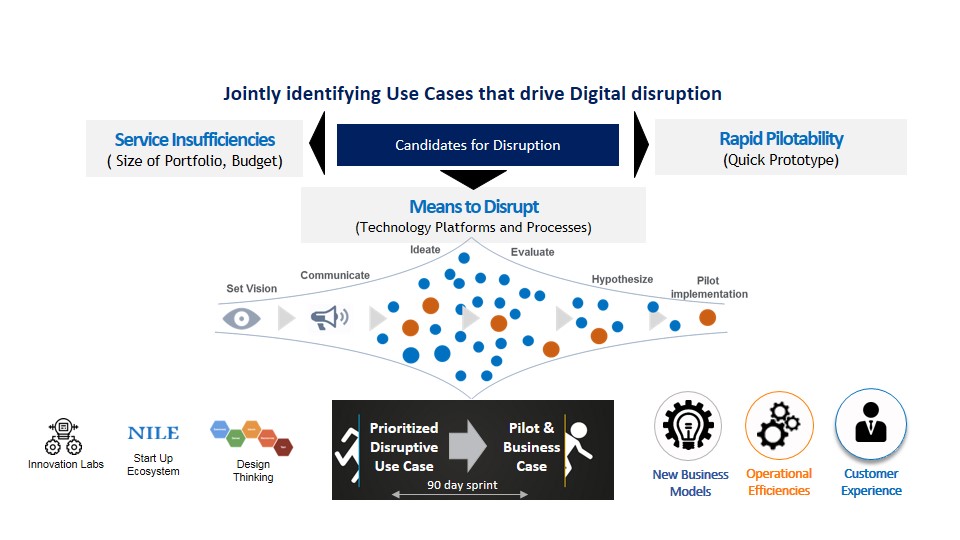

- DREAM: Once the core objectives are in place, the BIC team conducts internal ideation exercises to identify a series of probable use cases, along with estimated capital requirements and return on investment. Candidates for ideas are the ones that address service insufficiencies, offer rapid pilotability, and have the genuine means to positively disrupt current models. The ideas so identified are analyzed and discussed in depth, and a select few are shortlisted for the proof of concept (POC) stage.

- DESIGN: The BIC team then builds POCs to study implementation feasibility, using the agile delivery mode. Based on business needs, the BIC team may run multiple POCs in parallel, or launch them in planned phases. Once the POCs are approved by critical stakeholders, the BIC team executes a pilot implementation. This entails a successful run, with complete integration with the existing application landscape.

Once the pilot implementation has gone through successfully, solutions are handed over to the IT organization to create a full scale deployment roadmap. So, the 4th dimension to this model is DELIVER, which can be a longer time frame, wherein you develop, test and productionize the solution across multiple business units.

Examples of ideas that can emerge out of a BIC model, and be successfully piloted, include:

- Self-designed funds portfolio

- Digital client engagement platforms for financial advisors

- Personalized opti-channel investor solutions

- Digital omni-channel sales through API-led solutions

- Back-office cognitive automation

- Front-to-back digital customer on-boarding

- Data-driven 360o customer insights for cross-sell, up-sell, risk analytics

- AI-based BOTs to drive interactive campaigns

- Self-service BOTs to replace L0 Contact Center

- Gamification of services for higher customer loyalty and superior advisor performance

Conclusion

While technological innovations have definitely helped accelerate the growth of the banking and wealth management industry, organizations that focus on business innovation, rather than just pure-play IT transformations, will stand out as winners.

Latest Blogs

A closer look at Kimi K2 Thinking, an open agentic model that pushes autonomy, security, and…

We live in an era where data drives every strategic shift, fuels every decision, and informs…

The Evolution of Third-Party Risk: When Trust Meets Technology Not long ago, third-party risk…

Today, media and entertainment are changing quickly. The combination of artificial intelligence,…