Building Digital Trust: A Crucial Element of the Financial Institution’s Customer Journey

Banks place a high value on customer onboarding since it shapes the overall customer experience. Often, it is the client’s first contact with the bank, and it determines how they feel about the institution and whether they choose to use it in the future.

A well-designed onboarding process can help the bank establish a positive relationship with the customer, build trust, and provide a seamless experience. Customer happiness, loyalty, and retention may all improve as a result.

Conversely, a bad onboarding experience can make customers feel frustrated, perplexed, and unappreciated. This can result in adverse reviews, low customer satisfaction, and even business losses.

Customers are known to expect a smooth, seamless, and trouble-free experience when applying for a loan or opening a bank account. A streamlined Know Your Customer (KYC) process can reduce the time and effort required from customers, improving their overall experience and satisfaction.

When reviewing their KYC strategy, financial services institutions must remember that they are responsible for preventing fraud and assessing risk throughout the customer’s journey.

With customers expecting to be able to open accounts in minutes, having a seamless and intuitive onboarding experience, the onboarding process is an opportunity for banks and other firms to capture all the information essential to evaluate the risk of the customer and ensure that the calculated risk is within their agreed levels.

Regulations require some inspections, but the remainder can be implemented using a risk-based strategy. The key is to get the correct balance between strict regulatory compliance and placing sufficient checks to satisfy the bank’s risk appetite.

Identity verification is vital in ensuring that the person opening an account is legit and not some fraudster who used stolen data for identity. An onboarding process can be created using a proper online identity solution and informed AI, which the users would love.

How Jumio helps transform the customer onboarding process

Jumio’s identity verification and authentication platform can help streamline the customer onboarding process in several ways:

- Speeding up the onboarding process: Quick and accurate verification of the identity of customers allows the onboarding process to be completed within minutes and not days using Jumio’s identity verification.

- Reducing manual labor: Reduce the demand for manual intervention, leading to a minimal workload on customer service teams by automating the identity verification process using Jumio.

- Improving security: Mitigate fraud and enhance overall security by verifying the identity of customers.

- Enhancing the customer experience: Jumio’s user-friendly and easy-to-navigate platform improves the overall customer experience during onboarding.

- Meeting compliance requirements: Ensure compliance with relevant regulations by meeting various regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) using Jumio.

How can Jumio help:

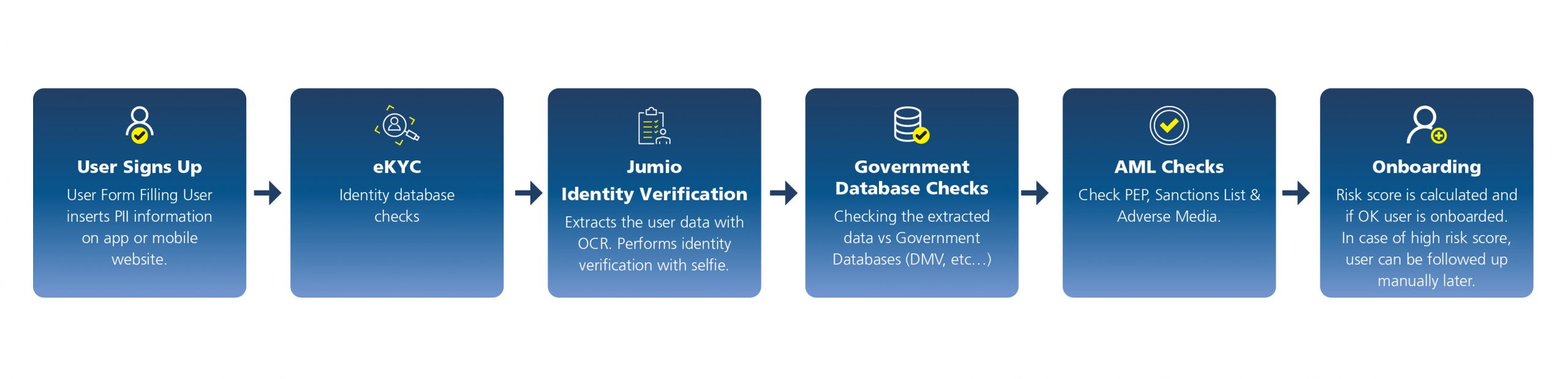

The flow below showcases a typical customer onboarding process with identity verification and database checks.

Benefits of the Jumio solution

- Dramatically Faster Verification: Jumio helps achieve present-day bank customers’ expectations of creating online accounts quicky, in a few minutes from anywhere and at any time.

- More ID Types: With Jumio, you can access a broader range of identification types. Globally, Jumio offers support for more than 5,000 subtypes of IDs, including driver’s licenses, passports, and ID cards.

- More Channels: Jumio assists with client onboarding via mobile SDK, web app, and API to reach a bigger audience across various demographics.

- More Chances: Jumio provides the exact reason for rejecting an ID provided or a selfie rather than rejecting the data outright. This helps the users online to correct their course and continue with their onboarding application.

- Less Verification Time: Jumio helps reduce onboarding time through its ID and identity verification solutions. Onboarding can happen in less than a minute instead of hours.

- Less Manual Review: Jumio leverages informed AI, computer vision, biometrics, and human review to deliver a definitive yes/no decision and reduce the demand for in-house manual reviews, saving time.

- Less Fraud: Jumio provides a much stronger defense against fraud and account takeovers than traditional identity verification and authentication methods by using a biometric-based approach, which includes knowledge-based authentication, credit bureau lookups, and SMS-based two-factor authentication.

- Bank-grade Security: Due to the nature of the data collected during the identity verification process and the compliance penalties related to improper client data management, bank-grade security is essential.

- Secure Standards: Jumio has undergone a thorough audit by many tier 1 global banks, independent regulators, and industry giants like Deloitte, KPMG, and EY.

- Secure Encryption: All personal data is encrypted in transit via TLS encryption using strong cipher suites and at rest with military-grade 256-bit AES encryption.

- Secure Compliance: Jumio has obtained certifications for PCI DSS, SOC2 Type 2, and ISO/IEC 27001:2013.

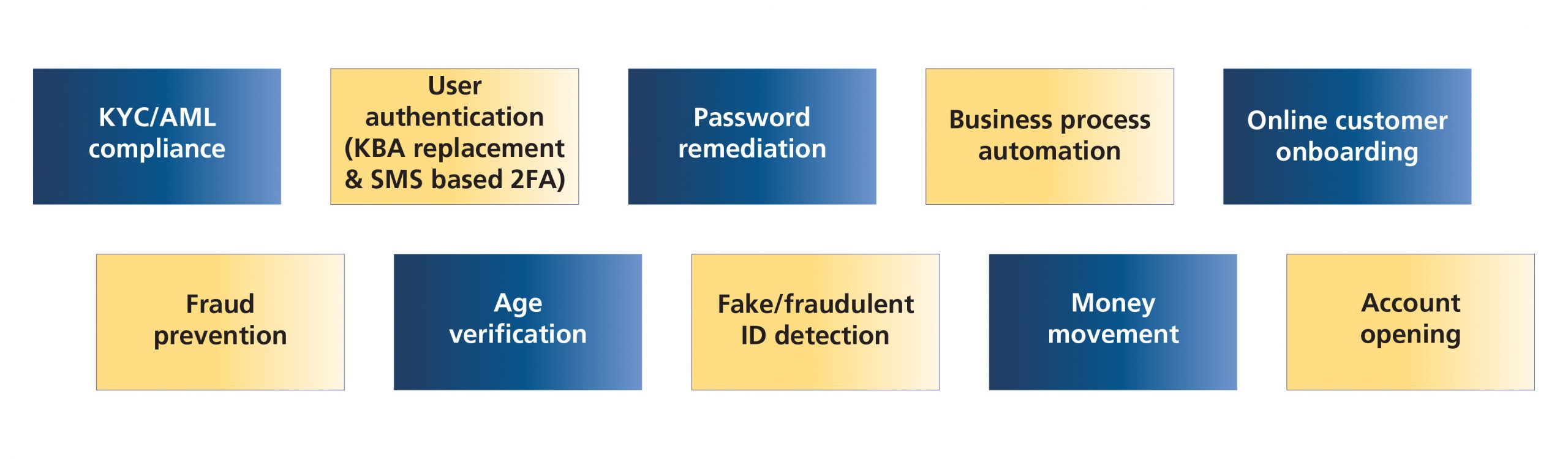

Together, LTIMindtree and Jumio help address a range of use cases:

About LTIMindtree

LTIMindtree is a global technology consulting and digital solutions company that enables enterprises across industries to reimagine business models, accelerate innovation, and maximize growth by harnessing digital technologies. As a digital transformation partner to more than 750 clients, LTIMindtree brings extensive domain and technology expertise to help drive superior competitive differentiation, customer experiences, and business outcomes in a converging world. Powered by nearly 90,000 talented and entrepreneurial professionals across more than 30 countries, LTIMindtree — a Larsen & Toubro Group company — combines the industry-acclaimed strengths of erstwhile Larsen and Toubro Infotech and Mindtree in solving the most complex business challenges and delivering transformation at scale.

About Jumio

Jumio is the leading provider of automated, end-to-end identity proofing, risk assessment and eKYC solutions.

Jumio helps organizations to know and trust their customers online. From account opening to ongoing monitoring, the Jumio KYX Platform provides advanced risk signals, identity proofing and compliance solutions that help you accurately establish, maintain and reassert trust.

More from Charan Kumar Hiremath

Introduction The financial services sector has seen considerable digital transformation over…

Buy Now Pay Later (BNPL) is a future-proof credit and payments solution to meet the growing…

Latest Blogs

A closer look at Kimi K2 Thinking, an open agentic model that pushes autonomy, security, and…

We live in an era where data drives every strategic shift, fuels every decision, and informs…

The Evolution of Third-Party Risk: When Trust Meets Technology Not long ago, third-party risk…

Today, media and entertainment are changing quickly. The combination of artificial intelligence,…