Are Auto Insurers Ready For Usage-Based Insurance (UBI)?

With ever-evolving next-gen technologies, data revolution, and the new mobility patterns such as rideshare, usage-based insurance (UBI) has been in the forefront over the last few years, more so than before. Though telematics has been present in the industry for the past decade, not many insurers had UBI in their priority list of strategic investments.

Usage-based insurance is predominantly applicable to the auto insurance space, though it is slowly gaining momentum in the life and health insurance market as well.

With the advent of the COVID-19 pandemic, due to lockdown restrictions and telecommuting options, most vehicles have been off-road. COVID-19 had also severely impacted the economy with business shutdowns and job losses. Therefore, more and more customers are rationing their expenses, and one of the options being explored is to reduce their auto insurance premium now when their vehicle is mostly confined to their garage and return to complete commute is not yet certain.

We are also seeing a rise in usage of rideshare services like Uber and Lyft for general commute, and therefore, personal vehicles are not always getting driven on a regular basis. For those who are driving regularly, from a behavioral aspect, are expecting some sort of reward or discount for safe driving, zero traffic violation, or zero accidents. Flat rate insurance does a disservice to drivers who are driving less mileage and safely, as the premium paid is generally higher to support the high mileage drivers.

All in all, customers are challenging the concept of giving flat rates for their auto insurance and rather have the Insurer personalize the rate based on their driving parameters. Customers are looking for insurers who can be competitive and also provide personalized offerings.

This is where Usage-Based Insurance is now gaining momentum among customers and forcing insurers to think in this direction.

In this blog, let’s venture as to what usage-based insurance is and what are some of the key concerns insurers have in adopting UBI.

Let’s understand Usage-Based Insurance (UBI)

Types of Usage-Based Insurance:

- Pay-as-you-drive: the number of miles driven during the given policy period is considered as the key factor in coming up with the policy premium.

- Pay-how-you-drive: driving behavior (i.e., how safe is the driving) during the given policy period is considered as the key factor in coming up with the policy premium.

There are many factors that contribute to the computation of policy price for UBI, such as:

Speed, Braking, Number of miles driven, Acceleration (Speed), Idle time, Weather, traffic environment, etc.

The number of the factors (stated above) to be considered can vary based on state or regional regulatory laws. The modus operandi is to have a device in the car to track and gather data on all the above factors and pass it back to the Insurer. Here again, there is a lot of flexibility around available technologies on how the insurer can capture and store such data. Some of the options are:

- Insurer providing the driver with a telematics plug in device (their own or tying up with a telematics vendor) to be installed in the car.

- Insurer providing a smartphone app that needs to be turned on by the driver as the car is being driven.

- Insurers have also started using onboard diagnostics systems in a car, such as a black box.

Most insurers have been providing usage-based benefits as a discount scheme to the customer’s existing auto policy. But the paradigm is shifting towards providing standalone usage-based insurance products in line with the evolving customer expectations.

The primary difference is in the premium being charged. Mostly the insurers provide the savings or an increase in premium during the renewal, based on the customer’s driving. There is generally no difference in the coverage offered in usage-based insurance compared to traditional auto insurance.

How Much Are Insurers and Consumers Ready for UBI?

There are various aspects to be looked into to answer the following:

- Can Insurers consider themselves ready for the UBI market?

- Why the adoption rate among customers is so slow for UBI?

Product Pricing: unless there is a considerable discount in premium provided (i.e., at least from 10% to 15%), it would be difficult to convince potential customers to switch to UBI that entails monitoring and capturing data. As per LexisNexis 2013 Insurance Telematics Study, 72% of drivers are more likely to try telematics solutions if an insurer offers an automatic discount of 10 percent for the first 6 months.

Also, the initial investment of any insurer in UBI technology is another area of concern. It is unlikely that any potential customer will agree to bear the cost of any telematics device. Customers may be more willing to go for a smartphone app. Also, for insurers, what will be the mechanism to monitor and capture data and running analytics? Will the infrastructure be set up by the Insurer, or would they tie up with such service providers for telematics/data analytics? Can the data collected be used in the current pricing model or a new pricing model is needed, and what will be the impact on profitability? How soon can break even be achieved?

Monitoring and Privacy: though the market is moving towards UBI, one of the key challenges still remains is to convince the customer to monitor and capture data related to their driving. Having a monitoring device in the vehicle can be considered an intrusion of privacy. Data ownership and misuse are also a concern. Also, given that it’s a fairly newer concept, it would be difficult for the insurer to expect massive adoption and retention of UBI customers. For drivers, who have high mileage or bad driving records, giving a flat rate would work better than opting to get tracked as their premium cost might get high. Insurers would need to come up with innovative ways to drive home the benefits and assure their potential customers about their data privacy.

Accurate Underwriting: the challenge here is to accurately underwrite the risk for each customer based on the data dump of the various factors being constantly fed in from the vehicle. Critical data mass needs to be gathered over a period of time to support data analytics and insights into current and potential risks, and that would be important to create a robust and effective underwriting model. Insurers who have had the first-mover advantage and have a substantial customer base would be at a major advantage compared to other insurers who are yet to enter the market. Many insurers are collaborating to share and get access to large data sets.

Upgrading legacy systems: though many insurers have already or are in the process of upgrading their policy admin system and claims system, many insurers still are continuing with their legacy systems. Policy administration for UBI should support the capability of maintaining the continuous data captured from the vehicles for the various factors, have the capability of running analytics, perform renewals/cancellation/reinstatements with rates driven by usage, etc. There are many COTs policy admin systems that provide easy integration with UBI technology/vendors. Therefore, unless insurers are ready to upgrade their policy admin system, it would be difficult for them to adopt UBI in the near future. Most of the insurers still have legacy claims systems, and therefore insurers are weighing out the option of investing in the complete modernization of the claims system compared to building UBI integration with the existing legacy system.

Data collection for Claims: UBI is expected to make the claims process simple, reduce claims cost, reduce fraudulent claims and help to accurately access the loss for claims. But many insurers who have initiated UBI are yet to use the data collected for their claims processing. The data collected from the vehicles for the various factors are yet to be integrated with their claims system.

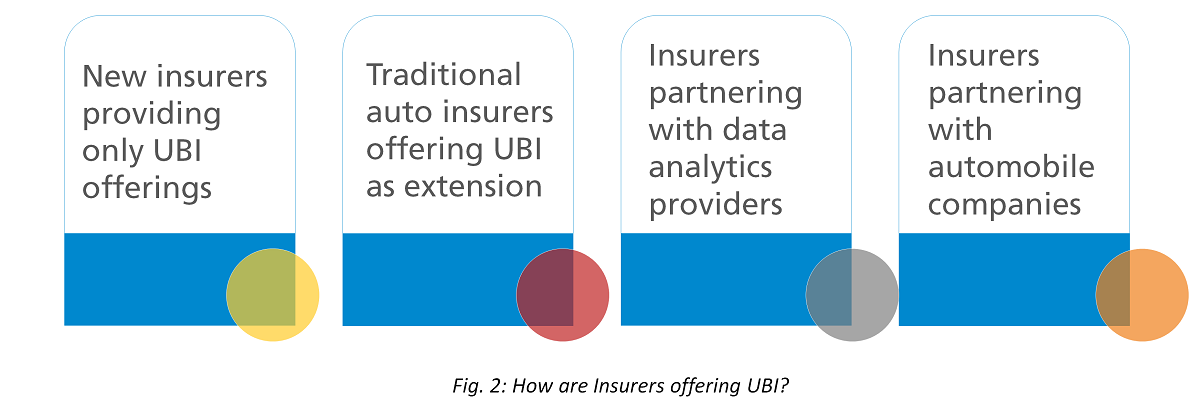

How Are Insurers Offering UBI?

There are insurers like Root and Metromile who specifically offer UBI. Such insurers have not adopted the traditional car insurance model. They provide both ‘pay-as-you-drive’ insurance, and ‘pay-how-you-drive’ insurance. Driving behavior is tracked through their respective apps.

Most of the traditional insurers are offering UBI services either via an app or a plug-in device, or both. Some of the insurers are ensuring that they take a slow approach to adoption by offering 30 days trial period. Some insurers are offering upfront enrollment discounts and then provide UBI discounts at the end of the policy period anywhere between 5% to up to 30% (during policy renewal). Most of the top US personal auto insurers are providing some sort of UBI discount along with their traditional products.

Many insurers are also partnering with data analytics providers, such as Verisk, who have been collecting driving data through their connected vehicles. Verisk Data Exchange gathers telematics data and applies analytics to eligible connected vehicles and standardizes them for any insurer to consume. This way, the customer can bypass any monitoring done by devices from the respective insurers. Example: In 2020, one of the top US insurers based out of Ohio has joined Verisk Data Exchange as part of their UBI strategy.

Insurers have also started partnering with automobile companies to get data from their connected vehicles to enable UBI for their customers. The automobile companies would take the consent of the vehicle owner to share information directly with the Insurer. Example: automakers like Ford and Lincoln have been in the forefront, partnering with top US insurers, to offer UBI options to their customer base.

The Road Ahead

According to a report published by Allied Market Research, the worldwide UBI market size was about $28.7 billion in 2019 and is expected to reach $149.2 billion by 2027. North America held the largest share in 2019, contributing to about two-fifths of the market. Post COVID-19, the need for usage-based insurance has been reinforced compared to traditional insurance.

Insurers, if not done already, need to have a focused approach towards usage-based insurance. Investments are needed upfront on product innovations, UBI technology, partnership with UBI/telematics providers, product marketing, data management, etc., to gain a share in this evolving market. Though achieving a break even and moving to a consistently profitable model depends on the UBI product adoption among customers, upgradation of core applications (like policy admin, claims, etc.) to support UBI would help offset the cost in the long run. Insurers would also need to invest specifically in data storage and privacy and constantly address any such concern from potential customers.

From a customer point of view, UBI will certainly move ahead of the traditional auto insurance model in the coming years. With the ease of downloading an app on a smartphone, tracking driving patterns is going to be a new norm rather than an anomaly. Also, as they see the benefits in terms of premium reduction, this in turn, will bring in momentum towards safe driving, thereby reducing accidents and claims. However, the concern over data privacy and ownership will still stay and might be a deterrent for many to adopt UBI.

More from Subrata Das

The small commercial business is a very active market, with new startups entering the US market…

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…