Alternative payment methods

Alternative payment methods (APMs), also known as local payment methods, are defined as those payment methods that fall outside of traditional card brand payments (Visa, Mastercard, AMEX, etc.).

Some of the most popular examples of APMs are bank transfers, digital wallets, local cards, cryptocurrencies, etc.

Contrary to popular belief, around 77% of the world’s e-commerce purchases are done using APMs rather than a card by Visa or MasterCard.

APMs are becoming so popular worldwide that in some countries they have become the de-facto payment method. For example, Alipay and WeChat in China, iDEAL in Netherlands, or Paypal in Germany.

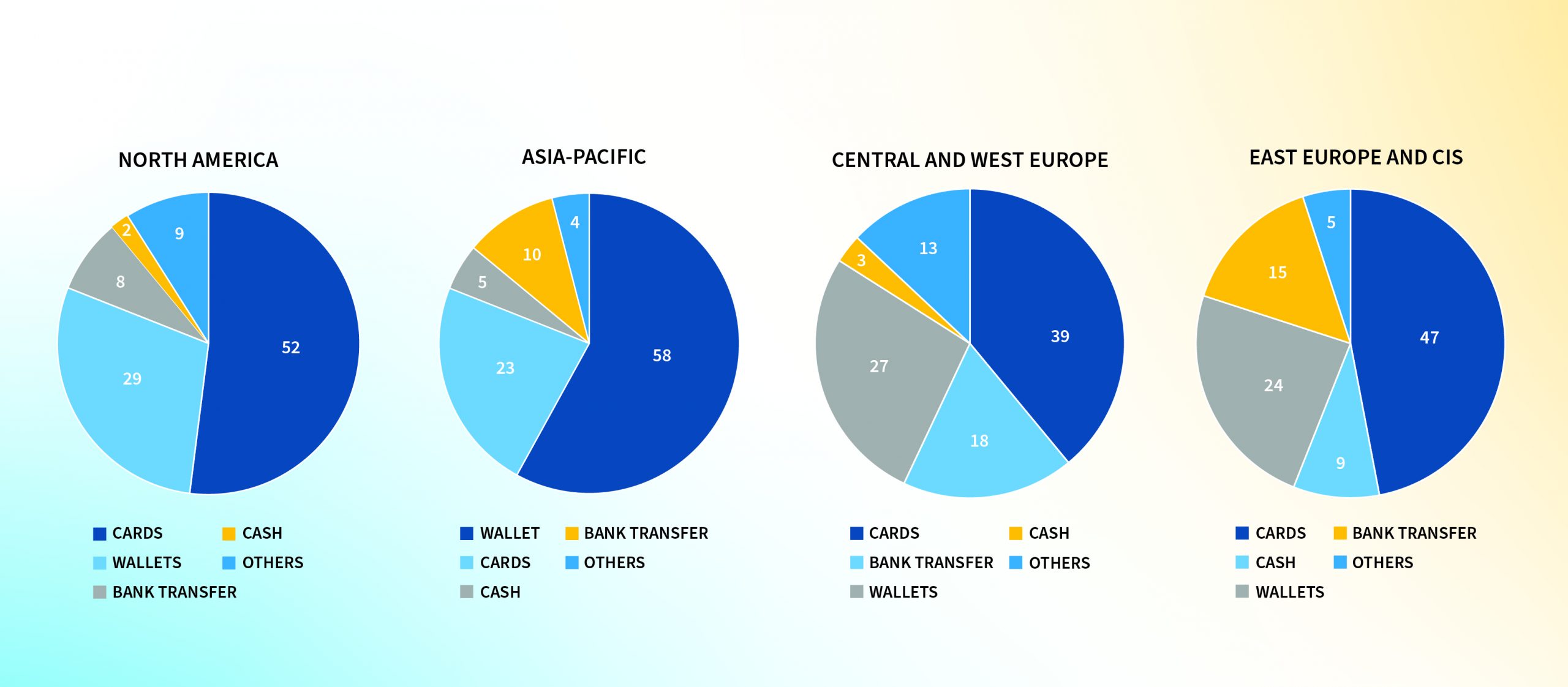

The graphic below gives a break-up of the different payment methods that consumers use for transacting.

Region-wise break-up of payment methods

The pandemic has changed or rather forced people to change their habits, particularly in terms of local payment methods. The use of cash has declined and there has been an exponential rise in consumers’ adoption of APMs and this trend is likely to continue in the future. A study from Juniper Research estimates that the total digital wallet spend will cross 10 trillion dollars in 2025 which is a two-fold increase from the 2020 value.

All of this has necessitated businesses adapting to changing consumer behavior. Market research by PPRO, a fintech company, found that 20% cart abandonment happens if users do not find their preferred payment method. Businesses need to realize the importance of allowing customers to make a purchase using their preferred payment method or run the risk of missing out on a purchase transaction and losing a future loyal customer. Not all users are comfortable providing their card details. So, giving users a reliable APM, builds a sense of safety and security in their minds. All businesses that hope to succeed will have to integrate local preferences into their platforms.

The next pertinent question facing businesses is, which APM to choose, from about 450 available options around the globe. The integration cost for multiple APMs is a challenge; hence, businesses need to focus on picking the right option. Payments methods vary from country to country–for instance, Dutch consumers use bank transfer app iDEAL while UPI is getting very popular in India.

While zeroing on an APM that a business can offer, certain factors may need to be considered.

- Understanding of target market

Consumers preference varies between different regions. Leverage local expertise and use analytics to uncover relevant insights for a region. For example, what percentage of people have bank accounts, what is the internet and smartphone penetration, etc. E-wallets might be popular in one region while a local card might be the preference for another region. There is no one-size-fits-all approach. Another important factor to consider is the customer profile–whether they are millennials or Gen Z since all they need is speed, convenience, and a frictionless experience. - Value for money

All APMs have a cost associated with them. Apart from the integration expense, there is a cost per transaction. Just because one APM offers greater convenience and flexibility, it might not be the best fit, especially if it impacts the bottom line of the business.

When considering an APM for your business here are some FAQs that will guide you in making your choice.

- What type of businesses should opt for APM?

Any business that wants to succeed, be it selling locally or across the border. Not offering any local payment methos is sure to increase cart abandonment and cause a dent in business revenue.

- What is the fee structure?

The fees vary but they are largely less than the mainstream payment methods.

- How secure is APM?

APM is secure in general if it is integrated well.

- How to integrate APM?

Though integration with APMs can be done by the service providers, integrating multiple APMs, testing and validating them, which includes compliance and legal checks, is very cumbersome. The best option is to engage with a specialist company like PPRO. A single integration with them will enable multiple APMs. All the heavy lifting with regard to contracts and operational complexities will be borne by PPRO while the business can focus on their core activities.

Conclusion

The payment landscape is evolving at a breakneck pace. Technology is helping create newer secure payment methods that are more convenient for users, and this trend is here is stay. Moreover, alternative payment methods are empowering both consumers and businesses. Consumers get to choose the best payment method. Businesses get a chance to increase their sales, both locally and globally. APMs acts an enabler in meeting changing customer demands and expectations.

References:

Latest Blogs

The energy and anticipation were evident even before entering the arena, and attendees had…

A tectonic shift in wealth is underway, and agility is the key factor that will distinguish…

Educational institutions are at a crossroads where their future hinges on a single question:…

In times of market unpredictability, alternative investments offer a valuable advantage by…