Accelerating And Simplifying Loan Origination

The simplification of the loan origination process needs some technical changes, which are to be looked around in the recent era. First, let’s investigate what a simplified loan origination process looks like:

What do we want a simplified commercial loan origination process to look like?

A simplified commercial loan origination process must contain four high-level characteristics:

By taking these four characteristics into account, we can access the latest innovative technologies that support mobile applications, optimized user experience, and rapid lending decisions. As explained in the details below:

1. Accessibility – Seamless initiation of the loan application

Today, consumers expect to perform their business-related transactions from their handsets, as they do from desktops or laptops. A loan application should be simple and consistent regardless of the device used, allowing prospective borrowers to apply for a business loan for their working capital via a mobile device, or in the comfort of a home or office. Applicants ought to be able to initiate and complete an application in minutes.

The Banks and Financial Institutions (FIs) should transform or modernize their legacy software into configurable loan origination applications, which will enable faster decisions and processing of all types of credit and lending requests. Additionally, this helps in gathering information using API virtually from multiple data sources.

2. Realtime data – Easier applicant information capture

Nowadays, the initiation of the application needs to be optimized into a process that makes entering applicant information as easy as possible. Configurable menus can help in this to allow Banks and FIs to create an enhanced user interface that guides applicants through the process using:

- Automation of processes to enable paperless submission of required documentation, such as driver’s license or pay stub

- Data optimization by logically displayed functions, based on application type, or previously entered data

- Data validation rules to minimize incorrect data entries

- Accessible on different devices such as mobile and desktop to ensure a smooth and exceptional user experience

A properly designed interface helps users to easily enter data and submit applications, enhancing customer experience. The ability to coordinate, create, test, and modify the user interface allows Banks and FIs to consistently improve one of the most important aspects of a loan origination process.

3. Responsiveness – Quick response on the loan application

The swiftness in deciding is the key to making it easy to submit a loan application. Modern loan origination solutions employ automated services and technologies to make the decision process easy and match the credit policies and terms with that of the applicant to deliver quick and rapid decisions. Changes that can help the faster loan processing are:

- Loan applications to become completely digital to enable rapid response, automated workflows, and eliminate time-consuming manual processes. The time taken to underwrite the loan gets significantly reduced as decisioning rules consistently and quickly apply to credit policies

- Using methods such as E-contracts and E-signatures help in eliminating delays associated with the manual loan application process

- Using an omnichannel-supported application to accelerate the lending process by making the application accessible on any device such as desktop, laptop, tablet, or mobile.

4. Scalability – Cloud

Having cloud-based lending applications will aid in faster decisions and offer competitive advantages using features like automated IDV (identity and verification), employment and income verification, vehicle valuation, and risk-based pricing.

With an automated cloud-based loan origination system, delays, as well as manual errors in loan processing can be eliminated, thus making it convenient for Banks and FIs to get access to customer information from existing data sources over the cloud.

Underwriters can easily work on these cloud solutions with minimal or no training. Cloud solutions are transparent, highly secure, and cost-effective for Banks and FIs. This can assure lenders that the entire data entered is error-free and can be extracted on demand from the available cloud sources.

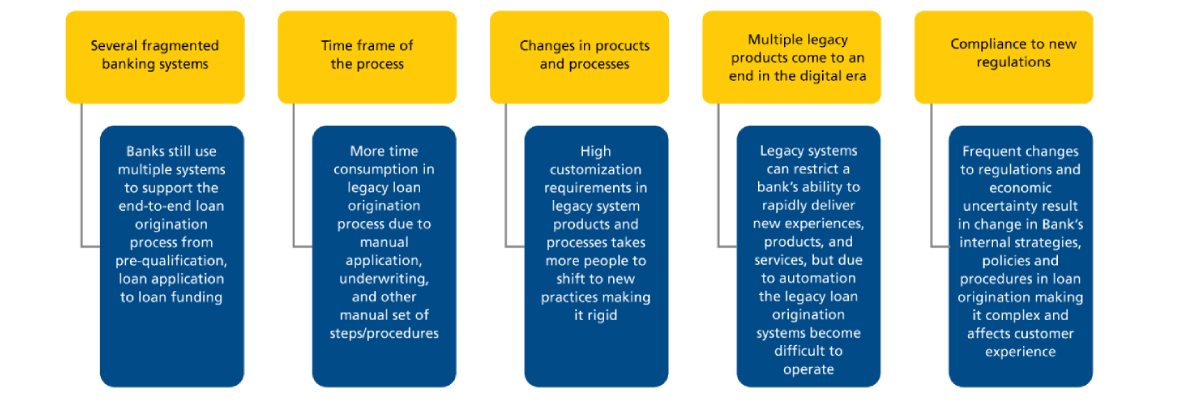

What are the challenges faced by banks and FIs in the present loan origination process?

What do we think can be a solution that accelerates loan origination?

The Bank or FIs should switch from legacy software to configurable loan origination software, which provides quick decisions and helps in processing all types of credit and lending requests that additionally help in gathering information virtually from any data source.

New players in the market such as nCino, are creating a huge difference in loan origination. These are built on the Salesforce platform and can be integrated with the core banking systems. It provides a seamless loan origination experience by eliminating paper loan files. It helps the customer to get a rapid response over loan applications from pre-underwriting to final funding.

Thus, we can say that to optimize their loan origination process, Banks and FIs should prefer integrated configurable loan origination software over legacy systems.

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…