FinOps That Works: Ditch the Guesswork and Build a Smarter Cloud Strategy

Why FinOps matter for banks? Cloud computing has completely transformed how organizations acquire and consume technology. The ability to run on a Zero Capex and All Opex model provides significant flexibility to small and enterprise-level organizations. Its ability to grow quickly, provide high resilience to heavily used critical applications, and supercharged security measures have made cloud computing popular among banks as well. However, there’s a catch. Without a solid FinOps (cloud financial operations) strategy, these benefits can quickly turn into excessive costs.

One South African bank, managing US$ 97 billion in assets (2024), experienced this firsthand. After a large-scale migration to Amazon Web Services (AWS), its cloud bills skyrocketed. In response, the bank established a FinOps team—but their focus on reactive cloud cost optimization barely made a dent.

This blog breaks down how a FinOps transformation strategy helped the bank save US$ 1.2 million in six months—and how you can do the same.

Why do traditional FinOps approaches fall short?

The bank’s initial FinOps team was set up quickly but lacked experience and a structured approach. Their primary focus? Identifying and remediating underutilized, untagged, and orphan AWS resources.

Sounds good in theory, but here’s the problem:

- Low engagement from teams: Resource owners were often too busy to act on cost-cutting recommendations.

- Short-term fixes: Cutting costs on a weekly basis didn’t stop new, inefficient resources from being deployed.

- Rigid application architecture: Certain workloads, like SAP systems, couldn’t easily be resized without impacting performance.

The result? A never-ending cycle of cost-cutting without long-term impact. The team soon realized that their cost-reduction efforts were barely covering the additional cloud expenses that kept piling up.

Recognizing this, bank’s CIO approached us to rethink their cloud financial operations strategy via the facets of Consulting.

Challenges: where do you even start?

As the FinOps team grappled with this reality, they faced several roadblocks:

- Confusion between short-term wins and long-term strategy: Quick cloud cost optimization seemed urgent, but a cultural shift was essential for sustained savings.

- Lack of vision and structure: Without clear goals, FinOps became an advisory function rather than a business enabler.

- No clear impact metrics: Without measurable KPIs, it was hard to prove FinOps was driving real business value.

These challenges boiled down to the classic struggle between people, process, and technology.

A strategic FinOps reset

- Defining clear vision and objectives

FinOps isn’t just a set of guidelines, it’s a cultural shift that instills accountability in cloud financial operations. The challenge, however, is that cost priorities often push this transformation to the backseat. Teams get caught up in daily cloud cost optimization efforts, overlooking the fact that a reactive approach leads to an endless cycle—there will always be more resources to remediate than the previous week.Breaking free from this loop required a shift in mindset. The first step was to establish a clear vision and objectives, laying the foundation for sustainable FinOps adoption. Instead of focusing solely on reducing cloud expenses, the goal was to foster a data-driven FinOps culture—one that prioritizes transparency, governance, and cost optimization to maximize business value. Every dollar spent on cloud should not just be accounted for but also work toward strategic objectives.

- Assessing maturity to define the starting point

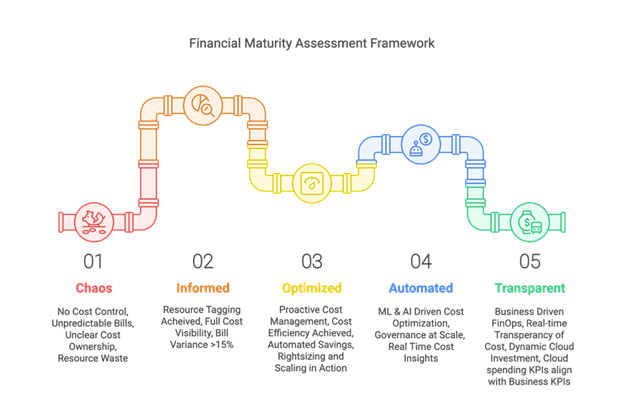

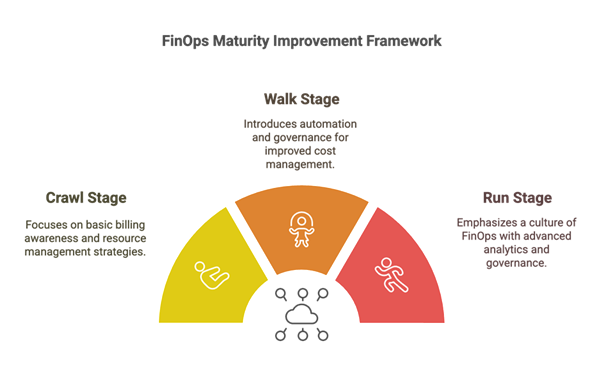

Before charting the course forward, it was essential to assess the bank’s FinOps maturity. The FinOps maturity model, typically broken into three stages—Crawl, Walk, and Run, provided a starting framework. However, a more nuanced approach was needed, splitting these into five different phases to help the team better understand their progress.Through a structured assessment, the FinOps team evaluated their cloud usage from a financial perspective and identified where they stood in their journey. The results placed them between the “Chaos” and “Informed” stages—meaning that despite ongoing efforts, they risked stagnation without a deliberate strategy to shift the trajectory.

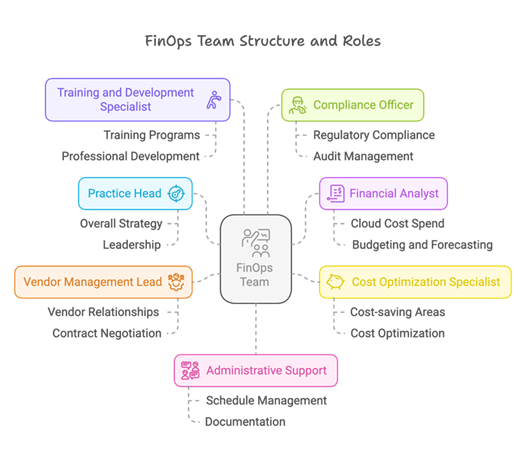

- Establishing a structured team

With a clearer picture of maturity levels, the next priority was to define roles within the FinOps practice. Given the limited personnel, many team members took on multiple responsibilities—a common scenario in growing teams. The practice head, for example, also managed vendor relationships, while a single resource handled both administrative support and training. Additionally, the bank moved forward with hiring an AWS cloud cost optimization specialist to bring dedicated expertise into the fold.

The goal was to establish clear role definitions, allowing each individual to focus on specific areas without overlap. This structure not only streamlined responsibilities but also ensured accountability, making it easier to track progress and measure impact.

- Advanced the FinOps journey: Crawl, Walk, Run

With the foundation in place, the focus shifted to action. Using the FinOps Classic Maturity Model, a checklist was designed for each stage, ensuring a structured progression. The approach was simple: pick up chores at each step, complete them, and move to the next. A stage was considered complete when 80% of its tasks were accomplished

Clear action items for each stage were as follows:

Crawl Stage: establishing awareness and control

- Understanding cloud finance and billing

- Implementing cost allocation tags

- Gaining visibility into cloud spending and resource tracking

- Defining budgets, forecasting, and setting up anomaly alerts

Walk Stage: strengthening governance and optimization

- Assigning all resources to cost centers

- Enhancing cost allocation strategies

- Implementing basic automation for cost monitoring

- Leveraging AWS Trusted Advisor, Reserved Instances, and Savings Plans

- Establishing governance policies and structuring the FinOps team within the organization

- Implementing a Showback or Chargeback model to promote accountability

Run Stage: achieving full integration and advanced optimization

- Embedding FinOps into IT culture and workflows

- Attaining real-time visibility and control over cloud spend

- Optimizing financial management processes

- Deploying advanced automation for cloud resource management

- Utilizing AI and machine learning for cost prediction

- Ensuring cloud spend aligns with business objectives through proactive governance

- Measuring success with KPIs

Tracking the success of a function like FinOps—where cultural transformation plays a key role—is no easy task. To maintain momentum, well-defined KPIs were established, covering both cloud spend and business impact. These provided quantifiable insights into efficiency gains and financial outcomes, reinforcing the value of FinOps beyond cost-cutting.

The impact: FinOps that delivers real savings

The impact: FinOps that delivers real savingsWith a structured FinOps advisory approach, the team moved into a stronger position than ever before. Clearly defined roles and responsibilities fostered better collaboration between business owners and cloud engineers, shifting the perception of AWS from just another data center to a consumption-based business model.

The introduction of a real-time KPI dashboard ensured that every action was logged and tracked. With a maturity framework tailored to the bank’s AWS adoption, priorities became clearer, and day-to-day operations were significantly more streamlined.

The results spoke for themselves—within six months, the bank reduced its cloud bill by US$ 1.2 million. More importantly, FinOps’ maturity level saw a significant improvement, positioning the team for future growth. As of January 2025, the bank is actively exploring machine learning-driven cloud financial operations strategies to sustain long-term optimization.

Conclusion

When a new practice, such as FinOps, is developed with very little actionable material and prior experience, it is usually difficult to get initial adoption. Early-stage success isn’t always immediately visible, making it crucial to establish KPIs that keep progress measurable. These function-centric KPIs must align with broader business objectives, ensuring that FinOps drives efficiency and cost-effectiveness rather than just acting as a reactive cost-cutting function.

A well-positioned FinOps practice, backed by a structured team, concrete short-term goals, and a long-term vision, creates far more value than sporadic optimization efforts. The true objective isn’t just to minimize cloud spend—it’s about embedding a culture of financial accountability in cloud operations, ensuring that every resource contributes to business growth.

More from Ashutosh Dixit

Latest Blogs

The consumer-packaged goods (CPG) market is a sprawling, competitive landscape, offering a…

It pays to be data driven. Research conducted by Forrester1 reveals that companies advanced…