AI-Powered ‘PolicyGenius’: Delivering Real-Time Insights and Actionable Intelligence for Brokers

In the ever-changing world of insurance brokerage, manually extracting valuable information from policy documents has always been a tedious and time-consuming task. Each insurance carrier has its own unique policy and quote format, making the extraction process more complex and tedious.

Generative AI has demonstrated significant capabilities in handling unstructured documents. By leveraging advanced techniques such as Retrieval-Augmented Generation (RAG), enhanced RAG, and graph-based architectures, these systems can significantly improve the accuracy of their outputs. Agentic AI further empowers these intelligent systems to autonomously make decisions and take actions with minimal human intervention. This article explores the development of Agentic AI-powered solutions designed to assist brokers in extracting precise information from intricate policy or quote documents.

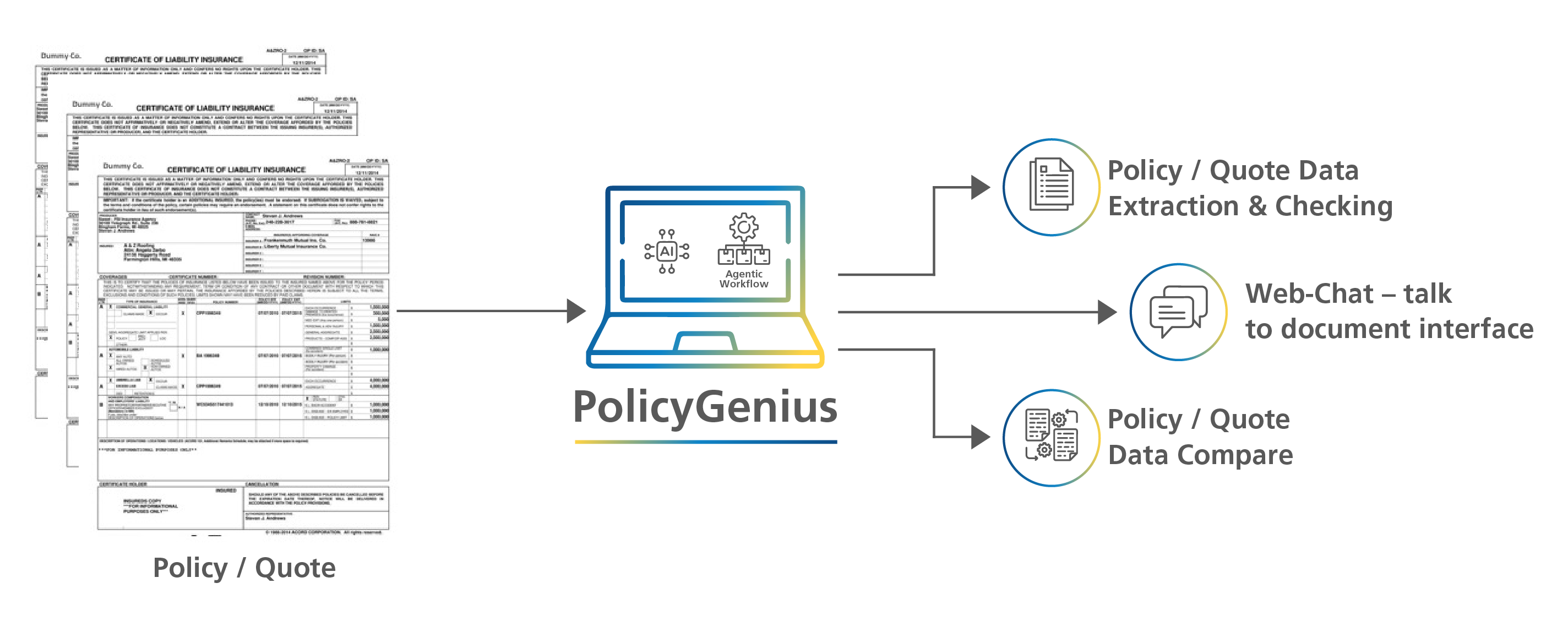

Imagine an advanced chatbot-based virtual assistant crafted to aid brokers in navigating intricate insurance policies, legal documents, and regulatory guidelines – Let us call it PolicyGenius. This intelligent assistant allows brokers to interact directly with documents, extracting precise information effortlessly. Such automation significantly reduces the time and effort required for meticulous comparisons and detail extraction, streamlining the entire process.

Figure 1 PolicyGenius Solution

Real-world Challenges with the Policy/ Quote Checking Process:

Structural Complexity:

Policy documents are complex, with numerous sections and detailed tabular data that brokers must interpret. These documents often have additional pages containing policy conditions, term definitions, illustrations, liabilities, and more. The current extraction systems find it challenging to differentiate between core policy details and supplementary information. As a result, brokers spend considerable time manually reviewing lengthy documents such as policies, quotes, and cover notes.

Extraction Inaccuracies Leading to Legal Disputes:

Insurance policies are legally binding contracts. Any inaccuracies in interpretation or advice could lead to legal disputes. Simply relying on OCR (Optical Character Recognition) and coordinates-based data identification will not deliver an accurate output. Since brokers assess risks based on policy and supporting documents, inaccurate information may lead to underestimating or overestimating risk exposure. While incorrect risk assessment affects premium calculations, claims handling, and overall profitability, misinterpreting policy terms may result in inadequate coverage.

Complex solutions like PolicyGenius require the unification of stochastic and deterministic computing to collaborate effectively.

How Can AI-powered Capabilities Help?

Gen AI models excel in understanding and processing unstructured data and deriving essential information from it. Generalized LLMs (Large Language Models) have a wide vocabulary from a vast range of topics.

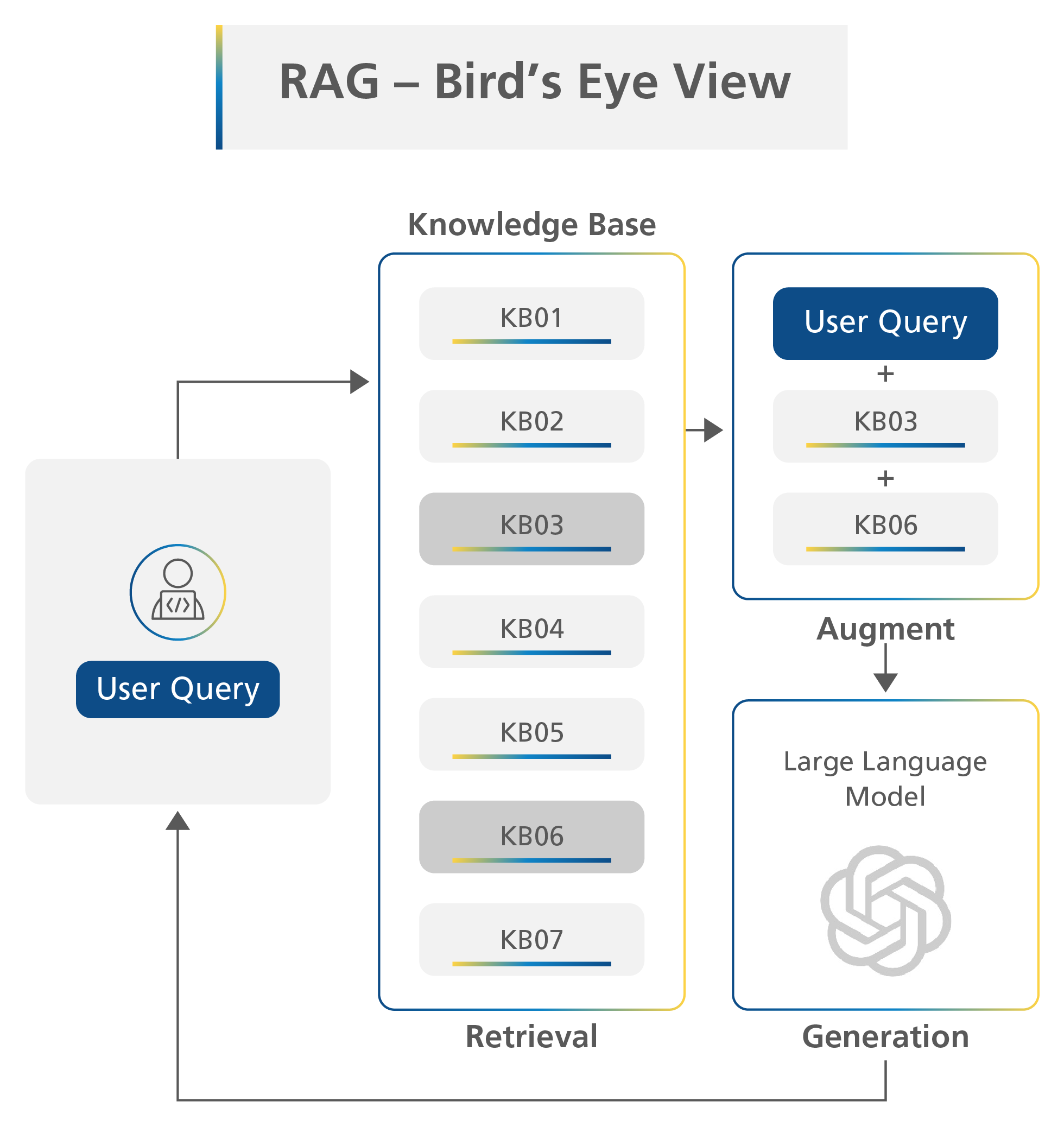

RAG plays a pivotal role here. RAG retrieves pertinent knowledge from specialized databases and ‘augments’ this information with policy documents before sending it to an LLM for inference or ‘generation.’

For instance, when a user inquires, “What’s the Policy Number?”, the RAG process identifies and retrieves all relevant information chunks related to the ‘Policy Number.‘ This data is then combined with the user’s query and sent to the LLM for processing. If the retrieved information is accurate, the LLM can generate precise responses. This process is repeated for each query, ensuring reliable and efficient information retrieval.

Agentic AI:

Agentic AI refers to artificial intelligence systems designed with a sense of agency, enabling them to make autonomous decisions, adapt to new information, and interact dynamically with their environment. Unlike traditional AI models that follow predefined rules and processes, Agentic AI systems possess the capability to learn, reason, and act independently to achieve specific goals.

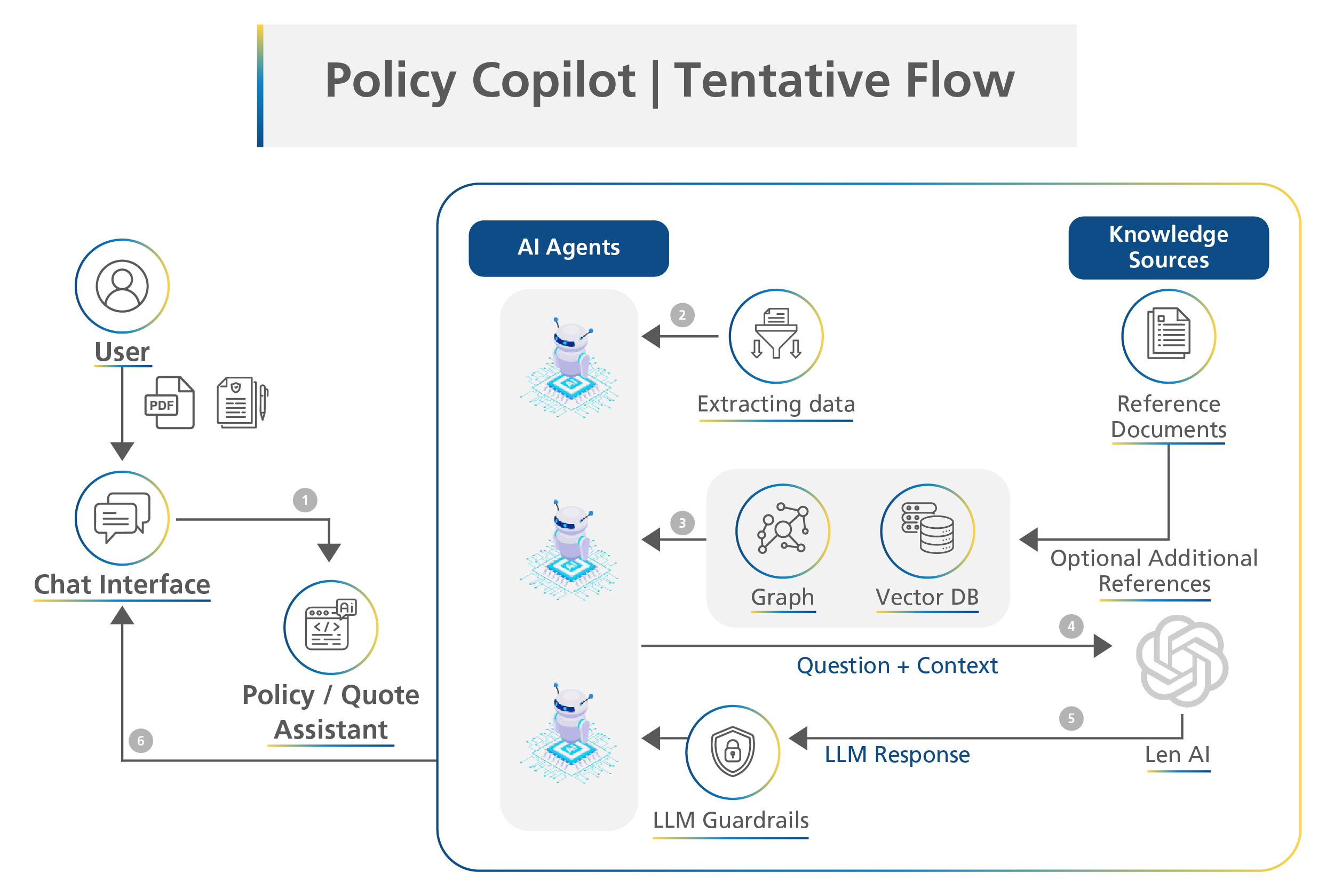

In the context of PolicyGenius, Agentic AI can significantly enhance accuracy and efficiency by autonomously extracting and processing data from complex insurance documents. This reduces the need for manual intervention, minimizes errors, and accelerates the policy generation and quoting processes. By leveraging Agentic AI, PolicyGenius can provide brokers with precise and actionable insights, streamlining their workflow and improving overall productivity.

Figure 3: PolicyGenius Flow with Agentic AI

Will Gen AI Work for Policy Data Extraction?

While policy extraction is a much more complicated use case for RAGs, multiple strategies such as Advance RAG, Chain of Thoughts, and Agentic RAG need to be combined for better accuracy.

Here are the top challenges that need to be addressed before using Gen AI for policy extraction.

- How to extract data from a PDF? Once the policy is uploaded, extraction libraries help derive the text from the PDF. Text extraction can also be performed with Python libraries. Complex documents can be extracted with the help of OCR, NLP, or even multi-modal LLMs. We have discussed these approaches in an earlier article.

- What is the best way to chunk this data? ‘Chunking’ refers to the process of breaking down a large document or text into smaller, more manageable pieces, or ‘chunks.’ This makes it easier for AI to process and understand the content. While dealing with the complex structure of policy documents for extraction and vectorization, a robust chunking and embedding strategy is essential. Below are few chunking strategies that are effective:

- Hierarchical Chunking: Policy documents often have a hierarchical structure with sections and subsections (e.g., coverages, exclusions, terms and conditions, etc.). When chunking is based on these natural divisions, it helps maintain context and ensures that related information is grouped together.

- Semantic Chunking: Semantic chunking is performed by analyzing the embedding of each sentence in a document, comparing their similarities, and grouping those with the most similar characteristics. By emphasizing the meaning and context of the text, semantic chunking improves retrieval quality. It is an excellent method to use when preserving the semantic integrity of the text is crucial.

It is not easy to generalize the chunking strategy that will work for all LOBs (Line of Business) and types of policies. However, one can certainly start with the above strategies.

- Selecting Model(s) aligned Use Case: The retrieved context obtained from the policy document, along with the user’s query, is sent to an LLM for inference. Our team has evaluated various LLMs, including GPT-4o, GPT-3.5 Turbo, Anthropic Cloud 3.5 Sonnet, Llama 3.1-70B, and other well-known models for accuracy of response. In some cases, it is beneficial to use a mix of different LLMs. For example (not a recommendation), GPT-4 can be used for queries involving numerical values (like premium, liability limits, etc.), while Llama 3.1-70B can be used for descriptive responses. Exploring different combinations in alignment with the query/ prompt can lead to improved performance and cost efficiency.It is important to note that a single user query can trigger multiple LLM calls depending on the complexity of the document and the chosen RAG pattern

- How to ensure responsible AI? The last and most important aspect revolves around ensuring guardrails for LLMs. These guardrails can be programmed to act as a firewall to eliminate any hallucination or toxicity in the response text. LTIMindtree’ s Euclid foundation provides comprehensive ‘Responsible AI’ capabilities and services that can help to eliminate these hurdles from response.

In addition to the RAG flow, other integration services are also required to connect to external systems (e.g., CRM, underwriting platforms), retrieve client-specific data (e.g., claims history, risk profiles), and update policy information as needed. Along with ‘secure by design’ principles, which advocate for building security into software from the very beginning of the development process, adding Role-based Access Control (RBAC) to ensure data privacy, encrypting sensitive data (e.g., policyholder details), and complying with industry standards (e.g., GDPR, HIPAA) are mandatory.

How does PolicyGenius work?

In the PolicyGenius application, users can upload one or more policy documents to extract key information efficiently. The application can be envisioned in three distinct modes: Batch Mode, Online Mode, and Comparison Mode. Let us delve into each of these modes in detail.

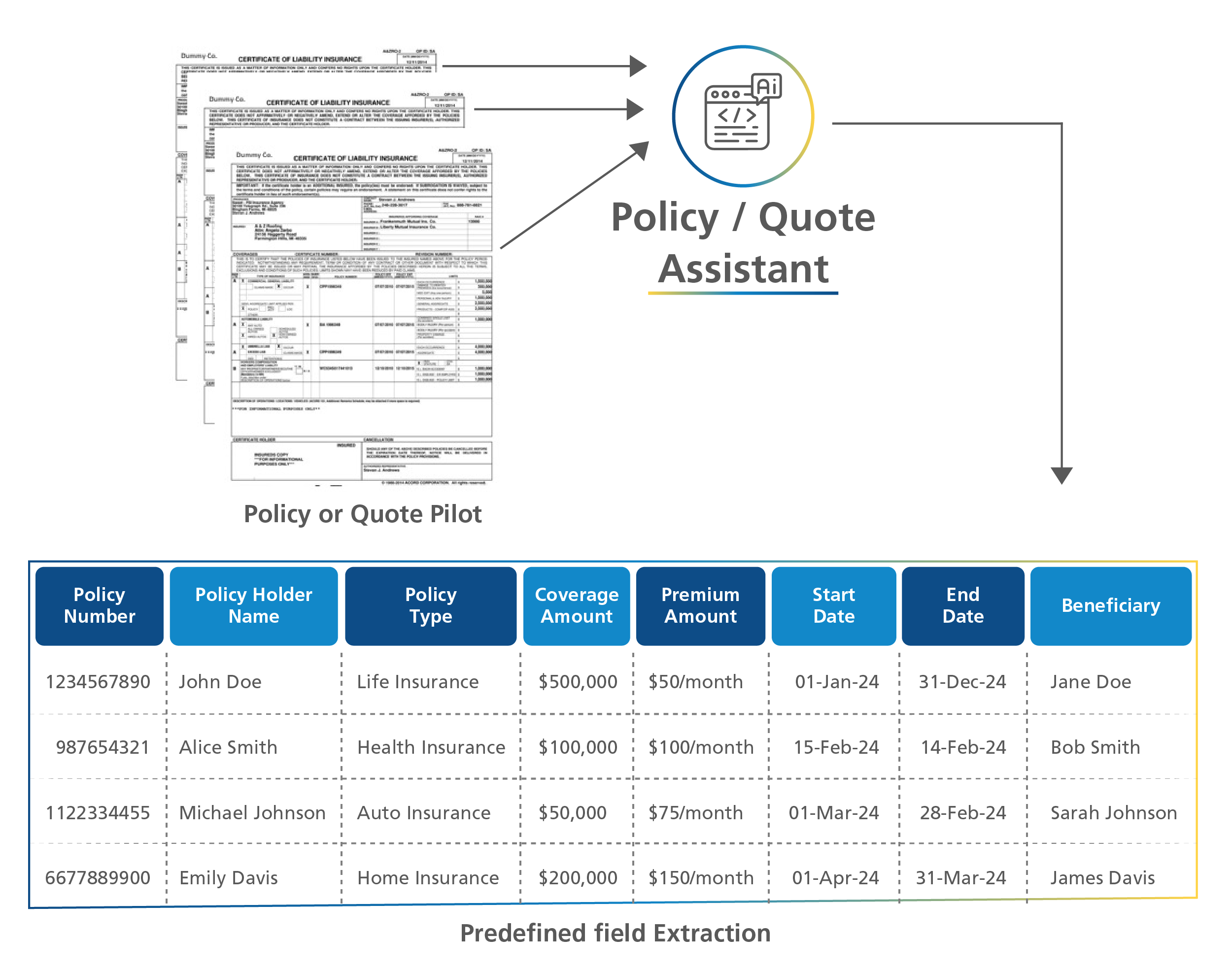

Batch Mode: As the name implies, this mode processes batches of policy documents. Users can define the number of fields to be extracted from the policy documents. These predefined fields will be configured with optimized prompts. The extracted output can be presented in various formats such as text, tables, or even JSON, and can be stored in NoSQL databases or file storage solutions like Amazon S3.

Figure 4: Batch Mode of Operation

Online Mode: This mode offers a chat interface where users can upload a policy document and interact with it. This mode is particularly useful for obtaining specific information from a policy document promptly.

Comparison Mode: This mode extends the functionality of the online mode by allowing users to upload multiple documents for data comparison. These documents could include a quote and a policy, policies from different carriers, or policies from different years. When a user asks a question such as “What are the Employers Liability Limits?” PolicyGenius will extract this information from all the uploaded documents and present a comparative view in a tabular format like below (sample output).

| Employee Liability Limits | Quote # 015164125 | Policy # 925164125 |

| Bodily Injury by Accident | $100,000 each accident | $120,000 each accident |

| Bodily Injury by Disease | $100,000 each employee | $80,000 each employee |

| Bodily Injury By Disease | $500,000 policy limit | $500,000 policy limit |

Figure 6: Comparison Mode

It is important to note that these three modes of operation are not mutually exclusive. They can coexist within a single application or be distributed across multiple applications as required.

Targeted Benefits:

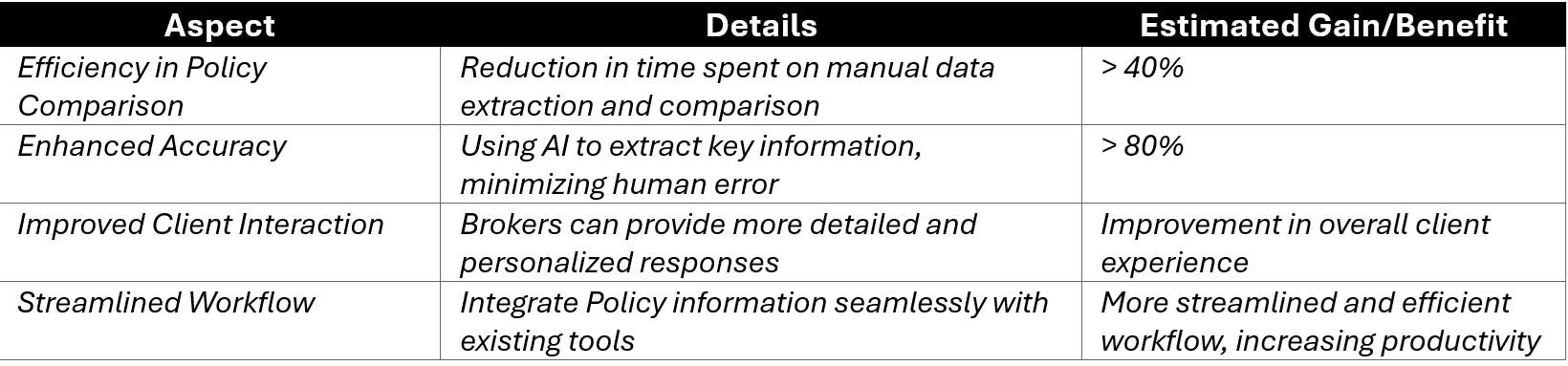

Based on our experience, PolicyGenius enables acceleration in multiple areas. A few of the key benefits are outlined here. Please note that the percentage benefit numbers are indicative:

Table 1: Estimated Benefits of PolicyGenius

Conclusion:

Brokers can harness the transformative power of Agentic AI through innovative applications like PolicyGenius. This tool not only streamlines the complex task of policy analysis but also delivers early business value. It paves the way for a future where technology and human expertise collaborate to achieve unparalleled excellence in insurance brokerage. As technology advances, AI-driven solutions are becoming increasingly sophisticated and aligned with human needs. From Optical Character Recognition (OCR) to Generative AI and Agentic AI, the accuracy and performance of these intelligent applications continue to enhance.

How Can LTIMindtree Help?

With extensive expertise in the insurance broker domain, LTIMindtree is uniquely positioned to deliver cutting-edge AI-driven business solutions. Leveraging our Euclid Platform, our Insurance Technology Office has developed the PolicyGenius MVP (Minimum Viable Product) and other value-driven generative AI use cases specifically for our broker clients. This innovative solution can process documents across various lines of business with over 90% accuracy and can be customized to meet the unique needs of each broker. Additionally, our experts have created a heat-map view of generative AI use cases for brokers, aiming to reimagine processes, enhance productivity, and improve accuracy within broker value streams.

For more information about our groundbreaking generative AI solutions for brokers, please contact our experts.

More from Ambarish Deshpande

Introduction The insurance broker industry is built on trust, efficiency, and competitiveness.…

Latest Blogs

As CISOs or cybersecurity decision-makers, how often do you come across questions such as "Am…

Last week, I had the privilege of attending Informatica World 2025 in Las Vegas, a landmark…

Introduction Vehicle Insurance has long been known for its complexity. Why? Because it relies…

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…