Overview

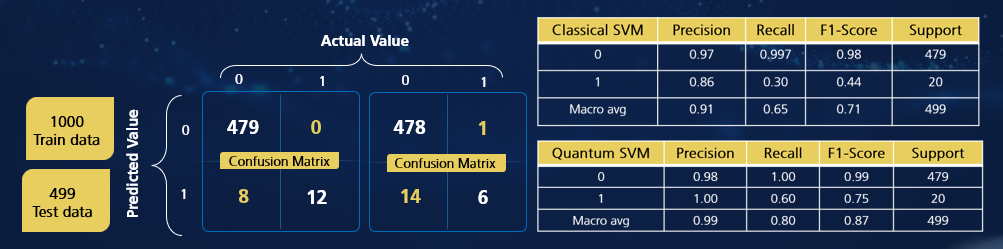

In recent years, the regulatory landscape under the Anti-Money Laundering (AML) Act of 2020 expanded, with the Financial Crimes Enforcement Network (FinCEN) publishing national priorities and new rules on beneficial ownership. FinCEN will also guide the use of emerging technologies like quantum computing for imbalanced data sets and machine learning for transaction monitoring. Effective AML processes now require a contextual monitoring approach, utilizing both internal and external data sources and innovative technologies to understand customer activities better, generate meaningful alerts, and improve operational efficiency. Moving beyond traditional rules-based methods, adopting intelligence-led strategies and advanced technologies is essential to combating financial crime and ensuring robust compliance.