Driving Business Efficiency with Generative AI for the Insurance Broker Industry

Introduction

The insurance broker industry is built on trust, efficiency, and competitiveness. Brokers play a vital role in establishing trust between insurance providers and clients. They ensure that policies are accurately represented and claims are handled efficiently. To perform their tasks effectively, brokers gather a wide range of data, including both structured and unstructured information. Clients rely on brokers to provide accurate and reliable information about insurance policies. Brokers act as intermediaries between insurance providers and clients, ensuring that policies are presented transparently and understandably. They handle a large volume of information, including policy documents, claims forms, and medical reports.

Generative AI, empowered by the latest advancements in enhanced large language models, is rapidly maturing to handle complex datasets and gaining better control over limitations such as hallucinations. The insurance broker industry is beginning to explore the adoption of generative AI to streamline its operational processes. Generative AI-powered solutions accelerate tasks such as reviewing policy documents, analyzing claims forms, and extracting data from various sources. By utilizing AI, brokers can save time, reduce manual errors, and improve overall efficiency in their operations.

This blog provides insight into the primary challenges in adopting generative AI-based solutions, various text extraction methods, and a high-level overview of Generative AI use cases. We will delve into individual use cases in greater detail in upcoming posts. Let’s get started!

Critical challenges

Brokers are required to meticulously review and process substantial volumes of unstructured data received from both parties when collaborating with the insured and carriers. This data encompasses various types of documents, such as:

- Prior policy documents

- Exposure data

- Submissions, quotes, policies

- Review reports

- First Notice of Loss (FNOL) information,

- Claim notes, loss run reports, etc.

These are primarily PDF documents, and any automation related to them requires accurate data extraction.

Comprehending the layout of these documents, insurance terminology, and their interconnections can be quite complex. Brokers often face another obstacle due to the diversity of formats. Different insurance companies frequently employ their own formats, terminologies, and explanations within the documents. Deriving a universally applicable, standardized format, such as a canonical JSON, from all these diverse sources can be extremely challenging.

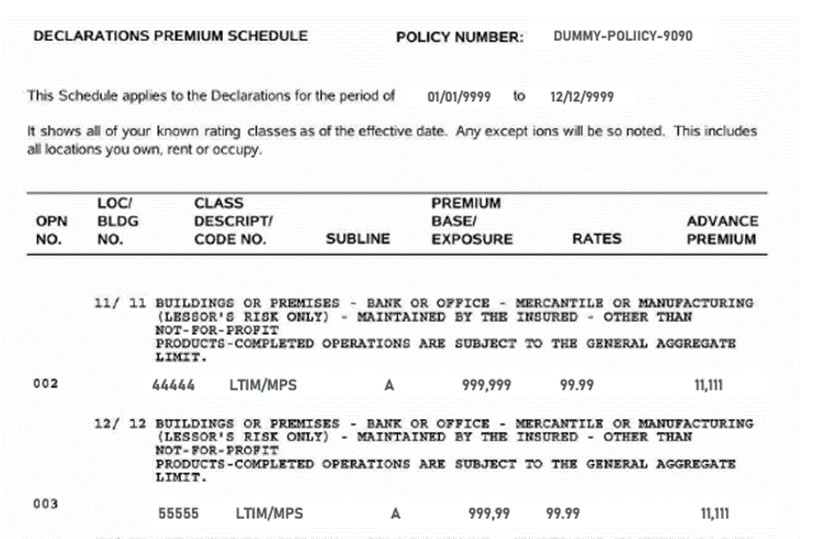

Figure 1: A table from a sample policy document

The way data is represented in documents creates an additional layer of complexity. Table structures in policy documents frequently lack borders, incorporate merged and unmerged cells, and contain text that overlaps cell boundaries.

Conventionally, brokers review documents and extract data manually. This is a process susceptible to time-consuming inefficiencies and human errors.

Generative AI models demonstrate exceptional proficiency in handling unstructured textual data. They adeptly extract valuable insights from raw text, irrespective of its format or lack of predefined structure. However, when applying generative AI in the insurance broker industry, the accuracy of data extraction from the aforementioned documents becomes crucial. Our team has conducted experiments using various data extraction techniques and evaluated their suitability. Let’s take a quick look.

Intelligent data extraction

Below are a few key approaches that give a concise overview of the capabilities and limitations of data extraction techniques:

- Common text extraction libraries: Python provides several libraries, such as PyPDF, pdfplumber, and Tabula. While most of these libraries perform well with text-based PDF content, they encounter difficulties handling complex tabular structures, as shown in Figure 1.

- Combination of OCR and NLP: A powerful combination of OCR (Optical Character Recognition) and NLP (Natural Language Processing) can be employed in addition to text extraction libraries. This unique blend enables the extraction of information with images or complex structures. However, multi-column paragraph text is still a challenge.

- Use of multi-modal LLMs: In addition to the extraction of structured data, Multi-modal LLMs (Large Language Models) can also be explored. These Generative AI models combine texts, visuals, and contextual information, allowing a more comprehensive understanding of the data. This approach is slower, but it has better accuracy than other approaches. Also, the insurance Industry has its own set of niche vocabulary. Generalized LLMs might face difficulty in understanding the context in a few cases.

- Trained AI model for extraction: By training the AI model on vast insurance industry data, it can quickly analyze and extract relevant information from complex documents. A well-trained AI model will understand the intricacies of these documents, including the terms, conditions, deductibles, coverage details, and exclusions.

A trained model can support other RAG (Retrieval Augmented Generation), Agentic AI Bots, and workflows. Details about these applications will be covered in subsequent articles in this series while discussing individual use cases.

Use cases with business values

Document extraction remains an essential prerequisite. With the help of Generative AI, this extracted content will be used to create practical use cases that add value within the Broker Industry. Through collaborative brainstorming with multiple customers, we have compiled a list of use cases to enhance business efficiency in this industry. The use cases mentioned below top the list:

- Policy Co-pilot

Generative AI’s chat-based capability can provide a policy Co-pilot virtual assistant that can read complex policy documents and find the exact information you need. Brokers often deal with intricate insurance policies, legal documents, and regulatory guidelines. Having an AI assistant navigate these documents quickly can save time and improve decision-making.

- Policy data extraction

With the help of generative AI, vital data from various quotes or policies from different insurance companies can be extracted and converted into a standardized format (like a structured JSON file). This structured data will facilitate better data-driven analysis, tracking changes, and easier comparison through tools.

- Claim summarization

Large language models are immensely capable of summarizing unstructured content, keeping the overall context alive. This feature can be utilized to summarize claim information, including claim documents and previous processing notes, for easier delegation and persistence. Further, with effective summarization, brokers can provide clear updates, explain claim status, and address client queries effectively.

- Quote comparison

Generative AI can extract relevant details from different insurance quotes (from various carriers) and compare them to what the customer wants. It can also suggest the best option. This will significantly reduce the time analysts spend collecting information from carriers with different quote formats.

- Underwriting assistant

Underwriters must review multiple documents, such as details of damage or financial loss and the potential magnitude of those events. A generative AI-based assistant can significantly add value by automating tasks, improving accuracy, and expediting decision-making. This enhances operational efficiency and ensures a more precise evaluation of risks.

As technology permeates the business domain, an increasing number of use cases emerge within the broker industry, enhancing business efficiency. The ongoing integration of generative AI has the potential to revolutionize how broker companies evaluate risk, provide personalized coverage, and navigate the intricate regulatory landscape.

What next?

In summary, effective text extraction mechanisms significantly impact the accuracy of AI-based solutions. Generative AI, with its diverse range of value-driven use cases for insurance brokers, can create virtual assistants, co-pilots, data processors, and analyzers to support brokers’ business.

In upcoming articles in this series, we will explore specific use cases and discuss solutions that enhance business efficiency. Our primary focus will be helping brokers leverage this technology to streamline processes, improve customer experiences, and maintain a competitive edge in the market.

More from Ambarish Deshpande

In the ever-changing world of insurance brokerage, manually extracting valuable information…

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…