Navigating Organizational Change: Building Financial Resilience through Effective Change Management and Financial Strategy

Digital Transformation in the Financial Industry

Digital transformation in the financial industry entails leveraging cutting-edge technology to streamline processes, enhance customer experiences and drive operational excellence. The driving force of digital transformation in the financial industry is meeting evolving customer expectations. In the journey of digital transformation in the financial industry, Organizational Change Management plays a significant role.

The Significance of Change Management in Finance Transformation

Finance transformation involves significant shifts in technology, processes, roles, and organizational structures. Organizational change management (OCM) is critical to the success of any finance transformation journey. Financial agility and efficiency become paramount as companies adapt to a rapidly evolving business landscape. However, even the most well-planned transformation efforts can fail without effective change management.

Understanding Finance Transformation Journey

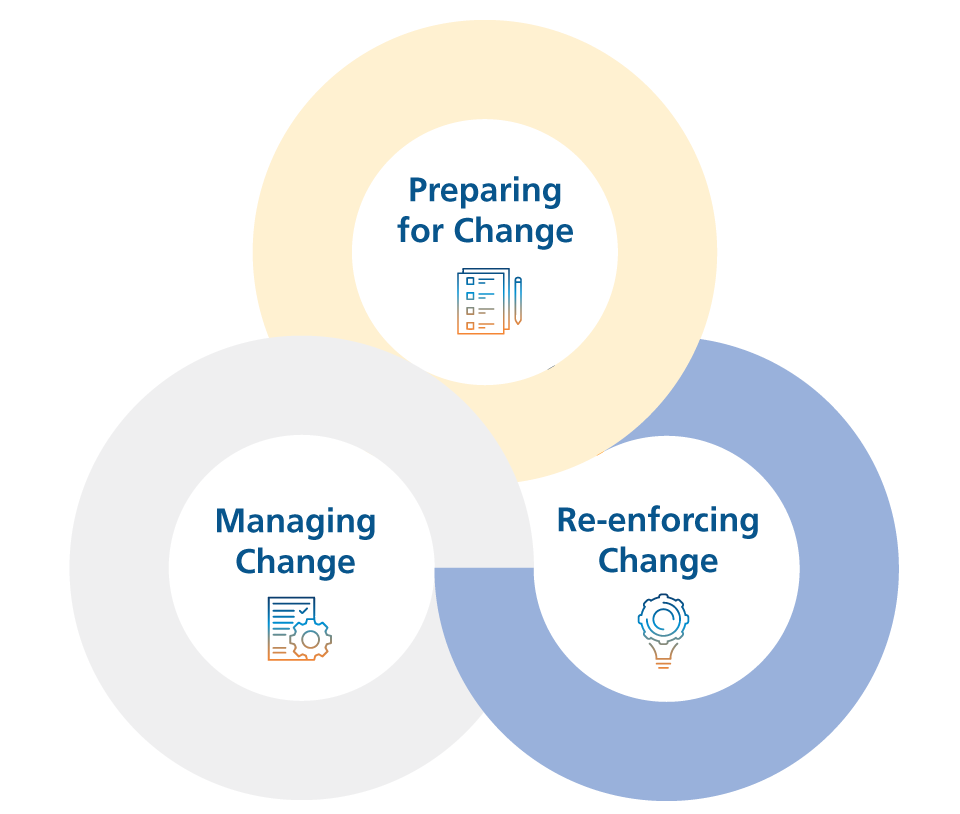

At LTIMindtree, we understand the importance of keeping things simple and focusing on the right outcome. That’s why we believe in the power of Organization Change Management, a process that ensures a successful transition from a current state to a desired future state.

The goal of change management is to minimize resistance to the change, and maximize the chances of success

It addresses the people’s side of change by considering the impact of changes on employees, customers, and stakeholders, by engaging, and supporting them throughout the change process.

Change Management Consultants focus on creating the best change strategy, communication and training plans, and performance monitoring to ensure the success of the change.

It involves analyzing and managing the impact of changes and addressing the needs and concerns of those affected.

Framework for a Successful Finance Transformation Journey

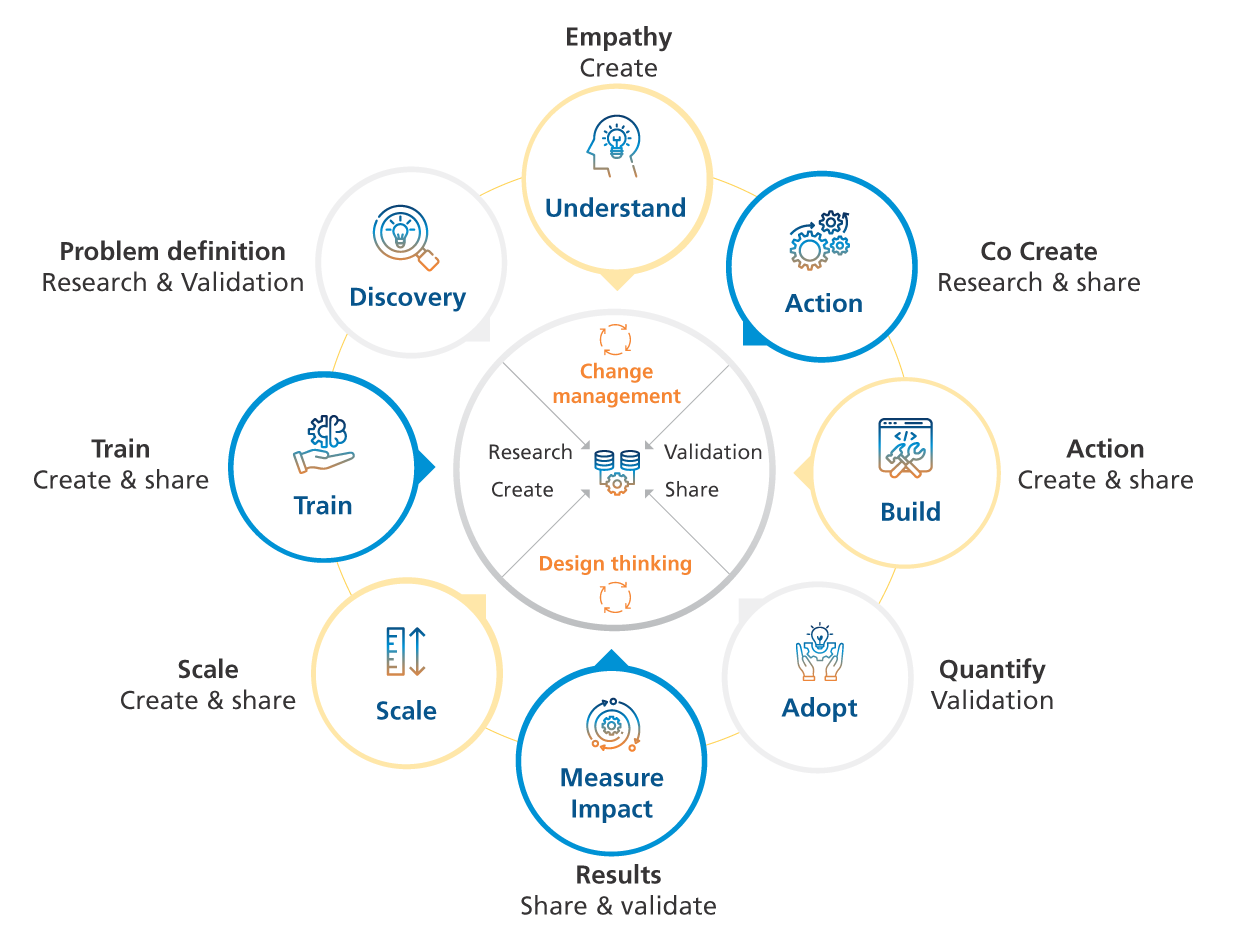

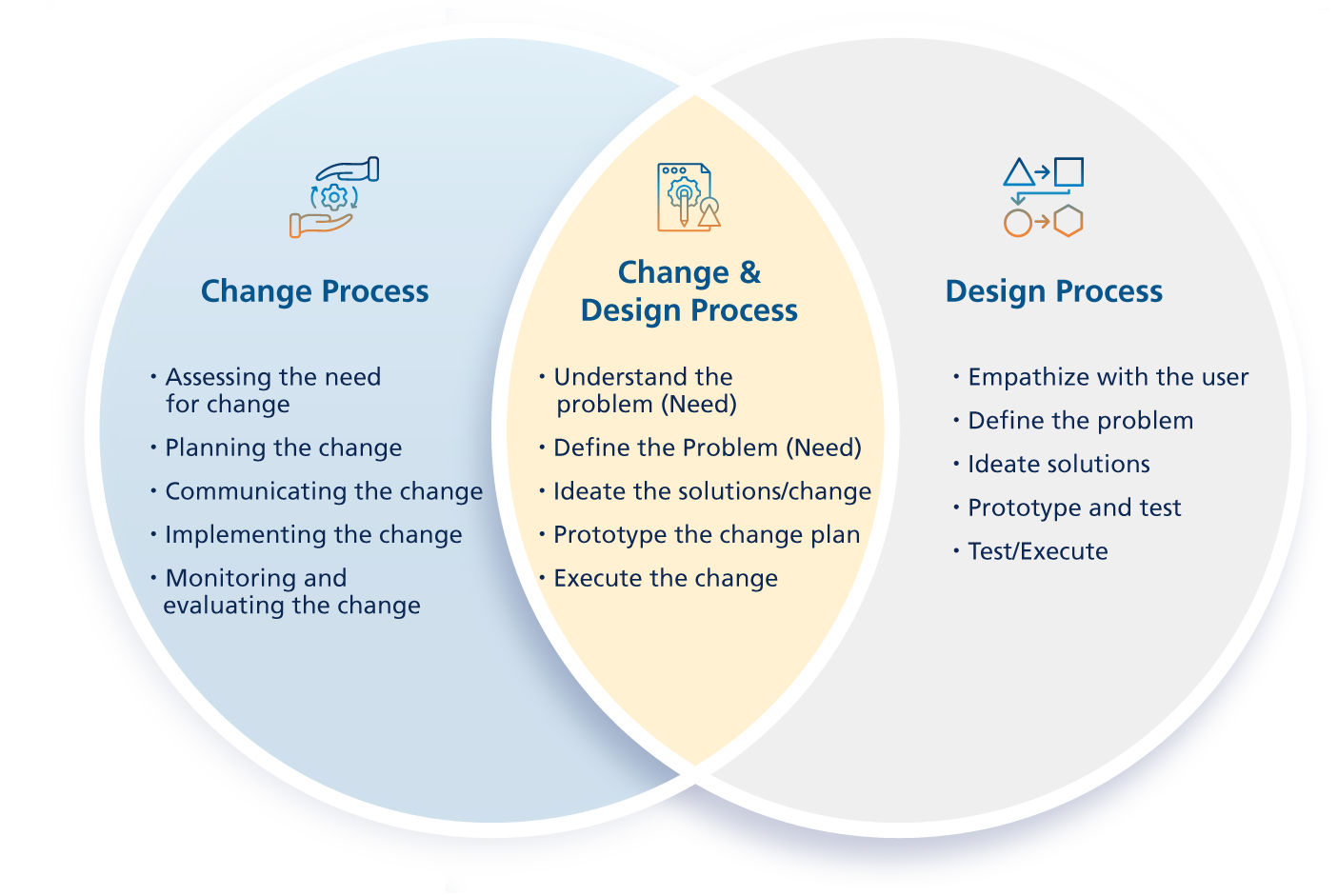

Change management can be applied to different changes, such as technological, organizational, process-related, and cultural changes. At LTIMindtree, we utilize the Organizational Change Management and Design Thinking framework to drive innovation and improve adoption.

Change management and design thinking can work together to drive innovation and improve adoption in an organization. While they have unique approaches and steps, they can overlap and complement each other to achieve the desired outcome. At LTIMindtree, we utilize both frameworks to ensure a successful and sustainable transformation process.

Aligning People and Process

Organizations must invest in change management and develop a comprehensive strategy to manage change effectively to ensure a successful financial transformation process. This can include regular communication, training, employee support, effective risk management, and stakeholder engagement. By doing so, they can achieve desired benefits.

During financial transformations, organizations must approach the process carefully, as Organizational Change Management (OCM) plays a significant role in the journey towards successful transformation.

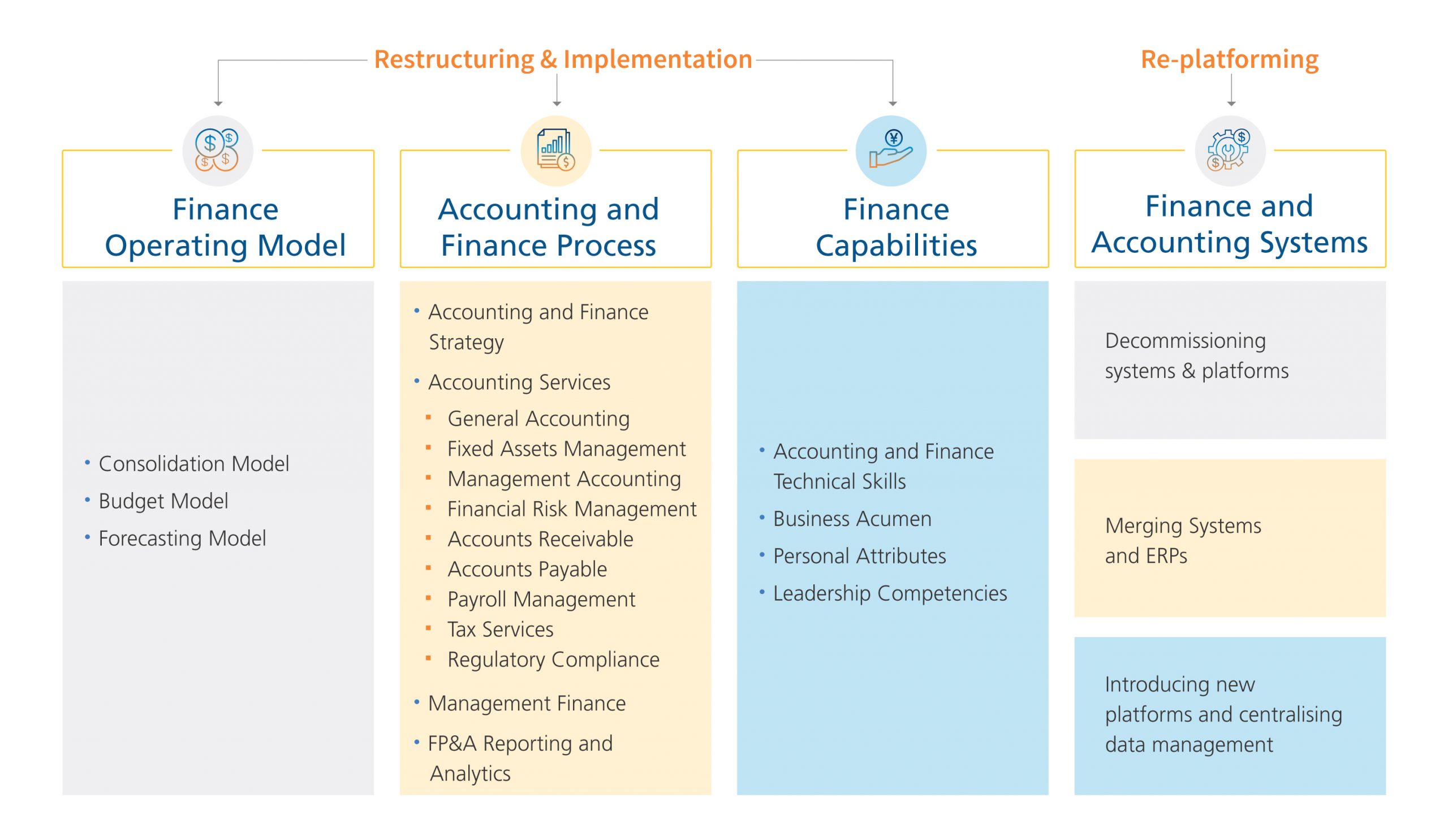

The finance function within any organization is responsible for all the critical tasks involving financial planning, budgeting, forecasting, accounting, and reporting. And in the current scenario, with the continuous advancement of technology and changing business landscape, transformation has become necessary for organizations to remain competitive and efficient.

Key Metrics and Evaluation in Finance Transformation Journey

Moreover, the success of change management initiatives is often measured in financial terms. Organizations need to track and measure the fiscal impact of their changes to determine if they are achieving their goals. Financial metrics such as return on investment (ROI), net present value (NPV) and internal rate of return (IRR) can help organizations evaluate the monetary impact of their change management initiatives.

Restructuring and Implementing Finance Transformation

Although a finance transformation journey is not just about implementing modern technology or improving processes, it also involves significant changes in organizational structures, operations, job roles, and working methods. It consists of both restructuring & implementation across the different areas of the domain.

Here comes the significant role of change management which is a critical component of any transformation journey including the finance transformation process. It ensures that the entire process is successful, sustainable, and aligned with the business strategy and goals, While focusing on the importance of change management during a finance transformation journey and what are the critical areas involved:

- Reduction of Resistance and Disruption to The Minimal

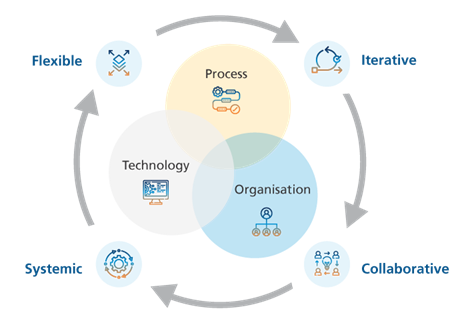

Utilizing Organization Change management methods provides you with the necessary tools to help minimize any resistance and disruption across all the dimensions and aspects. As the Finance transformation is rooted in three dimension and guided by four of the below aspects.

OCM not only helps by identifying and addressing the concerns of employees and stakeholders, but also help managing

the expectations of all involved key stakeholders by communicating the key benefits of the transformation and providing training and support to employees during the transition.

- Improved communication with all stakeholders to make them well-informed and understand the changes will help mitigate resistance and reduce confusion.

- Foster partnerships and collaboration between different departments and organizations in finance to help streamline processes and reduce the potential for disruption.

- Embrace technology and automation to streamline processes, reduce manual errors, and improve overall efficiency. This can help reduce resistance to change and minimize disruption.

- Encourage a culture of flexibility and adaptability in the Finance domain to help reduce resistance to change and minimize disruption by allowing organizations to respond quickly and effectively to evolving market conditions.

- Business Strategy and Goals Alignment

Having the transformation initiatives aligned with the overall strategy and goals becomes vital. With the application of OCM (Organizational Change Management), you can ensure that the changes made during the transformation will improve efficiency and effectiveness in the overall performance and that the finance function is better equipped to support the organization’s overall objectives.

- Stakeholder Expectation Management

All the involved parties or stakeholders, including employees, customers, and shareholders, play a crucial role in determining the success of the financial transformation process. This includes internal and external stakeholders, whom the change may impact differently.

Effective Stakeholder Expectation Management requires regular communication, stakeholder engagement, and a clear understanding of their needs and concerns. This information can then be used to develop strategies that address their expectations and ensure that change is successfully implemented. Within Finance functions, many related subfunctions also get impacted directly or indirectly due to any restructuring or implementation program.

Using OCM, we help manage their expectations by effectively communicating the transformation’s changes, benefits, and timeline. We also help to ensure that the involved and impacted parties understand the rationale and clear objective behind the transformation and are more involved and supportive of the process.

- Risk Mitigation

Mitigation of the risks is a key focus point during change management. All the risks associated with a finance transformation process must be identified for any potential challenges. And there must be a need to work on developing contingency plans to address them effectively. The process includes the organization to work on below steps:

- Risk assessment – To understand key/potential challenges.

- Contingency planning – For effective and timely addressing of potential risks.

- Regular monitoring – To effectively monitor the ongoing process and manage risks.

Transition Support To All Involved Parties

Supporting employees during the transition to the new systems, processes, and organizational structures becomes one of the process’s important pillars. With Change Management, we must design the process, which includes providing training and support and a well-designed communication plan about the changes and their potential benefits to employees.

Insights and Recommendations for a Successful Finance Transformation Journey

In summary, effective change and monetary management is critical to the success of any organization. Both are interrelated, and a well-planned and executed change management initiative can help organizations achieve their strategic objectives while ensuring they have the necessary financial resources to support their goals.

All the organizations that are successful in effectively managing change during a finance transformation or any internal organizational transformation is more likely to realize the desired benefits and achieve a successful outcome.

At LTIMindtree, we are well-equipped to drive successful financial transformation processes. With our expertise in change management, comprehensive strategies, and risk management, we can help organizations achieve their desired benefits and optimize their finance functions. Our focus on effective communication, training, and stakeholder engagement ensures a smooth and successful transition toward a transformed finance function.

Latest Blogs

Tired of spending countless hours troubleshooting failed API tests and keeping up with constant…

The business world is moving quickly and the only way to make informed decisions is to leverage…