A Comprehensive BNPL Solution by LTIMindtree, Jumio, Neener Analytics and Q2

Buy Now Pay Later (BNPL) is a future-proof credit and payments solution to meet the growing demands of banks, financial institutions, payment providers and FinTech companies, driven by the exponential growth in the consumer retail and ecommerce industries. It is a type of short-term financing or Point of Sale (POS) loan, allowing customers to purchase products on credit and pay later. It usually does not charge interest. Getting credit cards approved is not so easy, but BNPL is easier to get approved as compared to credit cards.

According to research by CB Insights, 67% millennials don’t have credit cards and $680 billion is estimated global spend using BNPL. BNPL not only helps individual customers, but also supports small and medium enterprise customers to manage their business with short-term micro-finance for invoice financing.

In this direction, LTIMindtree has teamed up with Jumio, Neener Analytics and Q2 to offer a three-pronged solution to simplify KYC compliance, enable credit risk assessment based on alternate data, and successfully run the lending process for BNPL providers across the globe.

The solution comprises three key aspects:

Streamlining Fraud Detection and KYC/AML Compliance with Jumio:

Jumio’s technology was chosen to deliver KYC checks in the joint BNPL solution’s workflow.

The solution helps address the impending needs of a robust KYC mechanism that can deliver superior customer experience seamlessly and consistently across channels, boost the operational efficiency by connecting with authoritative data sources for ID and AML/PEP verification, and turn around with results in seconds. It identifies fraudsters and reduces false positives, apart from helping businesses be compliant with regulatory standards, thereby adding to business growth through increased customer conversion – eventually increasing the deposits and credits by cross-selling and up-selling various products. With this ease in onboarding, a customer gets signed up and has access to the credit or deposit account in minutes. This stage of customer onboarding is crucial, given that a customer will choose to either go ahead or decline the process of onboarding if the processes are not simple.

Once customers are acquired, they evince interest in deposit or credit products. For instance, a customer is onboarded for a credit product, which is made available to him/ her in a span of a few minutes. This pleasant experience keeps the customer engaged with the bank for various other products too. Hence, short-term credit is extended to customers in a limited span of time, which includes hassle-free customer verification and credit checks – drawing their interest every time they need short-term credit. Thus, the availability of short-term credit like BNPL acts as a new revenue stream for banks.

A manual and complex KYC process can be time-consuming and resource-intensive for banks. Streamlining the KYC process can reduce the workload and costs associated with compliance, allowing banks to allocate their resources more efficiently and focus on other business priorities.

A streamlined KYC process can help banks detect and prevent fraudulent activities. By verifying the identity of their customers and monitoring their transactions, banks can detect suspicious activities and take appropriate action to prevent fraud and financial crime.

It is important for banks to invest time and resources in designing and implementing an effective onboarding process that meets the needs of their customers. This includes providing clear and concise information, offering personalized guidance and support, and ensuring a smooth and efficient process.

To protect consumers and ensure compliance with KYC and the new 2023 affordability laws, BNPL lenders can implement comprehensive KYC checks to confirm the identity of their customers for each transaction and implement safeguarding measures.

LTIMindtree’s BNPL Solution leverages the Jumio KYX Platform to streamline the KYC process in BNPL deals and ensure that customers really are who they say they are during onboarding and ongoing transactions.

The solution helps address a range of use cases:

- KYC/AML compliance – Screens customers against watchlists for sanctions, politically exposed persons (PEPs), adverse media etc.

- User authentication (Replacing KBA & SMS-based 2FA) – Validates a user’s ID, corroborates it with a selfie, and uses advanced detection techniques to ensure that the person is present.

- Password remediation – Biometric-based authentication makes sure that a returning user is the same person who was onboarded, preventing account takeovers.

- Business process automation – Powerful, risk-based workflows for exact business needs.

- Online customer onboarding – The flexible onboarding journey supports 5,000+ ID types in over 200 countries and territories.

- Fraud prevention – Sophisticated transaction monitoring and intuitive case management speeds investigation time and simplifies suspicious activity reporting.

- Age verification – 500+ global data sources to confirm customers’ date of birth.

- Fake/fraudulent ID detection – Verifies that the data provided by the user or extracted from the ID card matches the information in the jurisdiction that issued the legal document.

- Cardholder unavailable – Deters CNP (card-not-present) fraud in mobile transactions using mobile checkout card scanning.

- Money movement – AML compliance for detecting suspicious money transfer.

- Account opening- Single automated onboarding platform.

Enabling Credit Risk Assessment Based on Alternate data:

Alternate data refers to information that is conventionally not used for credit assessment. It can be an individual’s everyday banking activity like utility/ rental/ credit card payments and/ or any activity on social media. In the case of this solution, alternate data can be used as a supplement to conventional credit information to assess customers’ credit worthiness. By considering a wide range of parameters and data points, lenders can get a better and complete picture of a borrower who has the least or no credit history. The data related to borrowers’ income, employment and payments can easily serve as data points to decide on credit viability.

With the help of Neener Analytics’ AI-based financial risk decisioning technology (based on Human Data Science), LTIMindtree addresses the below use cases to acquire customers with credit worthiness, resulting in an increase in good borrowers:

- Rejection Recapture – Analyses consumer behavior and gives second chances by recapturing their rejected proposals.

- Default Prediction – Advanced AI and rules engine to monitor a consumer’s timeline to predict future defaults.

- Fraud Detection – Deeply monitoring consumer personality can help assess their trustworthiness and resilience.

At the Heart of the Solution is Q2 – The Lending Processing Engine:

With Q2’s cloud lending platform, the solution provides an innovative alternate source of lending, which solves the difficulties in obtaining other types of credit. LTIMindtree’s and Q2’s strategic partnership combines the latter’s best-in-breed lending capabilities with the former’s domain expertise, product engineering, and delivery capability through this BNPL solution.

Q2 provides easier end-to-end customer onboarding according to the needs and makes lending a time-efficient process with the below products:

- CL Originate – This underwriting platform converts applications into contracts for servicing. It is customer-centric, agile, and cloud-based.

- CL Loan – This comprehensive lending platform accelerates loan processing, simplifies borrower experiences, reduces operational inefficiencies through automation and configuration, and increases application volumes.

- CL Collections – This helps relationship managers in terms of defining and automating their collections processes.

LTIMindtree’s BNPL solution in partnership with Jumio, Neener Analytics and Q2:

What Do BNPL Customers Derive from This Solution?

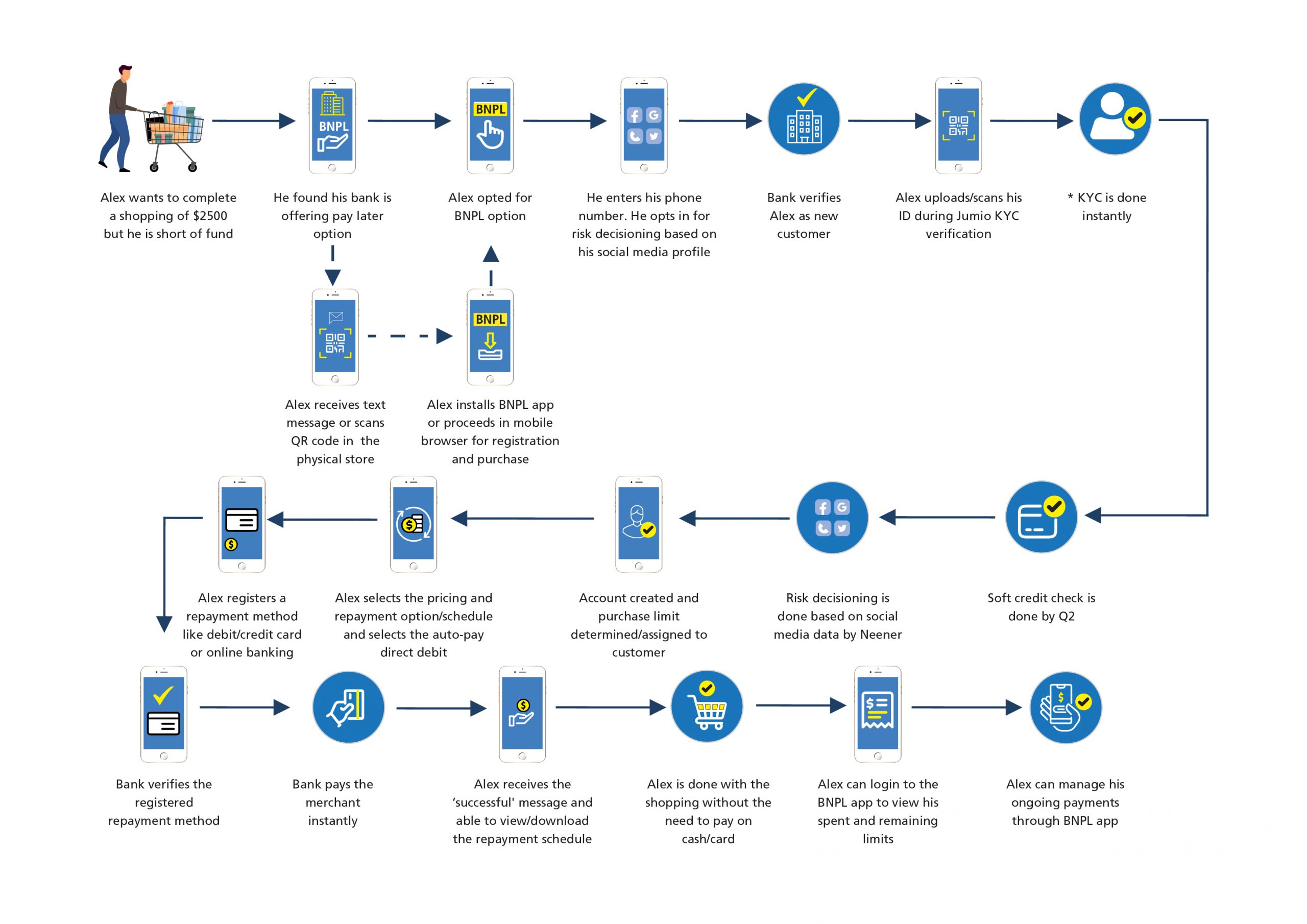

Let us take an example. Alex is a 27-year-old software engineer from the US who has recently relocated to the UK to complete his masters from a business school. He needs to buy a laptop/MacBook for his education. Alex visits the Shelby Online store to make the purchase. He has decided to purchase a MacBook Pro M1 Max, which costs $2500. Since Alex is a student, he doesn’t want to spend a lot of money upfront and wants to have cash-in-hand. Hence, he decides to go in for the Pay Later option. Luckily, he is delighted to see that the store accepts BNPL payment options. Alex selects the BNPL option and purchases the MacBook.

Here are the highlights:

- Alex purchased the MacBook from Shelby Online Store.

- Alex has received a purchase limit of $10,000 from the BNPL solution.

- Alex has a monthly payout of only $833.33.

- No upfront amount needed from Alex.

- He will pay $833.33 after one month for the next three months without any interest.

- He is now a happy customer of the store.

- Alex is also delighted with the BNPL experience.

Conclusion

BNPL can help banks achieve superior customer experience with new revenue streams by offering:

- Instant verification and customer onboarding

- Great customer experience with easy one-click payments

- Interest-free repayments

With an alternative data-based credit assessment, BNPL offers instant credit facilities to customers during the online checkout or the point of sale. The convenient and seamless one-click checkout experience, personalized real-time payment options without any hassle, digital biometric-based instant customer onboarding and KYC verification, and the flexibility to shop now and pay later without interest charges will result in enhanced customer experience, increased sales, and improved customer loyalty over time.

To know more about how we can help you address your requirements, please write to info@ltimindtree.com.

LTIMindtree

LTIMindtree is a global technology consulting and digital solutions company that enables enterprises across industries to reimagine business models, accelerate innovation, and maximize growth by harnessing digital technologies. As a digital transformation partner to more than 700+ clients, LTIMindtree brings extensive domain and technology expertise to help drive superior competitive differentiation, customer experiences, and business outcomes in a converging world. Powered by nearly 90,000 talented and entrepreneurial professionals across more than 30 countries, LTIMindtree — a Larsen & Toubro Group company — combines the industry-acclaimed strengths of erstwhile Larsen and Toubro Infotech and Mindtree in solving the most complex business challenges and delivering transformation at scale.

Jumio

Jumio is a leading provider of automated and comprehensive identity proofing, risk assessment and eKYC solutions. It helps organizations know and trust their customers online. From account opening to ongoing monitoring, the Jumio KYX Platform provides advanced risk signals, identity proofing and compliance solutions that help you accurately establish, maintain, and reassert trust.

Q2

Q2 is a financial experience company dedicated to helping monetary institutions and other services providers become lifelong partners to their account holders and customers. It offers comprehensive solution sets for consumer and commercial banking, lending, security, onboarding, and more.

Q2’s solution sets are designed to be comprehensive – replacing or seamlessly integrating previously disparate, disjointed point solutions into a cohesive, secure, and streamlined financial experience. Its Salesforce-native lending solutions offer existing users a seamless rollout of scalable, secure, compliant lending and leasing.

Neener Analytics

Neener Analytics is the leader in Cognitive AI and the only behavioral biometrics solution that delivers specific and individual risk outcomes in a completely frictionless environment.

Neener Analytics looks at each user’s individual social media presence and leverages social biometrics to determine their risk. It helps in assessing the risk generated by individual consumers. To everything that a customer says, Neener Analytics predicts a risk-correlated FICO score with almost 80% accuracy in just one click.

More from Charan Kumar Hiremath

Introduction The financial services sector has seen considerable digital transformation over…

Banks place a high value on customer onboarding since it shapes the overall customer experience.…

Latest Blogs

he supply chain is a network of suppliers, factories, logistics, warehouses, distributers and…

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…