How to Maximize Your Customer Lifetime Value to Customer Acquisition Cost Ratio

Introduction

The number of customers you acquire can have a significant impact on how much revenue your business makes. If you acquire more customers than you lose, you are increasing revenue and profits by increasing your LTV-CAC ratio. If, however, your cost per acquisition (CPA) is too high compared to the amount of revenue generated from each customer acquired (LTV), then this can lead to decreased profits as well as negative cash flow for your business. How do you know if this is happening? The answer lies in calculating a metric called customer lifetime value to customer acquisition cost ratio or LTV-CAC ratio.

Knowing your customer lifetime value (CLV) and customer acquisition cost (CAC) is essential for any business. Having a high CLV to CAC ratio means that you are acquiring customers at a more cost-efficient rate, which can lead to greater profits. This blog will walk you through the process of maximizing your CLV to CAC ratio. You will learn how to properly calculate both your CLV and CAC, as well as understand the importance of having a good ratio. You will also discover ways to increase your CLV, such as providing incentives and creating loyalty programs, as well as strategies to lower your CAC.

What Is Customer Lifetime Value?

Customer lifetime value (CLV) is the sum of all future revenue and cost savings that a customer can generate for you over the course of their relationship with your company. It is not just about how much money they pay in total each year, but also how much they spend on things like advertising, marketing, and sales.

Customer lifetime value (CLV) is the projected total profit from a single customer over their lifetime. This includes the initial profit from their purchase as well as the profit from any referrals they make. CLV considers many different factors, such as the initial profit from a single purchase, the customer’s lifespan, the number of additional purchases they make, the profit from each additional purchase, and the number of referrals they make. It can be a helpful metric to use when deciding whether to focus on customer acquisition or retention. Often, businesses will focus on acquiring new customers because they are quick and easy. However, retaining customers is more profitable since you do not have to go through the entire acquisition process again.

In short: is a metric that shows how much profit potential an individual customer has for your business.

How to Calculate Your CLV?

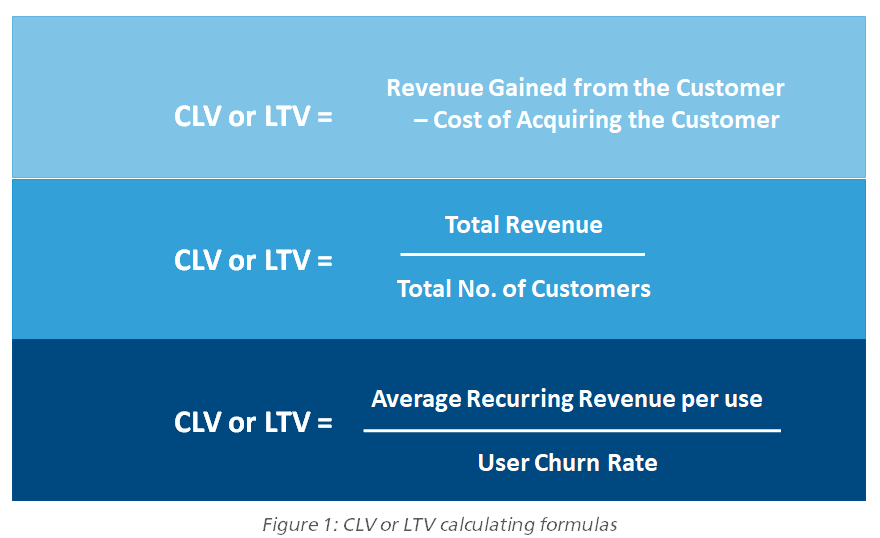

There are many formulas, in that few simplest formulas to calculate CLV are:

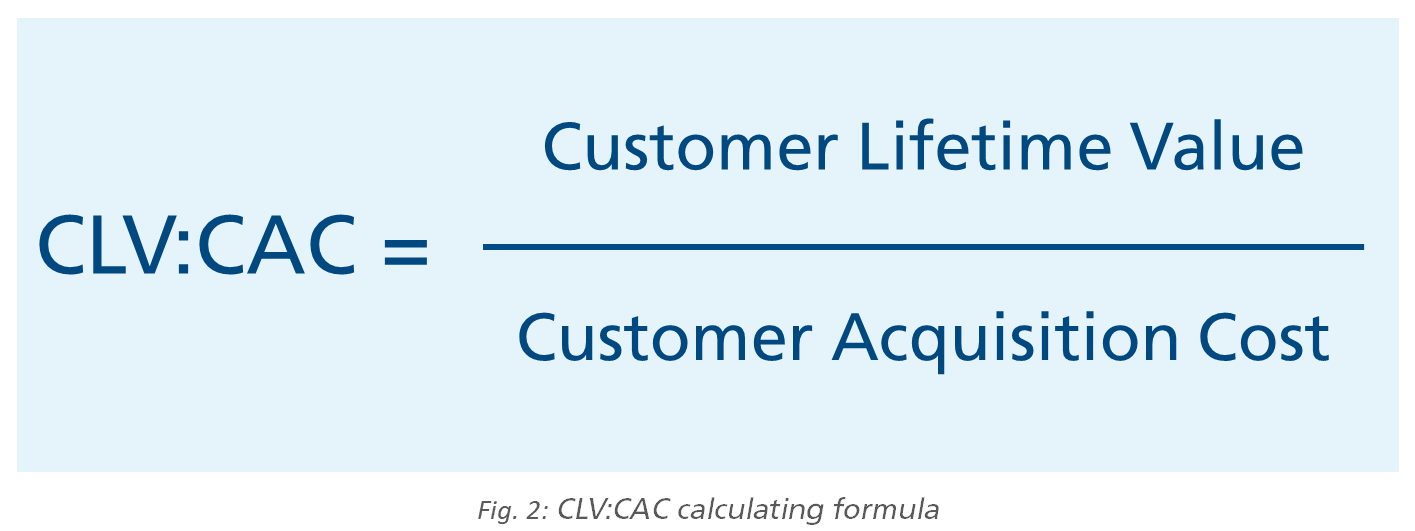

How to Calculate Customer Lifetime Value to Customer Acquisition Cost Ratio?

To calculate the LTV-CAC ratio, you need to know two things:

- The customer lifetime value (CLV) of each customer

- The customer acquisition cost

What Is Cost per Acquisition?

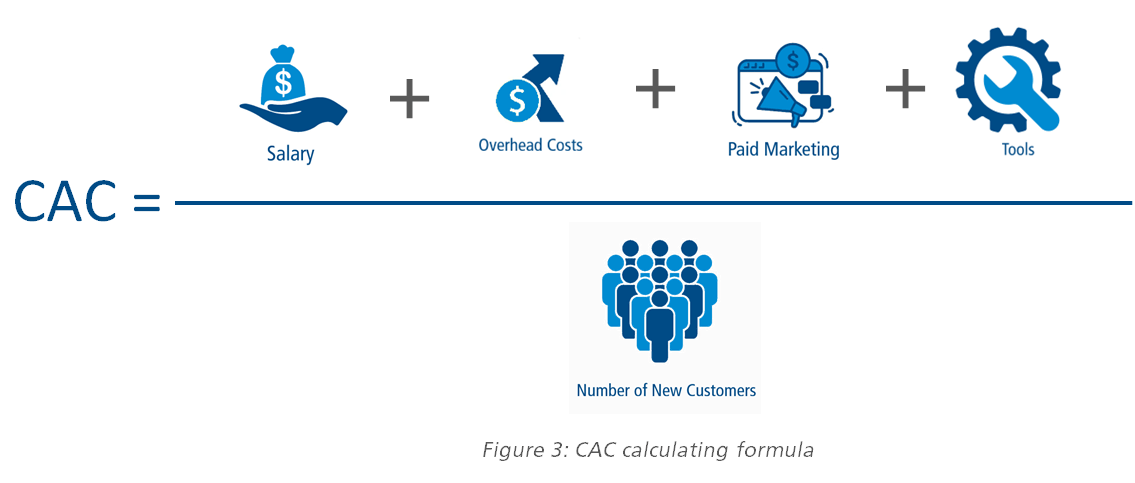

Cost per acquisition (CPA) OR Customer acquisition cost (CAC) is the total amount of money needed to acquire a new customer. This includes all the costs associated with finding, marketing to, and closing a new customer, such as advertising costs, salaries for sales representatives, and salaries for marketing teams. CAC is an important metric to track because it allows you to understand the costs of acquiring new customers, which can help you to decide whether your marketing campaigns are profitable. CAC is a metric that is often used in tandem with CLV, since it allows you to understand how much it will cost to acquire a new customer and the amount of time that customer will stay with you. It can also help you to determine what kind of person you should be targeting with your marketing campaigns, as well as which channels are best for acquiring new customers.

A CPA or CAC ratio is often used as an indicator that you are spending too much money on advertising or other marketing activities. If this happens, you should consider reducing your advertising budget or diverting funds towards other efforts such as product development, product delivery, or customer experience management

How to Calculate Your CAC?

Where Does the Ltv-Cac Model Come From?

The LTV-CAC model is a marketing model that helps you understand how much you can spend on marketing and advertising to get a new customer. The model helps understand the cost of acquiring a customer, so that it is easier for businesses to decide which of the customers are more valuable and worth more investment in their campaigns.

In fact, one of our favorite definitions of business success comes from Robert Collier: “Businessmen are successful if they pay less than they could and sell more than their neighbors.” This means that if your competitor pays $100 per visitor and you only pay $50 per visitor or less, you are going to win!

Why It Is Important to Track Your LTV-CAC Ratio.

Your LTV-CAC ratio is important because it can help you optimize your marketing and sales strategies. You can identify whether your customer acquisition is profitable or not by calculating the lifetime value (LTV) and customer acquisition cost (CAC).

LTV-CAC ratio will help you to identify the efficiency of different marketing channels used in your organization. This helps organizations cut off underperforming channels and reallocate resources to higher-performing channels. This ratio is a Good Indicator of the organization’s Growth Opportunities.

How to Improve Your LTV-CAC Ratio?

The LTV-CAC ratio is a key metric for understanding the profitability of your business. A high LTV-CAC ratio means that you are selling high-value products or services at a low cost, whereas a low LTV-CAC ratio means that you are selling lower value products or services at higher cost.

You can improve your LTV-CAC ratio by increasing the value of your product or service, reducing marketing costs, and increasing customer retention rates. Below are few tips for minimizing the unnecessary costs while maximizing the value and improve the ratio:

- Improve conversion rates by using effective landing pages or call-to-action buttons on your website

- Increase traffic to your site through social media advertising campaigns (e.g., Facebook ads)

- Create an email campaign that includes information about upcoming events at local businesses in order to increase foot traffic from interested customers, who would like more information about these events, before attending them. They could also make an appointment with one of these businesses, instead of making another trip down the street from where they live, just so they could get there first!

- Implement a personalized experience

- Introduce a subscription experience

- Optimize paid ads for customer acquisition

- Create a customer loyalty program

- Incentivize customer referrals

- Reorder capabilities to minimize friction

- Upsell and cross-sell based on search and order history

- Provide outstanding customer service

Measuring and improving your LTV-CAC ratio can help you get more customers while keeping your costs down.

Let us say you are running a small business, and it has been a while since the last time someone signed up for your services. You need to make sure that new customers have a pleasant experience before they sign on the dotted line. So, what do you do? How do you improve your customer acquisition cost ratio?

The first step is tracking their progress so far. How many of them are still active after six months (or whatever period works best for your needs)? If none of them have stopped using your product or service within this time frame, then perhaps there are some things you could do differently, in order to increase LTV-CAC over time – like creating value-added features or offering different types of plans based on individual preferences.

Conclusion

As an entrepreneur, you should always be looking for ways to improve your business. Measuring and tracking your customer lifetime value to customer acquisition cost ratio is a fantastic way to do this. By tracking this metric, you can identify where there may be bottlenecks in your sales process or other areas, where you can improve efficiency and increase revenue.

Having a high CLV to CAC ratio is essential for any business. A high ratio means that you are acquiring customers at a more cost-efficient rate, which can help you expand your business. This can also lead to increased revenue from your current customers, since you can provide superior customer service and stay ahead of demand. Now that you understand what CLV and CAC are, as well as the importance of having a good ratio, you can start taking actionable steps towards maximizing your ratio. This can include providing incentives and creating loyalty programs to increase customer lifetime value, as well as lowering your CAC through more cost-effective marketing methods. By following the tips and strategies outlined, you will be able to maximize your CLV to CAC ratio and gain a competitive edge in the market.

LTIMindtree’s digital marketing and commerce offerings help organizations design and realize outcome driven experiences across different stages of the customer journey with personalized content and frictionless commerce. We take an outcome driven approach to digital marketing and commerce operations to accelerate time-to-market, maximize reach and achieve conversions at scale thereby increasing their LTV-CAC ratio. Please refer to the following link to learn more about our commerce and digital marketing services & solution offerings https://www.ltimindtree.com/services/customer-success/digital-marketing-and-commerce/

References:

Latest Blogs

Last week, I had the privilege of attending Informatica World 2025 in Las Vegas, a landmark…

Core banking platforms like Temenos Transact, FIS® Systematics, Fiserv DNA, Thought Machine,…

We are at a turning point for healthcare. The complexity of healthcare systems, strict regulations,…

Clinical trials evaluate the efficacy and safety of a new drug before it comes into the market.…