P2P Payments: Embracing The Smart Way To Pay

Peer-to-Peer: The concept

In the current world of digitalization, the way we transact has exhibited a paradigm shift that saves our time and effort. Cash-less, card-less, and peer-to-peer payments (P2P) are here to only grow in the coming future. A P2P platform directly connects individuals while completing a financial transaction without the intervention of any third-party. These platforms employ technology to focus on the costs of trust, legal enforcement, and information anomalies, removing the need for trusted third-party intermediaries. P2P platforms offer features like payment processing, payer and payee management, and quality assurance, and help users easily split dinner checks among friends, pay utility bills, or perform small transactions at local stores.

How does it function?

P2P transactions (also termed as person-to-person transactions or P2P payments) are essentially electronic made by one user to another through P2P payment applications.

There are many P2P payment apps that are available in Google’s Play Store and Apple’s App Store. These apps can be configured using a phone number and/or email address and connected to bank accounts, credit cards, or debit cards of the users. Once configured, payments can be sent and received from mobiles or computers using the internet. The time taken by P2P apps to transfer money may vary from a few minutes to up to three days, depending on state guidelines and bank regulations.

In recent times, many medium to large fintech companies have started penetrating this growing market by developing their payment applications. As of today, all the P2P payment apps that are developed worldwide can be categorized into four common models.

Bank-centric Apps – Some banks have offered mobile payment apps or devices that are crafted to pair with certain Point-of-Sales (POS). With these apps, users can transact with bank accounts, credit, or debit cards directly. The mobile network operator provides assurance on Quality of Service (QoS) here. Common examples include Dwolla and ClearXchange.

Standalone Apps – Examples include PayPal and Square Case. These apps don’t need banking entities to decide the rules and regulations – they can develop their own ecosystem with an e-wallet feature to offer both online and offline P2P payments either in the bank or within stored accounts.

Mobile OS-based Apps – Apple Pay, Google Pay, or Samsung Pay have gained popularity worldwide as mobile payment apps. These apps are used extensively nowadays to transfer money within their ecosystem. Users can pay at POS with NFC technology. In this model, the app is secured with biometric authentication and transactions are executed with tokenized cards. This model works well in countries with suitable payment infrastructure and for users who are accustomed to its usage.

Social Media or Messaging-based Apps – Social media giants deploy P2P apps for sending payments to contacts using cards. These apps can initiate a transaction without stringent authentication. Common examples are Square Cash and Snapchat. In India, WhatsApp is enabling immediate bank-to-bank payment services amongst its users.

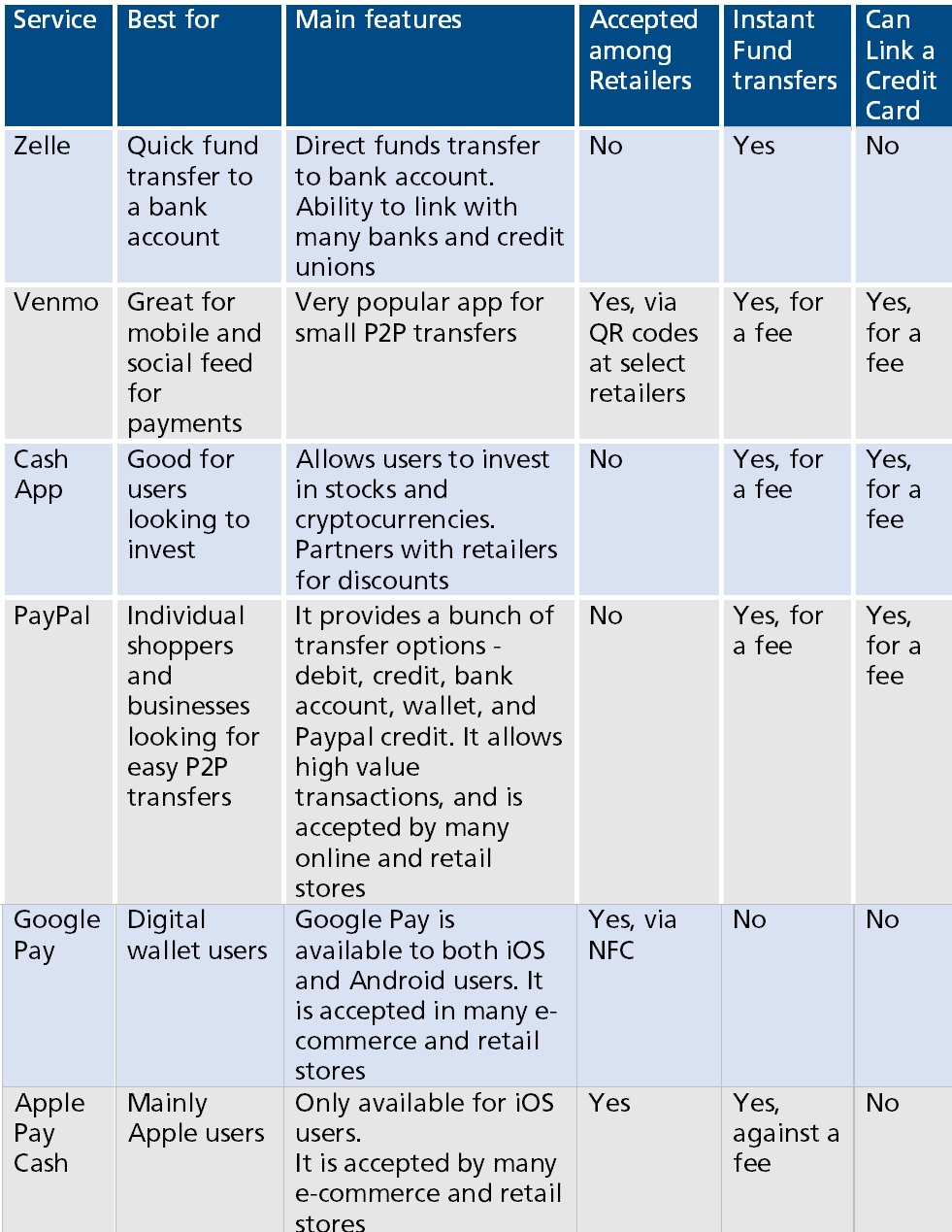

Common P2P payments service providers:

Concerns:

While P2P platforms offer a slew of advantages, it is also pertinent to keep the below concerns in mind.

Never send money to an unknown person. It is advisable only to send money within the network as P2P transfers do not offer the same protection that traditional banking or a credit card system offers.

P2P refund policies are not always consumer-friendly, and a lot of legwork and persistence is needed to get the money back in comparison to a credit card refund, for instance, where a simple call to customer care suffices.

P2P platform users must note that these apps are not regulated in most cases and depend on the provider for the security. The Central Bank has very little control over these apps.

P2P is basically a trade of security with convenience. So, it is always better to take the traditional banking route for large amount transfers.

Conclusion:

P2P payments can be used for anything from paying rent/loans, to investing, and several other cases. It allows users to securely pay their friends or family members within seconds. Thus, it has spread widely among individuals of different strata, sects, and ages. People are shifting from physical to digital money.

The P2P payment volume was assessed at $1,889.16 billion globally in 2020. It is expected to clock $9,097.06 billion by 2030, with a CAGR of 17.3% during 2021 – 2030. In Asia-Pacific, the highest CAGR of 20.1% was exhibited since 2021.

The COVID-19 pandemic has had a positive impact on P2P payments across the globe, attributed to the increasing demand for non-cash, contactless transactions.

An increase in the acceptance of online/mobile banking, e-commerce, and m-commerce, and the usage of NFC (Near-field communication), RFID (Radio-frequency identification), and HCE (host card emulation) technologies offer massive prospects of evolution of the P2P payments and market.

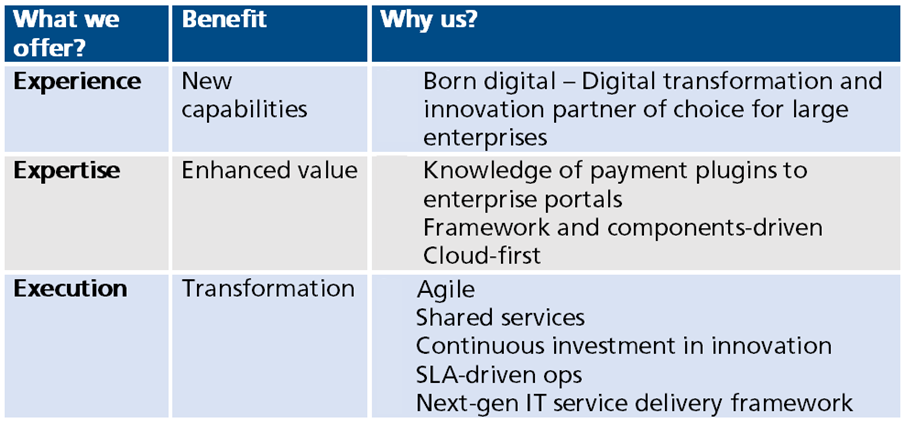

How can LTIMindtree help:

References:

Latest Blogs

he supply chain is a network of suppliers, factories, logistics, warehouses, distributers and…

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…