Augmenting Media Consumer Experience – Additional Data Pieces for Improved Relevance & Targeting

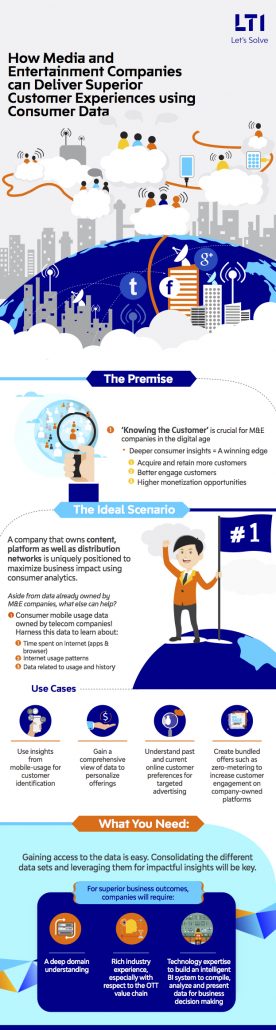

The disruptions happening in Media and Entertainment industry are of scale and impact unheard of till date in many industries. And as is the case with any major disruption, technology is at the center of the changing world. While consumers are flooded with choices of content and platforms for consumption, media companies are facing an overwhelming need to realign their entire media value chain to remain relevant to customers, and stay ahead of competition. With consumer experience emerging as the deciding factor for success in this space, the most important part of this realignment lies in ‘knowing your customer’. This ‘knowing’ has to start from the point where a potential consumer becomes part of the addressable market, and continues through the entire consumer lifetime.

Media companies have realized the need for ‘knowing the consumers’, especially with digital platforms and deployed multiple analytics solutions that provide insights into consumers’ preferences and behaviours. They have tried making the best use of these insights to acquire more consumers, retain existing ones, winning back the consumers who left, and to have all these consumers spend more and more time on digital platforms watching more and more content. But these insights were primarily focused on consumer profiles, based on social media accounts or platform-specific accounts and on consumer behaviour as they watch content over the platform. But there’s another important piece of data that’s not available with most of the media companies owning these platforms; which if made available, would probably make the combined data a hundred times more valuable and useful. This will enable higher business growth for media companies. But this important supplementary piece of data lies with the telecom companies; piece that comprises of data related to consumer internet usage, browsing history, app usages and mobile data consumption patterns.

Let’s have a look at valuable data which telecom companies have, that can be leveraged by media companies for better marketing, consumer acquisition and retention as well as for more targeted advertising. Telecom companies provide mobile data and home broadband plans, and have rich data around user activities such as –

- Time spent on internet both on web browser and on apps

- Internet usage pattern across the day and week – such as higher consumption during late evening and over weekends

- Type of apps used, frequency and duration – gaming, news, videos, social, e-commerce, food delivery, travel booking, banking, etc.

- Browsing history indicating areas of interest

The data that can be captured depends on country-specific regulations around data privacy. The depth of insights may vary from country to country, based on such regulations. However, the telecom companies will always have ample data and insights to help media companies with the aforementioned business outcomes.

The data that can be captured depends on country-specific regulations around data privacy. The depth of insights may vary from country to country, based on such regulations. However, the telecom companies will always have ample data and insights to help media companies with the aforementioned business outcomes.

Now let’s consider an ideal scenario that can lead to the best possible use of all data to achieve maximum business impact. This scenario is possible when both pieces of data, one around mobile usage and other around content viewing, are owned by a single entity; and such cases do exist. The Over-The-Top (OTT) platform HOOQ, that serves South East Asia and India regions, is owned jointly by Singtel, Sony Pictures Entertainment and Warner Bros. The data available to HOOQ, both through Singtel’s mobility and through the content platform itself, gives it a unique competitive advantage. HOOQ ends up knowing a lot more about its consumers on the Singtel network, than any other OTT platform running on third party networks. Any company that is vertically integrated enough to own the content, the platform and the distribution (network) is uniquely positioned to enable greater business impact, using consumer analytics. Let’s look at few use cases in this context.

- Customer Acquisition – The insights from mobile usage can be used to identify potential customers and the clusters that they belong to. Someone who is spending a good amount of his or her internet data pack and time on YouTube – or other content platforms, may be a good prospect to target. On the other hand, someone who has minimal data subscription that is used for utility apps may not be the priority customer. The company can decide their consumer marketing strategy based on where the target consumer is spending most of their time. For example, if the target group is spending good amount of time on travel apps and websites, then that might be the right place to spend dollars on for digital advertising targeted at customer acquisition.

- Personalization –In the absence of mobile usage data, most of the companies will personalize their OTT platform around a consumer’s profile and content watching history. But what if a given consumer, say Rick, hasn’t come across a chat show of his favorite host that exists on your platform. Rick follows the host on social media, googles him on internet, reads his articles and news about him. But analytics based on user profile and content watching history, are not tapping such key data points that can make Rick spend more time on your platform watching his favorite content. The data from mobile usage can plug that gap.

- Targeted Advertising – This would probably be the most impactful and business relevant area that can lead to higher ad viewing and greater conversions. Consider Lara, a college student who loves travelling and has her vacations starting in a month. She has been spending extended time on travel reviews, planning, booking apps and websites. But when she’s watching a comedy show on your OTT platform, she gets ads for apparels and cosmetics and others because that’s all that can be done based on the data you have from inside the OTT app. The consumers’ priorities and preferences change over time – some over days, some over months or years. Targeted advertising shall take into account both history and current attributes that makes it targeted in a true sense. Mobile usage data can provide that missing piece to drive relevance and conversions for ads.

- Customized Marketing – Another area of immense scope is enabling customized bundled offers such as zero-metering on internet for owned OTT platform. The zero metering can be for the entire period or up to a given data cap, or for a specific duration or time during the day – example zero-metering from 11 PM to 6 AM or up to 5 GB content viewing on owned OTT platform. So when a consumer, say Steve, buys a data plan with a monthly cap, he can be offered additional data or 3 days’ worth of free data (for example) if he’s approaching a data cap. Knowing that he will use most of that free internet to watch content on company’s OTT app, resulting in additional advertising dollars. And such offers can be customized at consumer level providing Steve, Lara and Rick offers based on factors such as their data plan, OTT platform usage, etc.

The differentiators created by these additional pieces of datasets are quite evident. And making this data available shall not be a challenge for cases such as HOOQ. Marrying the two pieces of data and leveraging them to gain impactful insights, is where the expertise is needed. The required expertise will be a mix of deep domain understanding and experience of Media & Entertainment industry, especially with OTT value chain, and technology to build intelligent BI system that captures, analyses, and understands data in context and channel it to make superior business decisions resulting in desired business outcomes.

More from Manish Sinha

In today’s world, where calling every industry a ‘technology industry’ is no longer considered…

Media companies have been shifting their focus from ‘content-centric approach’ to ‘customer-centric…

Latest Blogs

Introduction What if training powerful AI models didn’t have to be slow, expensive, or data-hungry?…

Pharmaceutical marketing has evolved significantly with digital platforms, but strict regulations…

Leveraging the right cloud technology with appropriate strategies can lead to significant cost…

Introduction The financial industry drives the global economy, but its exposure to risks has…